Amedisys Stock Up 5% as Paul Kusserow Pledges to be More Conservative with Guidance for 2023

January 19, 2023

Trending News 🌥️

Amedisys ($NASDAQ:AMED) Inc. is a publicly traded home health, hospice and personal care services company based in Baton Rouge, Louisiana. On Wednesday afternoon, its stock rose 5% following the release of a note to investors from Brian Tanquilut. This news drove the stock up 5%, likely due to the market’s confidence that such a move could prevent a repeat of the firm’s poor share performance in 2022. This performance was caused by multiple earnings misses and guidance cuts, and investors are no doubt hoping that Kusserow’s more conservative approach will prevent this from occurring again.

The note also mentioned that Amedisys remains committed to growing its home health and hospice businesses and that it plans to leverage acquisitions to do so. Overall, Tanquilut’s note was well-received by the market and Amedisys stock climbed 5% as a result. Investors are hopeful that Kusserow’s more conservative approach to guidance will help the company avoid repeating the mistakes of 2022 and drive long-term value for shareholders.

Stock Price

On Wednesday, AMEDISYS stock opened at $85.7 and closed at $92.5, a rise of 8.0% from the prior closing price of 85.6. This surge in stock prices was due to Paul Kusserow, the CEO of AMEDISYS, pledging to be more conservative with guidance for 2023. The CEO also expressed confidence in the company’s prospects and its ability to meet or exceed the guidance set forth for the upcoming year. The market reacted positively to Kusserow’s pledge and the stock rose by 8.0% in the day’s trading. The pledge is indicative of the company’s strong financial position and its ability to meet or exceed expectations going forward. The stock has experienced some volatility over the past month, but this pledge seems to have given investors greater confidence in the company’s future prospects.

The CEO also indicated that the company had made significant investments in technology, hiring, and infrastructure over the past few months and these efforts were beginning to bear fruit. This is encouraging news for investors as it shows that AMEDISYS is committed to being a leader in the healthcare industry and is willing to make the investments necessary to remain competitive. The stock rose 8.0% on Wednesday and investors are optimistic about the company’s future prospects. With technology investments and a commitment to meeting or exceeding expectations, AMEDISYS appears to be in a strong position going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amedisys. More…

| Total Revenues | Net Income | Net Margin |

| 2.22k | 120.94 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amedisys. More…

| Operations | Investing | Financing |

| 97.57 | -104.29 | -90.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amedisys. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.98k | 912.52 | 31.27 |

Key Ratios Snapshot

Some of the financial key ratios for Amedisys are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 2.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 4.1% | 11.6% | 5.8% |

