Accelerate Diagnostics Intrinsic Stock Value – Accelerate Diagnostics Misses EPS and Revenue Estimates

May 12, 2023

Trending News 🌧️

Unfortunately, the company fell short of analyst expectations as their GAAP EPS of -$0.17 missed projections by $0.03 and revenue of $2.81M fell short of the expected $3.35M. Accelerate Diagnostics ($NASDAQ:AXDX) is a commercial-stage diagnostics company focused on providing solutions to improve patient outcomes and decrease the cost of healthcare by delivering rapid diagnostic information to healthcare providers. With their fully automated systems, they are well-positioned to provide timely and accurate diagnostic insight, enabling physicians to make better decisions that lead to improved healthcare outcomes. Their products are being used in hospitals across the U.S., Europe, and the Middle East.

Price History

On Thursday, ACCELERATE DIAGNOSTICS reported an earnings miss, with revenue and earnings per share (EPS) estimates coming in lower than analysts’ expectations. The company’s stock opened at $0.8 and closed at $0.8, down by 2.6% from its last closing price of $0.8. This news put a damper on the company’s performance and caused investors to sell off their shares.

Overall, investors were disappointed with the results and the stock dropped as a result. Despite the negative news, analysts remain optimistic on ACCELERATE DIAGNOSTICS’ long-term growth prospects and believe that the company is still well-positioned to capitalize on growth opportunities in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Accelerate Diagnostics. More…

| Total Revenues | Net Income | Net Margin |

| 12.75 | -62.49 | -518.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Accelerate Diagnostics. More…

| Operations | Investing | Financing |

| -48.73 | 12.42 | 31.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Accelerate Diagnostics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 65.02 | 87.28 | -0.1 |

Key Ratios Snapshot

Some of the financial key ratios for Accelerate Diagnostics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | – | -461.1% |

