Northwest Pipe Company Welcomes Irma Lockridge to its Board of Directors.

March 2, 2023

Trending News ☀️

NORTHWEST ($NASDAQ:NWPX): T h e B o a r d o f D i r e c t o r s o f t h e N o r t h w e s t P i p e C o m p a n y h a v e e l e c t e d I r m a L o c k r i d g e t o j o i n t h e m a n d b r i n g h e r d i v e r s e s k i l l s a n d k n o w l e d g e t o t h e t a b l e . L o c k r i d g e h a s a l s o s e r v e d a s a b o a r d m e m b e r f o r p u b l i c a n d p r i v a t e c o m p a n i e s a n d h a s a s t r o n g u n d e r s t a n d i n g o f m e r g e r s a n d a c q u i s i t i o n s , f i n a n c i a l a n a l y s i s , a n d c o r p o r a t e g o v e r n a n c e . L o c k r i d g e w i l l b e a n i n v a l u a b l e a s s e t t o N o r t h w e s t P i p e C o m p a n y a n d h e r e x p e r t i s e i n f i n a n c e , s t r a t e g y , a n d c a p i t a l m a r k e t s w i l l b e i n v a l u a b l e f o r t h e c o m p a n y . H e r e x p e r i e n c e i n c o r p o r a t e g o v e r n a n c e a n d m a n a g i n g i n v e s t m e n t s w i l l p r o v i d e t h e B o a r d o f D i r e c t o r s g r e a t e r i n s i g h t i n t o m a k i n g i n f o r m e d d e c i s i o n s .

W i t h t h i s n e w a d d i t i o n t o t h e B o a r d o f D i r e c t o r s , N o r t h w e s t P i p e C o m p a n y w i l l a c q u i r e m o r e r e s o u r c e s t h a t c a n h e l p m a n a g e t h e i r i n v e s t m e n t s a n d o t h e r a s p e c t s o f t h e c o m p a n y . O v e r a l l , t h e a d d i t i o n o f I r m a L o c k r i d g e t o t h e B o a r d o f D i r e c t o r s o f N o r t h w e s t P i p e C o m p a n y w i l l b e a n i m m e n s e l y b e n e f i c i a l m o v e f o r t h e c o m p a n y . H e r e x p e r i e n c e a n d e x p e r t i s e b r i n g a n i n v a l u a b l e a s s e t t o t h e t a b l e t h a t c a n h e l p t h e b u s i n e s s m a k e i n f o r m e d d e c i s i o n s w h i c h c a n u l t i m a t e l y l e a d t o t h e g r o w t h a n d s u c c e s s o f t h e c o m p a n y.

Price History

On Monday, Northwest Pipe Company (NORTHWEST PIPE) saw its stock open at $38.5 and close at $38.9, a 1.2% rise from its last closing price of 38.4. The company has welcomed Irma Lockridge to its Board of Directors. Lockridge brings extensive executive experience to the Board, which includes roles as the President of two public companies.

Additionally, Lockridge currently serves on the boards of various other companies and will now be joining the Board of Directors at NORTHWEST PIPE. The addition of Lockridge to the Board of Directors is expected to help the company grow and position itself as a leader in the piping industry. NORTHWEST PIPE’s financials have been strong this quarter and the addition of Lockridge will only further strengthen their position as a leading supplier of both engineered and standard piping solutions. With Lockridge’s expertise added to the Board, NORTHWEST PIPE is poised for success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Northwest Pipe. More…

| Total Revenues | Net Income | Net Margin |

| 453.38 | 25.46 | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Northwest Pipe. More…

| Operations | Investing | Financing |

| -0.71 | -100.15 | 71.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Northwest Pipe. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 586.48 | 277.8 | 29.91 |

Key Ratios Snapshot

Some of the financial key ratios for Northwest Pipe are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | 24.7% | 8.2% |

