Lemaitre Vascular Stock Fair Value Calculator – LeMaitre Vascular Reports Impressive Earnings and Revenue Beat in Q3

May 3, 2023

Trending News ☀️

LEMAITRE ($NASDAQ:LMAT): LeMaitre Vascular, Inc. is a leading provider of medical devices and implants used in the treatment of peripheral vascular diseases. LeMaitre reported Non-GAAP EPS of $0.32, which exceeded expectations by $0.07, and revenue of $47.1M, a beat of $3.56M. LeMaitre’s performance was driven by strong sales of its vascular grafts as well as increased sales of its GraftMaster devices, which is used for endovascular aneurysm repair. Investors are optimistic that the company will maintain its record of strong performance and further boost their stock price.

Stock Price

On Tuesday, LeMaitre Vascular released its financial report for the third quarter of the year, revealing impressive results. The stock opened at $54.5 and closed at $54.8, up by 0.1% from the previous closing price of 54.7. Overall, LeMaitre Vascular’s performance was impressive, and investors reacted positively to the news. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lemaitre Vascular. More…

| Total Revenues | Net Income | Net Margin |

| 161.65 | 20.64 | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lemaitre Vascular. More…

| Operations | Investing | Financing |

| 25.38 | -10.37 | -9.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lemaitre Vascular. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 310.48 | 42.27 | 12.14 |

Key Ratios Snapshot

Some of the financial key ratios for Lemaitre Vascular are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.3% | 12.2% | 17.0% |