| FCF Margin | ROE | ROA |

| -386.5% | 229.2% | -56.5% |

Analysis – Accelerate Diagnostics Intrinsic Stock Value

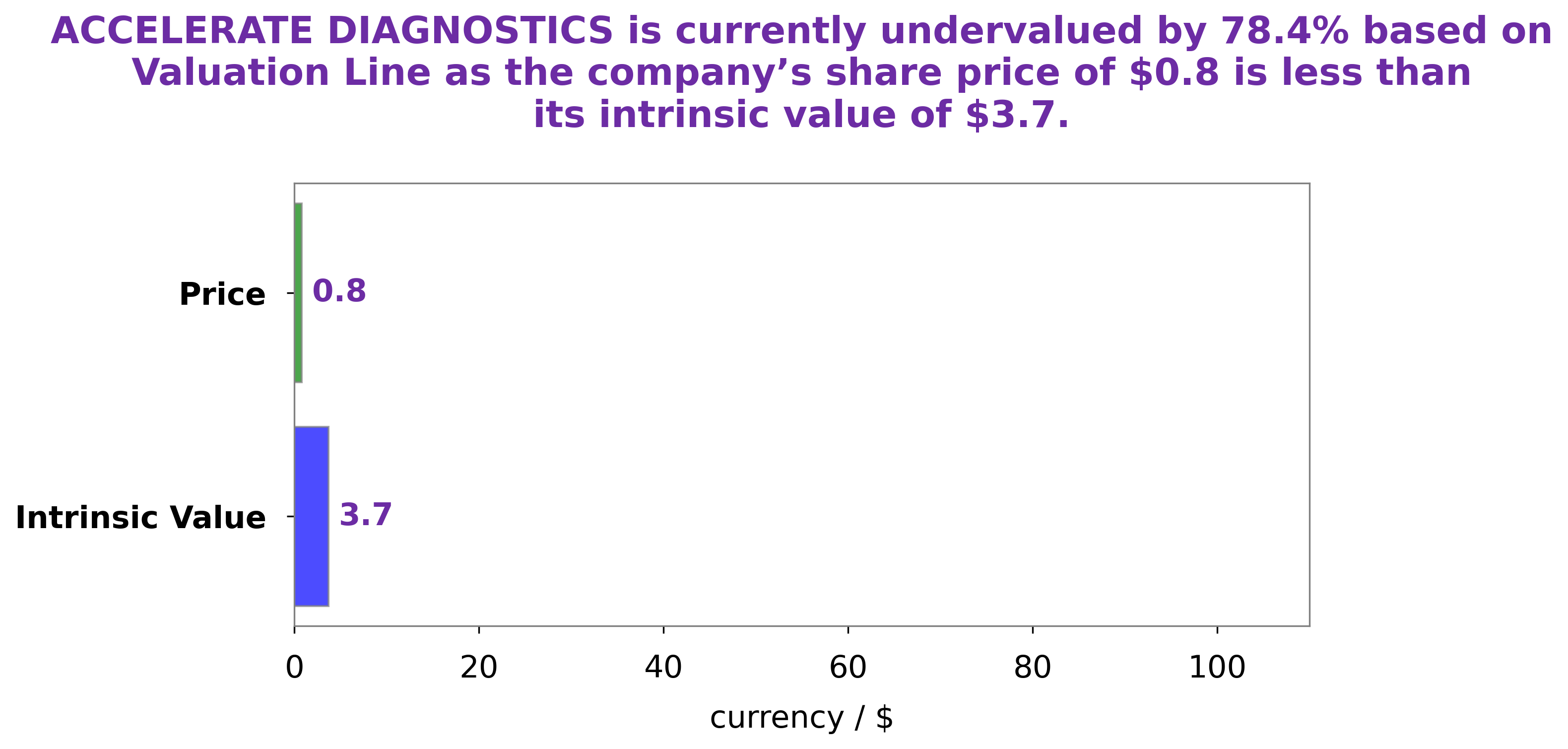

At GoodWhale, we have conducted an analysis of ACCELERATE DIAGNOSTICS‘s wellbeing and found that the intrinsic value of their share is around $3.7. This value has been calculated using our proprietary Valuation Line, an advanced financial analysis tool that accurately measures the true worth of a company. Currently, ACCELERATE DIAGNOSTICS is being traded at just $0.8 per share, a huge 78.5% discount to its true value. This offers investors an exciting opportunity to purchase ACCELERATE DIAGNOSTICS shares at a significant discount to their intrinsic worth. More…

Peers

It is the leader in the field and is making advancements in the development of products to enable faster and more accurate diagnosis of infectious diseases. It faces competition from Lexagene Holdings Inc, Lucira Health Inc, and Novacyt SA, all of which are developing cutting-edge technology and products to improve the accuracy and speed of diagnosis.

– Lexagene Holdings Inc ($TSXV:LXG)

Lexagene Holdings Inc is a biotechnology company that focuses on developing molecular diagnostic solutions to improve the accuracy of diagnostic results, enhance the speed of testing, and reduce the cost of molecular diagnostics. The company has a market cap of 37.46M as of 2023, reflecting a strong presence in the biotechnology industry. Additionally, Lexagene Holdings Inc has a Return on Equity of -164.09% which is an indication of the company’s inability to generate profits from its investments. The negative return on equity is likely due to the company’s high research and development costs.

– Lucira Health Inc ($NASDAQ:LHDX)

Lucira Health Inc is a healthcare technology company based in California. The company specializes in the development and commercialization of molecular diagnostics and devices for the detection of infectious diseases. As of 2023, Lucira Health Inc had a market cap of 12.64M, indicating that its total value is greater than its current liabilities. Despite its relatively small size, Lucira Health Inc had a Return on Equity of -71.77%, indicating that it has not been able to generate sufficient profits to cover its equity investments. This suggests that the company may be facing various challenges, such as low profit margins or high operating costs.

– Novacyt SA ($OTCPK:NVYTF)

Novacyt SA is a biotechnology company that specializes in providing innovative solutions to the global healthcare sector. The company is based in France and focuses on the development of advanced diagnostic tests and clinical pathology products. With a market capitalization of 72.21 million euros, Novacyt SA is a relatively small but growing player in the biotechnology industry. Despite its size, the company has managed to generate an impressive -1.05% return on equity, indicating that it is making sound investments and managing its capital efficiently. This suggests that Novacyt SA is well-positioned to continue its growth trajectory in the coming years.

Summary

Accelerate Diagnostics, a molecular diagnostics company, reported a disappointing earnings report for the quarter. These results have caused investors to be concerned about the company’s financial performance and ability to compete in the competitive diagnostics field. Analysts will be closely examining the company’s progress in order to determine if further investment is warranted.

Recent Posts