SVB Leerink Reduces Price Target for IsoPlexis Corporation to $1.50

December 27, 2022

Trending News 🌥️

ISOPLEXIS ($NASDAQ:ISO): IsoPlexis Corporation is a biotechnology company that develops and commercializes single-cell analysis technology for the life sciences and healthcare sectors. The company’s technology platform provides a comprehensive, high-throughput analysis of single-cells, enabling a deeper understanding of disease biology and enabling the development of precision therapies. This price target is based on their assessment of the company’s current financial performance and future prospects. This reduction in the price target is indicative of the uncertainty surrounding the company’s ability to meet its goals in the short term. In addition to the reduction in the price target, analysts at SVB Leerink also noted that there are a number of risks associated with IsoPlexis Corporation. These risks include the uncertainty of their ability to effectively monetize their single-cell analysis technology, the potential for increased competition in the market, and the potential for regulatory delays or other hurdles. Despite these risks, IsoPlexis Corporation has been gaining traction with its technology platform and has recently secured several strategic partnerships with leading life science and healthcare companies. These partnerships have enabled the company to expand its reach and increase its exposure within the industry. Overall, the reduction in the price target for IsoPlexis Corporation is likely reflective of the current market conditions and the uncertainty surrounding the company’s ability to meet its goals in the short term.

However, with the company’s recent strategic partnerships, there is potential for long-term growth and success for IsoPlexis Corporation.

Stock Price

Friday saw a major development when SVB Leerink, an investment banking and asset management firm, reduced its price target for IsoPlexis Corporation to $1.50. So far, news coverage of the company has been mostly negative. Despite this, on Friday the IsoPlexis Corporation stock opened at $1.4 and closed at $1.6, a soar of 16.4% from the last closing price of $1.4. This latest news of price target reduction may be a cause for concern for investors in the company and may push them to sell their shares.

However, it is important to note that despite the downward trend in the company’s share price, it has seen a remarkable jump of 16.4% on Friday. This could be a sign that the current market sentiment towards IsoPlexis Corporation is shifting. It could also be an indication that investors are beginning to look beyond the negative news and focusing more on the company’s fundamentals and potential. With the stock price already at a low point, it could be that investors are less likely to be deterred by this news and may be more inclined to buy shares of the company in anticipation of its future performance. It could also be that investors are waiting for a clearer indication of what the future holds for IsoPlexis Corporation before making any decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Isoplexis Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 18.94 | -98.49 | -516.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Isoplexis Corporation. More…

| Operations | Investing | Financing |

| -109.05 | -9.3 | 130.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Isoplexis Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 134.85 | 61.35 | 1.86 |

Key Ratios Snapshot

Some of the financial key ratios for Isoplexis Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -493.2% |

