ModivCare Experiences Record-High Gains Despite Growing Losses

January 7, 2023

Trending News ☀️

MODIVCARE INC ($NASDAQ:MODV) is a publicly-traded company that specializes in developing innovative healthcare solutions. Despite the growth, the company has recently seen a dip in its performance, with losses beginning to mount. Last week, however, investors sent the company’s stock skyrocketing by 6.0%, despite the mounting losses. This marked a record-high for the company and its stock price, indicating that investors are still bullish on MODIVCARE’s future prospects. The sudden surge in the stock is likely due to investors’ hopes that the company will be able to turn things around in the near future and return to profitability. The positive news is also likely a result of the company’s recent efforts to restructure operations and focus on developing new products and services.

MODIVCARE has been investing heavily in research and development, as well as exploring new markets and partnerships. This strategic shift appears to be paying off, as evidenced by the strong performance of its stock. Despite the recent gains, MODIVCARE still faces significant challenges. The company’s losses have been mounting for some time, and it remains to be seen whether its restructuring efforts will be enough to turn things around. That said, investors seem to be optimistic about the company’s prospects and are betting on a turnaround in the near future.

Market Price

Despite the current media coverage being largely negative, MODIVCARE INC continues to experience record-high gains despite growing losses. On Thursday, MODIVCARE INC stock opened at $92.2 and closed at $89.4, down by 3.7% from its previous closing price of 92.8. Nonetheless, the stock has been on an upswing for quite some time and has seen a consistent increase in its market value. The company’s recent success is attributed to its focus on innovation and technological advances. MODIVCARE INC has been investing heavily in research and development and has been able to consistently introduce new products and services to the market. This has allowed the company to stay ahead of the competition and capture a large share of the market.

In addition, MODIVCARE INC has been able to capitalize on its existing customer base by offering discounts and promotions. This has helped them to retain existing customers while also attracting new ones. The company has also focused on expanding its market reach by expanding into new regions and countries. This has allowed them to reach out to more customers and further boost their profits. Overall, MODIVCARE INC is continuing to experience record-high gains despite growing losses. The company’s focus on innovation and technological advances, coupled with its ability to capitalize on its existing customer base, have allowed it to stay ahead of the competition and capture a large share of the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Modivcare Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.43k | -56.38 | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Modivcare Inc. More…

| Operations | Investing | Financing |

| 57.67 | -108.94 | -2.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Modivcare Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.99k | 1.64k | 25.19 |

Key Ratios Snapshot

Some of the financial key ratios for Modivcare Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 33.3% | 2.9% |

