Oncology Institute Partners with IDEOlogy Health to Offer Customized Medical Education

May 10, 2023

Trending News 🌥️

The Oncology Institute ($NASDAQ:TOI) has recently formed a strategic partnership with IDEOlogy Health, a leader in medical education. With this new partnership, the Institute is taking a huge step towards providing high quality, personalized medical education for its members. The Oncology Institute is a unique healthcare institution that provides advanced and specialized cancer care, research and education. It is one of the leading oncology centers in the country, offering the most advanced treatments and therapies to its patients. The Institute is committed to providing the highest level of patient care and creating a positive environment for its members. The Institute believes that the best results can be achieved by providing personalized medical education.

This is why they have partnered with IDEOlogy Health – a leader in medical education. Through this partnership, the Institute will be able to offer its members customized education that is tailored to their individual needs. This will ensure that each member receives the best possible care, whether it is for preventive services, diagnostics, or treatment. This partnership will help ensure that the Institute’s members receive the best possible care and that they are well informed about their health. The Institute believes that this innovative approach to medical education will benefit its members and lead to better outcomes.

Stock Price

This strategic partnership will enable ONCOLOGY INSTITUTE to leverage IDEOlogy Health’s expertise in developing effective and engaging educational programs for healthcare professionals. The partnership will offer healthcare professionals access to high-quality medical education through webinars, lectures, and videos.

Additionally, this partnership will allow healthcare professionals to receive the latest updates on medical advances, treatments, and procedures. The collaboration between ONCOLOGY INSTITUTE and IDEOlogy Health is expected to improve patient outcomes by providing healthcare professionals with the necessary information and skills they need to deliver quality care. This partnership also provides an opportunity for healthcare professionals to stay up-to-date on the latest treatments and technologies in the field of oncology. The news of the partnership saw ONCOLOGY INSTITUTE’s stock surge by 3.1% from its previous closing price of $0.5, with the stock opening at $0.5 and closing at $0.5. The partnership is expected to have a positive impact on ONCOLOGY INSTITUTE’s business in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oncology Institute. More…

| Total Revenues | Net Income | Net Margin |

| 252.48 | 1.23 | -26.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oncology Institute. More…

| Operations | Investing | Financing |

| -61.76 | -131.61 | 92.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oncology Institute. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 263.75 | 139.07 | 1.7 |

Key Ratios Snapshot

Some of the financial key ratios for Oncology Institute are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.6% | – | 2.4% |