| FCF Margin | ROE | ROA |

| 13.7% | 6.5% | 5.5% |

Analysis – Lemaitre Vascular Stock Fair Value Calculator

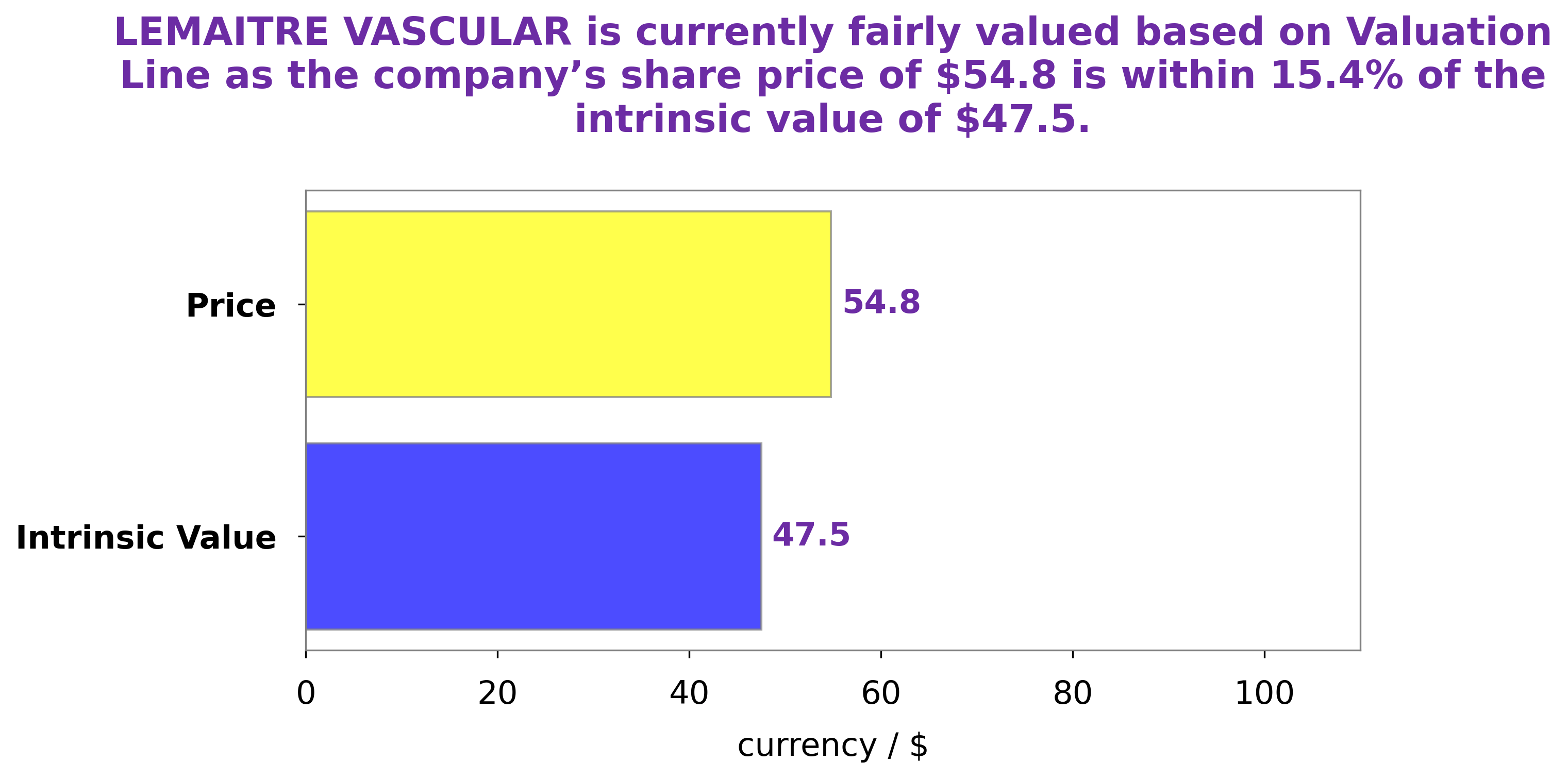

At GoodWhale, we have taken a close look into LEMAITRE VASCULAR‘s fundamentals and have come up with an intrinsic value of around $47.5. This figure is based on our proprietary Valuation Line, which takes into account a range of metrics including the company’s financial health, growth prospects, competitive positioning and overall market sentiment. This may be due to a number of factors, such as strong investor sentiment, economic momentum and overall market conditions. It seems that investors are optimistic about the company’s performance in the near future, and are willing to pay a premium now for potential future rewards. More…

Peers

It focuses on the development, manufacture and marketing of minimally invasive products for the treatment of peripheral vascular diseases. The company operates through two segments, Direct and OEM. The Direct segment offers proprietary products to hospitals and other medical institutions through direct sales force. The OEM segment provides stents and other products to Original Equipment Manufacturers (OEMs) for sale under their own brands. LeMaitre’s competitors include Atrion Corp, Implanet SA, Vycor Medical Inc.

– Atrion Corp ($NASDAQ:ATRI)

Atrion Corporation is a medical device company that develops, manufactures and markets products primarily for use in cardiac and ophthalmic surgery. The company’s products include Cardiax, a cannula used in cardiac surgery; Ophthalmic products, including the HydroVue and Glaucoma Shunt systems to treat glaucoma; and PerQCat, a catheter used in urology procedures.

– Implanet SA ($OTCPK:IMPZY)

Implanet SA is a French company specializing in the design and manufacture of medical implants for the treatment of orthopedic pathologies. The company’s products are used in the treatment of various conditions, including osteoarthritis, degenerative disc disease, scoliosis, and deformities of the hip, knee, and shoulder. As of 2022, Implanet SA had a market capitalization of 3.88 million euros and a return on equity of -114.56%. The company’s products are sold in over 50 countries worldwide and its customers include some of the world’s leading orthopedic surgeons and hospitals.

– Vycor Medical Inc ($OTCPK:VYCO)

Vycor Medical Inc is a medical device company that specializes in the development and commercialization of minimally invasive products for neurosurgery. The company’s products are designed to provide surgeons with improved access and visualization during surgery, while minimizing tissue damage and surgical time. Vycor Medical’s products are sold in over 30 countries worldwide.

As of 2022, Vycor Medical Inc had a market capitalization of 3.17 million and a return on equity of 6.36%. The company’s products are used in a variety of neurosurgical procedures, including brain surgery, spinal surgery, and skull-base surgery.

Summary

LEMAITRE VASCULAR continues to strengthen its position in the market, as they have seen solid demand for their products and services as well as strong execution of their strategic initiatives. Looking ahead, the company remains committed to delivering long-term value to its shareholders and continuing to drive growth.

Recent Posts