| FCF Margin | ROE | ROA |

| -3.9% | 7.8% | 3.9% |

Analysis

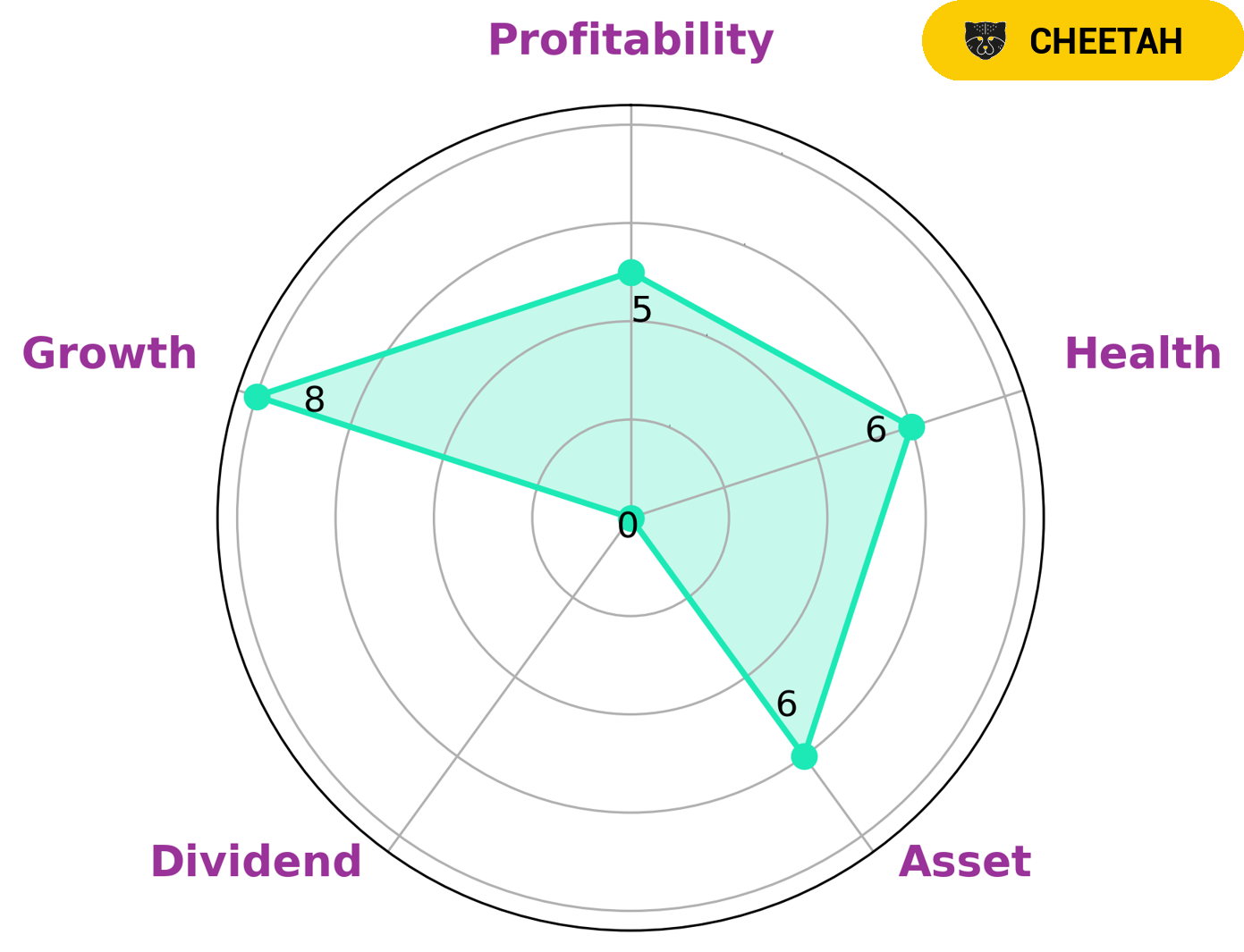

After conducting an analysis of NORTHWEST PIPE‘s financials, GoodWhale has concluded that the company has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that it might be able to safely ride out any crisis without the risk of bankruptcy. Based on our proprietary Star Chart, NORTHWEST PIPE is classified as a ‘cheetah’ company, meaning it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Due to its high growth profile and medium asset and profitability scores, NORTHWEST PIPE is likely to be attractive to investors who are looking for below-average dividend yields and above-average capital gain potential. Risk-tolerant investors, who are seeking higher returns with higher risk, might find NORTHWEST PIPE attractive as it offers the potential for capital appreciation and a reasonable level of downside protection. NORTHWEST PIPE is also likely to be of interest to value investors who are interested in buying a low-priced asset with good long-term growth prospects. More…

Peers

The company’s primary competitors are Seychelle Environmental Technologies Inc, Mueller Water Products, Inc., Water Now, Inc.

– Seychelle Environmental Technologies Inc ($OTCPK:SYEV)

Seychelle Environmental Technologies Inc is a company that produces and sells water filtration products. The company has a market cap of 63.94k as of 2022 and a return on equity of -2.17%. The company’s products are designed to remove contaminants from water, making it safe to drink. The company’s products are sold in over 60 countries around the world.

– Mueller Water Products, Inc. ($NYSE:MWA)

Mueller Water Products, Inc. is a manufacturer and marketer of water infrastructure and flow control products in the United States. The company operates in three segments: Infrastructure, Residential, and Industrial. The Infrastructure segment provides water and gas distribution products, service, and solutions for the water, gas, and energy industries. The Residential segment provides water service line and plumbing repair products, and solutions for the residential do-it-yourself and professional markets. The Industrial segment provides flow control products and solutions for the oil and gas, mining, power generation, and other industrial applications. Mueller Water Products, Inc. was founded in 1857 and is headquartered in Atlanta, Georgia.

– Water Now, Inc. ($OTCPK:WTNW)

Water Now, Inc. is a leading provider of water treatment solutions. The company has a market cap of 40.45k and a ROE of 29.93%. The company’s products are used in a variety of industries, including oil and gas, power generation, food and beverage, pharmaceuticals, and more. Water Now is committed to providing innovative, cost-effective solutions to meet the challenges of water scarcity and water pollution.

Summary

Northwest Pipe Company recently welcomed Irma Lockridge to its Board of Directors. This adds a valuable new perspective to the company and strengthens its commitment to providing quality pipe products and services. As an investor, it’s important to keep a close eye on Northwest Pipe Company’s financials and operating performance.

Analysts expect the company’s strong cash flow, steady share price, growing dividend, and efficient cost containment to result in continued growth and shareholder value. This is especially true given the consistent demand for its products and services in the infrastructure, energy, and municipal markets.

Recent Posts