iRhythm Technologies Receives FDA Warning Letter Over Medical Device Regulation ‘Non Conformities’

June 1, 2023

🌧️Trending News

IRHYTHM ($NASDAQ:IRTC): iRhythm Technologies, a publicly traded digital health company, announced in a regulatory filing on Tuesday evening that the US Food and Drug Administration (FDA) had issued a warning letter concerning non-conformities with medical device regulations in an August inspection of its manufacturing facility. The company specializes in the development of cardiac monitoring devices and data analytics software that are used to diagnose and treat various cardiac conditions. The FDA warning letter noted several non-conformities with the applicable medical device regulations, including inadequate design controls, inadequate corrective and preventive action (CAPA) procedures, and inadequate supplier controls. In response to the letter, iRhythm has initiated corrective action plans and has committed to working with the FDA to bring their facility into compliance.

The FDA warning letter does not affect the safety or efficacy of iRhythm’s products, but it does have a potential financial impact on the company. The FDA could impose fines, and iRhythm could face delays in its product launches or other regulatory actions. The company is currently working to address the issues raised in the letter and is confident that it will be able to do so in a timely manner.

Share Price

On Wednesday, iRhythm Technologies stock dropped by 6.1% after the company received a warning letter from the U.S. Food and Drug Administration (FDA). The FDA’s warning letter was in response to the identified “non conformities” of medical device regulations. These non conformities related to the company’s submission of documents, processes, and records for its medical device, Zio XT. The FDA’s review of these non conformities indicated a lack of quality control in the company’s procedures and practices.

The FDA letter outlines that iRhythm Technologies must take corrective action in order to comply with current Good Manufacturing Practice regulations. This news has caused concern among investors as any action taken to correct the FDA’s identified issues may delay the company’s existing product launch plans. iRhythm Technologies must now work to ensure that its medical devices are compliant with FDA regulations before further launches. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Irhythm Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 429.98 | -104.66 | -24.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Irhythm Technologies. More…

| Operations | Investing | Financing |

| -14.88 | -40.09 | 12.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Irhythm Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 421.7 | 199.87 | 7.28 |

Key Ratios Snapshot

Some of the financial key ratios for Irhythm Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.2% | – | -23.6% |