| FCF Margin | ROE | ROA |

| -26.6% | 3.0% | 1.4% |

Analysis

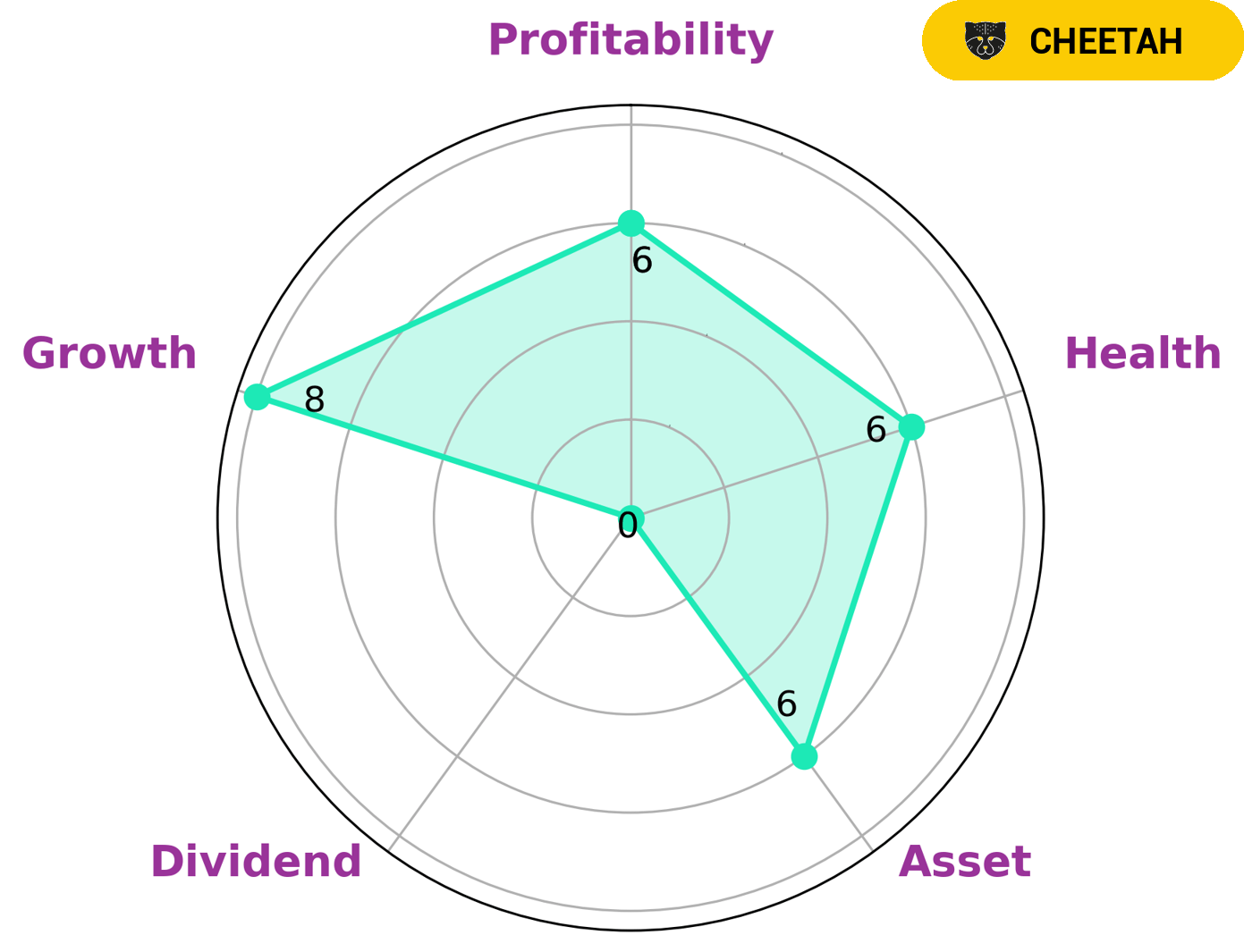

GoodWhale has conducted an analysis on the wellbeing of ONCOLOGY INSTITUTE, which is classified as ‘cheetah’ according to Star Chart. This type of company usually achieves high revenue or earnings growth, but is considered less stable due to lower profitability. From our analysis, we can conclude that ONCOLOGY INSTITUTE is strong in growth, medium in asset and profitability, and weak in dividend. This means that the company may be a good investment for investors who are looking for opportunities with higher returns but are willing to accept a certain degree of risk. In terms of financial health, ONCOLOGY INSTITUTE has an intermediate health score of 6/10 with regard to its cashflows and debt. This indicates that the company should be able to pay off its debt and fund future operations without difficulty. More…

Peers

Its competitors are Renalytix PLC, Synaptogenix Inc, Biodesix Inc.

– Renalytix PLC ($LSE:RENX)

Renalytix PLC, a kidney disease diagnostic company, has a market capitalization of 54.3 million as of 2022. The company’s Return on Equity is -91.92%. Renalytix PLC develops and commercializes kidney disease diagnostic products based on artificial intelligence. The company was founded in 2016 and is headquartered in London, the United Kingdom.

– Synaptogenix Inc ($NASDAQ:SNPX)

Synaptogenix Inc is a clinical stage biotechnology company focused on the development of drugs to treat cognitive disorders. The company’s lead product candidate is SYN-120, a small molecule that is in Phase II clinical trials for the treatment of Alzheimer’s disease. Synaptogenix’s market cap is $48.23M and its ROE is -38.9%.

– Biodesix Inc ($NASDAQ:BDSX)

Biodesix, Inc. is a commercial-stage diagnostics company developing and commercializing blood tests for the early detection, diagnosis and guidance of treatment for cancer and other serious diseases. The company’s first product, the VeriStrat test, is a proteomic blood test used to predict how a patient will respond to standard of care non-small cell lung cancer treatments. The company’s second product, the Nodify Lung test, is a proteomic blood test used to diagnose lung cancer. The company’s third product, the Nodify XL2 test, is a proteomic blood test used to guide the treatment of patients with diffuse large B-cell lymphoma. Biodesix is also developing blood tests for the early detection and diagnosis of other cancers, including ovarian, colorectal and pancreatic cancers.

Summary

The Oncology Institute, Inc. has experienced a surge in their stock price on the same day they announced a strategic partnership with IDEOlogy Health. This partnership provides customized medical education to their customers and is expected to have a positive effect on the company’s performance. Investors should take note of this strategic move and consider investing in the Oncology Institute as its stock price could continue to increase. The long-term success of this partnership will provide the company with long-term growth potential.

Recent Posts