| FCF Margin | ROE | ROA |

| -624.8% | -71.2% | -43.3% |

VI Analysis

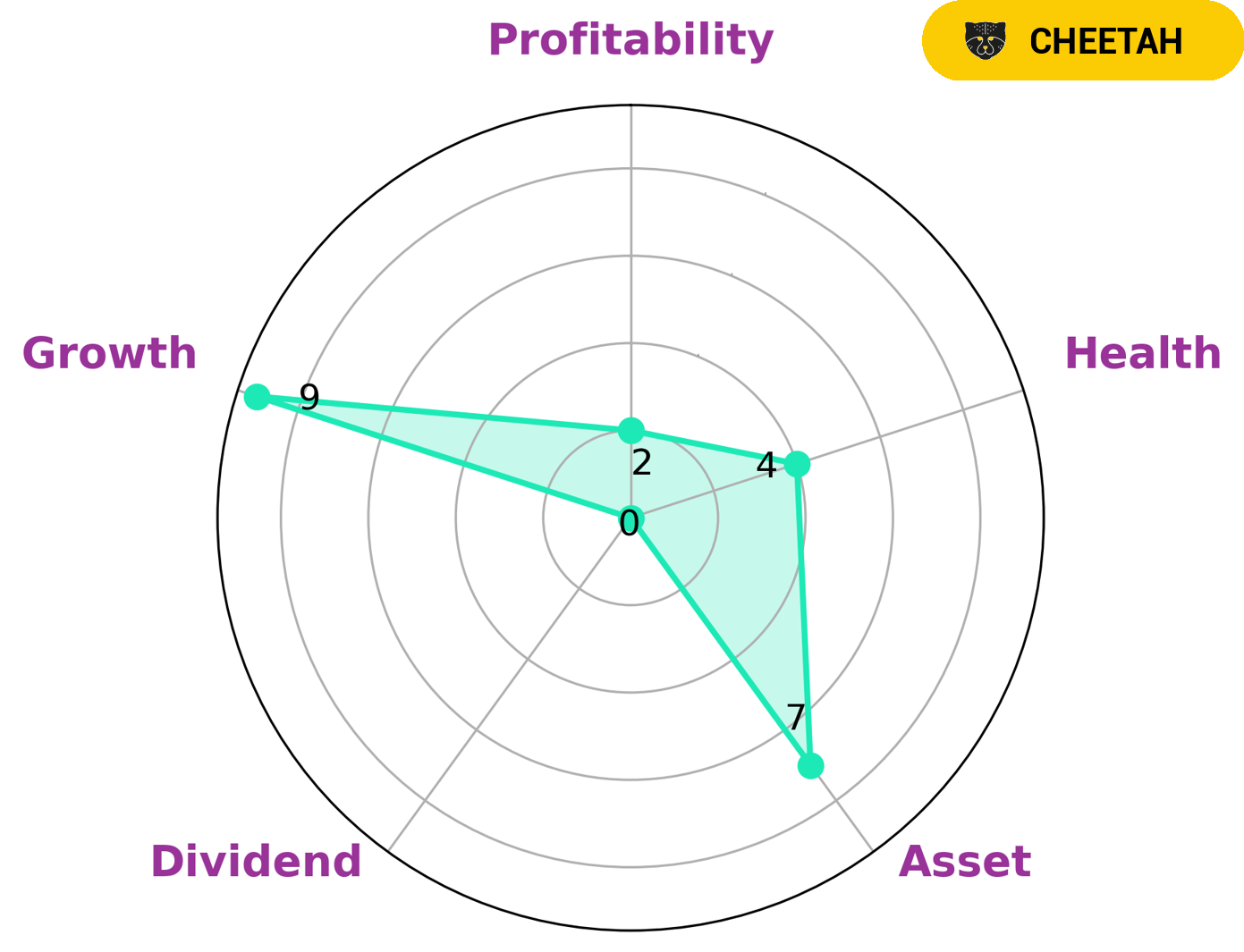

ISOPLEXIS CORPORATION is a strong company with respect to its fundamentals, as demonstrated by the VI Star Chart. It is strong in assets, growth, but weak in dividend and profitability. This makes it a ‘cheetah’ type of company, one that has experienced high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in such companies are typically those looking for potential long-term growth. They are able to take on some risk in the short term, in hopes of a more secure future. Such investors may also be attracted to the company’s intermediate health score of 4/10, as this suggests that it is able to pay off debt and fund future operations. In conclusion, ISOPLEXIS CORPORATION has strong fundamentals, making it attractive to investors who are looking for potential long-term growth. Its intermediate health score of 4/10 is also reassuring for those who are willing to take some risk in the short term. More…

VI Peers

The company’s competitors are ThermoGenesis Holdings Inc, Sernova Corp, and CVRx Inc.

– ThermoGenesis Holdings Inc ($NASDAQ:THMO)

ThermoGenesis Holdings Inc is a company that provides thermal management solutions. The company has a market capitalization of 4.82 million as of 2022 and a return on equity of -66.76%. The company’s products are used in a variety of industries, including semiconductor, life sciences, aerospace, and defense.

– Sernova Corp ($TSXV:SVA)

CVRx Inc is a medical device company that develops and commercializes therapies for cardiovascular diseases. The company has a market cap of 248.04 million as of 2022 and a return on equity of -20.86%. CVRx’s products are designed to treat conditions such as heart failure, hypertension, and arrhythmias. The company’s products are sold in over 30 countries worldwide.

Summary

ISOPLEXIS Corporation is a biotechnology company that focuses on developing single-cell technology to improve health outcomes. Despite this, the stock price moved up the same day, suggesting market optimism. Overall, investors remain upbeat about the company’s future prospects and view it as a potential long-term investment.

Analysts also consider the company’s proprietary technology as a potential game changer in the biotechnology industry. It is important to do further research into the company’s financials and potential risks before making an investment decision.

Recent Posts