| FCF Margin | ROE | ROA |

| -11.1% | -27.4% | -15.0% |

Analysis

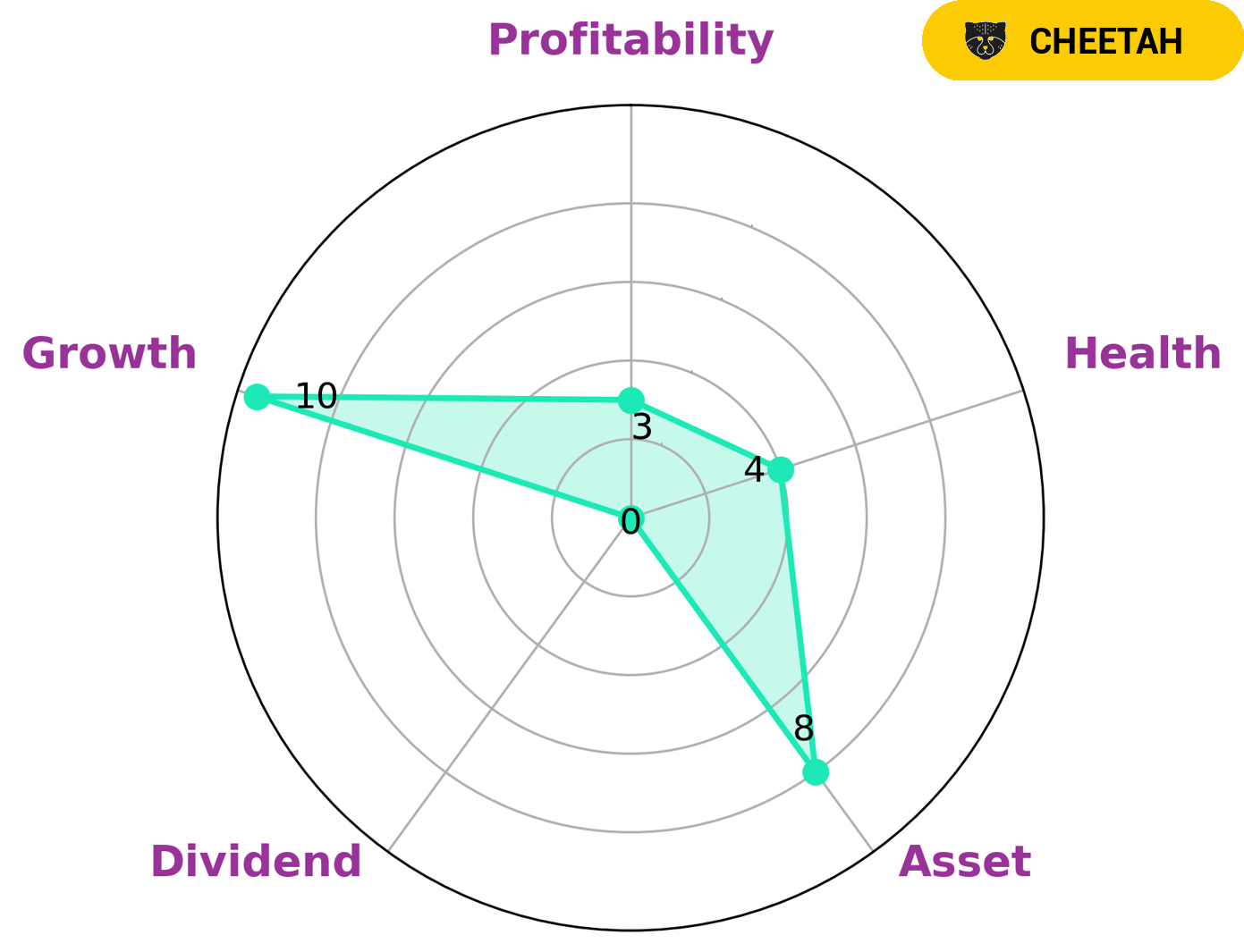

GoodWhale has conducted an analysis of IRHYTHM TECHNOLOGIES‘s financials and identified that the company is strong in asset and growth, but weak in dividend and profitability. According to our Star Chart, IRHYTHM TECHNOLOGIES achieves an intermediate health score of 4/10 considering its cashflows and debt, implying that it might be able to safely ride out any crisis without the risk of bankruptcy. We have classified IRHYTHM TECHNOLOGIES as a ‘cheetah’, a type of company which achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given its characteristics, IRHYTHM TECHNOLOGIES may be attractive to investors with a higher risk appetite. Investors such as venture capitalists and private equity firms may be interested in this company since they are often willing to take on higher risks in exchange for potentially higher returns. Growth-oriented investors may also be keen on IRHYTHM TECHNOLOGIES due to its strong asset and growth metrics. More…

Peers

The competition between iRhythm Technologies Inc and its competitors is fierce. Each company is striving to develop the best technology and products to help cancer patients. While iRhythm Technologies Inc is focused on developing products to help patients with cancer, its competitors are also working hard to develop their own products to help cancer patients.

– Advanced Oncotherapy PLC ($LSE:AVO)

Advanced Oncotherapy PLC is a UK-based company that provides proton therapy treatment for cancer patients. The company has a market capitalization of 114.21 million as of 2022 and a return on equity of -27.6%. Advanced Oncotherapy PLC is a provider of proton therapy, which is a type of cancer treatment that uses protons to destroy cancer cells. The company’s proton therapy system is called the LIGHT system, which is currently in clinical trials.

– VeriTeQ Corp ($OTCPK:VTEQ)

VeriTeQ Corp is a provider of digital vaccine and health passport technology solutions. The company’s solutions are designed to increase patient safety and improve clinical outcomes by providing real-time visibility into the vaccination and immunization status of patients. VeriTeQ’s vaccine and health passport technology is used by healthcare providers, pharmaceutical companies, and government agencies to track and verify the vaccination and immunization status of patients.

– Bone Biologics Corp ($NASDAQ:BBLG)

Biologics Corp is a company that develops and commercializes biologic products for the treatment of orthopedic diseases and conditions. The company has a market cap of 7.46M and a ROE of -16.65%.

Summary

Investors should be aware of the warning letter received by iRhythm Technologies from the US Food and Drug Administration regarding its medical devices. This news caused the company’s stock price to fall on the same day. This event should be considered when making an investing decision in iRhythm Technologies.

It is important to research the company and the regulations it is subject to, as well as any potential risks associated with the investment. Staying informed about further developments may help investors make wise decisions.

Recent Posts