| FCF Margin | ROE | ROA |

| 1.0% | 12.1% | 2.2% |

VI Analysis

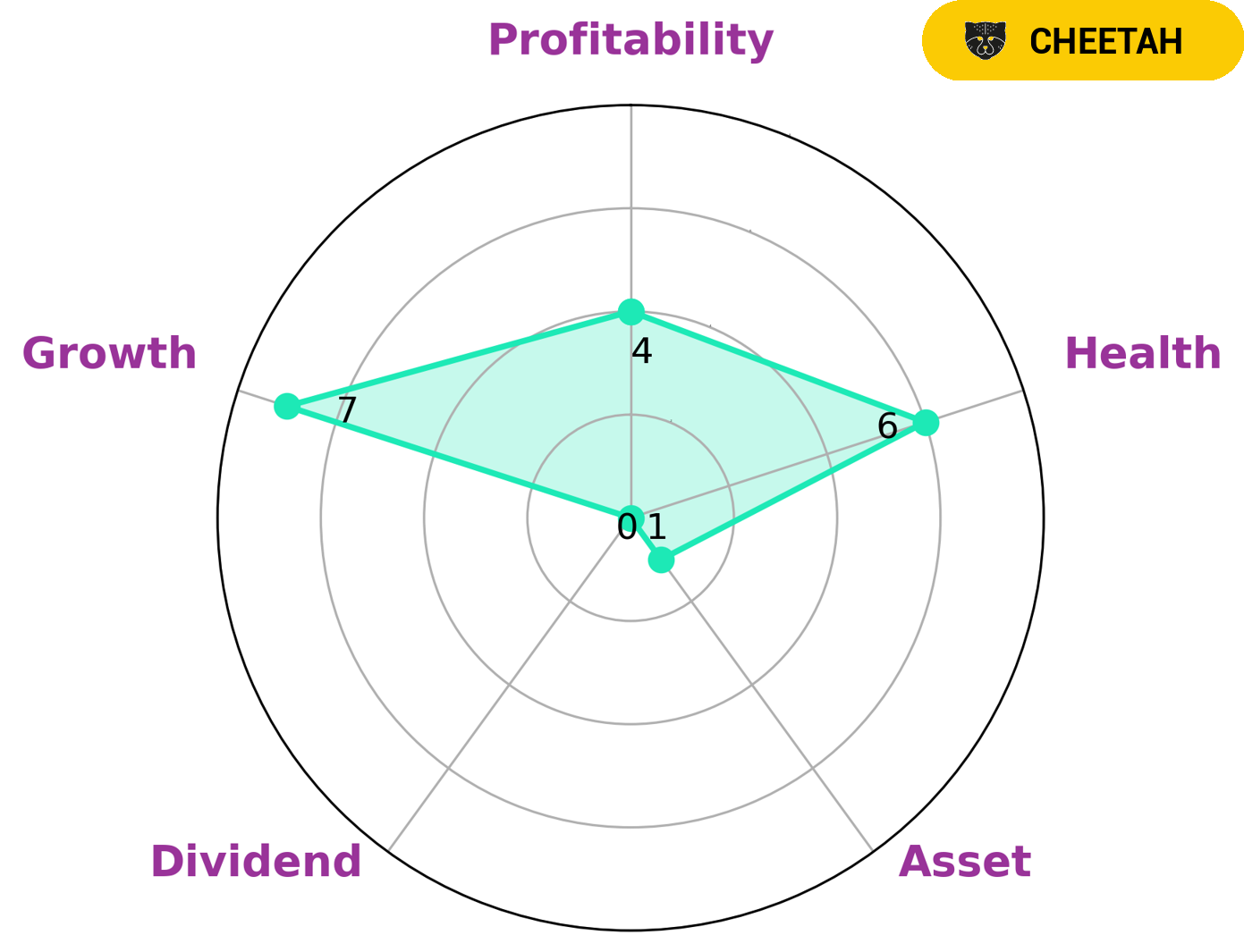

MODIVCARE INC is classified as a ‘cheetah’ company, which has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such companies are attractive for investors who are looking for potential growth but are willing to accept a higher risk of losses. MODIVCARE INC is strong in growth, medium in profitability and weak in assets, dividend. It has an intermediate health score of 6/10 with regard to its cash flows and debt, indicating that it is likely to sustain future operations in times of crisis. Investors who are drawn towards MODIVCARE INC typically have a higher risk tolerance and are looking for potential returns that exceed the average market returns. Such investors are likely to be aggressive in their stock selection and often rely on the company’s fundamentals to assess its long-term potential. Investors must also pay attention to the company’s financial health, cash flows and debt levels, as these will be important indicators of the company’s sustainability. In general, MODIVCARE INC may provide investors with the opportunity to benefit from potentially higher returns while also accepting a higher risk of losses. Such investors must consider the company’s fundamentals and financial health to determine if it is a suitable investment. More…

VI Peers

In the healthcare industry, there is intense competition between ModivCare Inc and its competitors: Humana AB, Mednax Inc, and Hanger Inc. These companies are all vying for a share of the market, and each has its own unique strengths and weaknesses. Humana AB is a large, international company that offers a wide range of services. Mednax Inc is a smaller company that specializes in maternal and child health. Hanger Inc is a publicly traded company that focuses on orthopedics.

– Humana AB ($LTS:0RF7)

Humana AB is a Swedish health insurance company with a market capitalization of 2.04 billion as of 2022. The company has a return on equity of 10.21%. Humana AB provides health insurance products and services to individuals, families, and businesses in Sweden. The company offers a range of health insurance products, including hospital, medical, and dental insurance. Humana AB also provides health and wellness services, such as health coaching and wellness programs.

– Mednax Inc ($NYSE:MD)

Mednax, Inc. is a national provider of maternal-fetal, newborn and pediatric clinical and anesthesia services. The Company operates through three segments: Physician Services, Ancillary Services and Other Services. The Company’s physician services include clinical care provided by its affiliated physicians and other clinicians to expectant mothers, newborn infants and pediatric patients in connection with their mothers’ pregnancies and deliveries, and neonatal intensive care unit (NICU) care. Ancillary services include diagnostic testing, pharmacy and ambulatory surgery center (ASC) operations. The Company’s other services include remote patient monitoring, patient engagement solutions and population health management services.

Summary

ModivCare Inc. has seen record-high gains in the midst of growing losses. Despite this, negative media coverage has caused the stock price to dip. Investors should consider this information when evaluating the company, as it could be a sign of future financial issues. They should also look into the company’s financials, business strategy, and other factors to decide if the stock is a good investment.

Recent Posts