VI Analysis

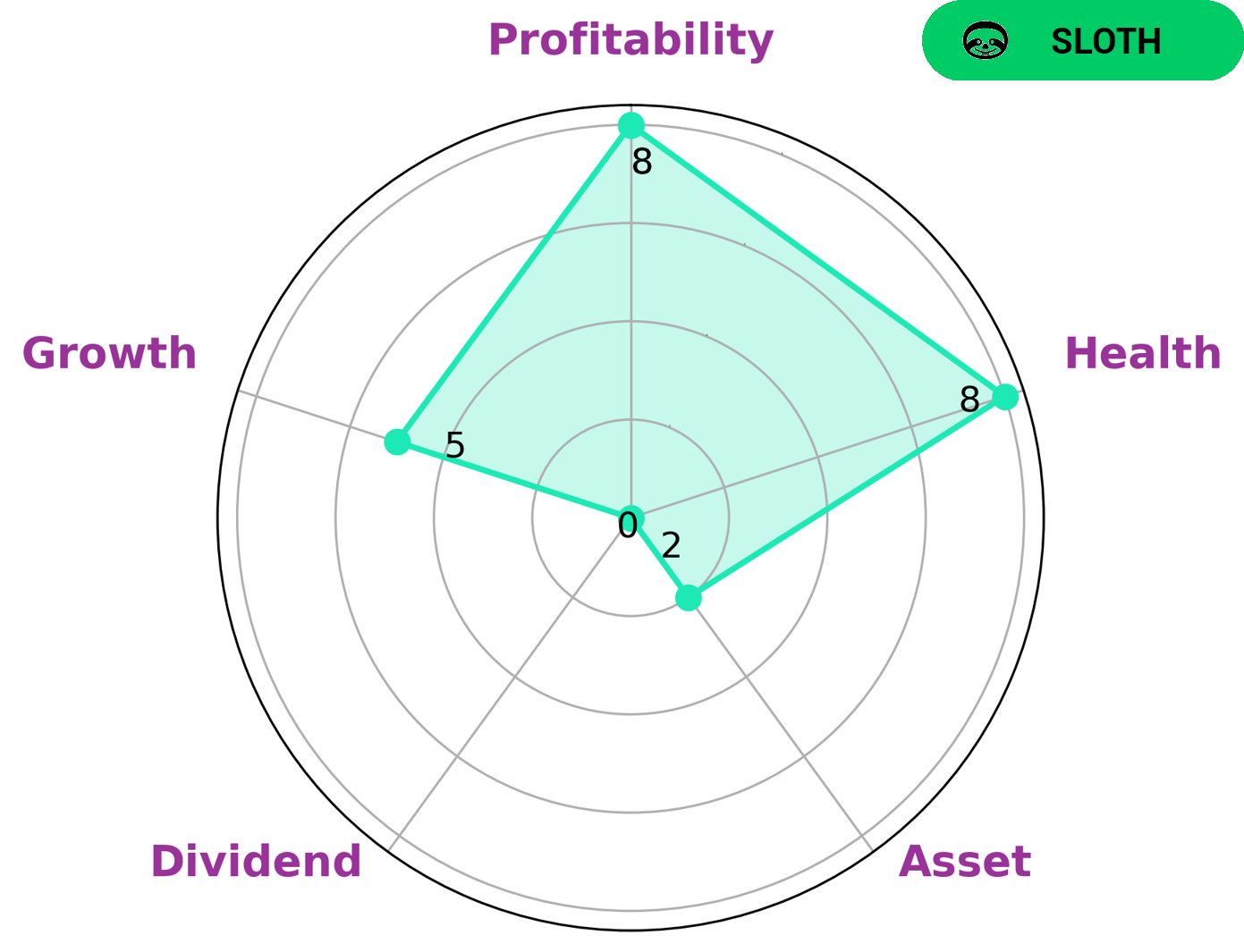

Investing in a company’s fundamentals is key to understanding its long term potential. The VI app simplifies this process by providing a visual representation of the company’s performance in terms of profitability, growth, assets and dividends. AMEDISYS is no exception, with a strong showing in profitability, a medium score in growth, and weak ratings in asset and dividend. When looking at the company’s overall health, AMEDISYS has an impressive score of 8/10 with regard to its cashflows and debt. This indicates that it is capable of safely riding out any crisis without the risk of bankruptcy. This type of company may be attractive to investors who are looking for a long-term investment opportunity with solid fundamentals, but may not be suitable for those seeking quick returns. In conclusion, AMEDISYS is a solid investment opportunity for those who are willing to take the time to understand its fundamentals and accept the slowness of its growth. Its good health score and strong profitability make it an attractive option for those looking for a secure long-term investment. More…

VI Peers

Its competitors include National Healthcare Corp, Aveanna Healthcare Holdings Inc, and Nova Leap Health Corp.

– National Healthcare Corp ($NYSEAM:NHC)

National Healthcare Corporation is a diversified healthcare services company that owns and operates long-term care facilities, hospitals, home health agencies, and hospice care businesses. The company has a market capitalization of $942.75 million and a return on equity of 2.65%. National Healthcare Corporation is headquartered in Nashville, Tennessee.

– Aveanna Healthcare Holdings Inc ($NASDAQ:AVAH)

Aveanna Healthcare Holdings Inc is a publicly traded company that provides health care services. The company has a market capitalization of 290.03 million as of 2022 and a return on equity of -71.08%. The company’s primary business is providing in-home health care services to patients. The company operates in the United States, Canada, and Puerto Rico.

– Nova Leap Health Corp ($TSXV:NLH)

Nova Leap Health Corp is a Canadian publicly traded company with a market cap of 23.25M as of 2022. The company is a provider of home health care services. The company has a Return on Equity of 1.6%. The company’s services include personal care, nursing, and homemaking services.

Summary

Amedisys Inc. is a publicly-traded healthcare services company that offers home health services and hospice care to patients across the United States. Recently, the company’s stock price moved up 5% following CEO Paul Kusserow’s pledge to be more conservative with guidance for 2023. This move has been seen as a positive sign for investors, as it signals Amedisys’ commitment to cautious growth in the coming years. Given Amedisys’ strong financial performance, investors may want to consider adding the stock to their portfolios.

Recent Posts