GT STEEL GROUP sees 50.23% fluctuation, Last Price at HK$1.91.

March 3, 2023

Trending News ☀️

GT ($SEHK:08402) STEEL GROUP has recently experienced a 50.23% fluctuation in its stock price. Currently, the price stands at HK$1.91, a significant shift from the starting price. This has created a stir in the market, as investors and analysts try to assess the situation and gain insight into what this could mean for the future of GT STEEL GROUP. Analysts have been quick to point to a number of factors that could have contributed to this sharp decline in stock price. A recent cut in production due to weak demand from the construction industry has been highlighted as a possible cause, as well as the current global economic uncertainty.

However, it is still unclear exactly how the market will respond to this rapid shift in stock price. Moving forward, it is expected that GT STEEL GROUP’s stock price will continue to be volatile. Investors are advised to carefully review any potential investments and monitor the markets if they wish to buy or sell shares. It will be interesting to see if the stock price can recover from this sharp drop and potentially reach new highs.

Stock Price

This is despite the fact that news coverage has largely been positive. On Friday, the stock opened at HK$2.2 and closed at HK$2.0, representing a 7.8% drop from its prior closing price of HK$2.2. This was the largest drop in the company’s stock price since it began trading on the Hong Kong Exchange. Despite the fluctuation, investors remain positive that the company’s long-term performance will improve. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gt Steel Construction. More…

| Total Revenues | Net Income | Net Margin |

| 3.86 | -10.23 | -265.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gt Steel Construction. More…

| Operations | Investing | Financing |

| 0.19 | -0.31 | -0.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gt Steel Construction. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.57 | 6.63 | 0.03 |

Key Ratios Snapshot

Some of the financial key ratios for Gt Steel Construction are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -58.2% | 31.0% | -261.6% |

| FCF Margin | ROE | ROA |

| -3.1% | -45.3% | -30.7% |

Analysis

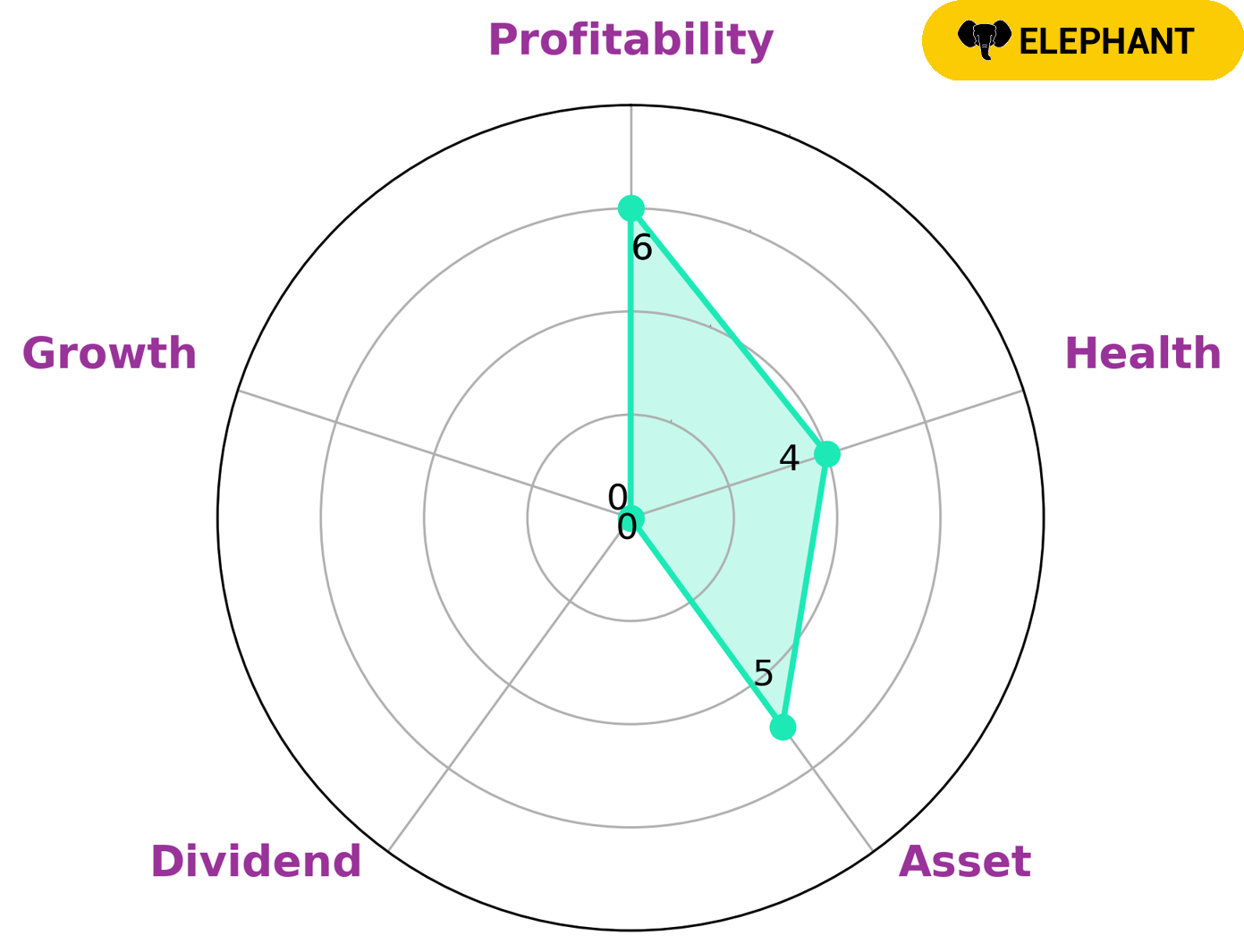

At GoodWhale, we analyzed the financials of GT STEEL CONSTRUCTION to gain insight into their current position. Our Star Chart revealed that GT STEEL CONSTRUCTION is classified as an ‘elephant’, meaning that a company has a lot of assets after liabilities have been deducted. This indicates that the company has a strong financial footing. Investors looking for stability and significant assets may find GT STEEL CONSTRUCTION attractive. GT STEEL COSTRUCTION has an intermediate health score of 4/10 with regards to its cash flows and debt, indicating that the company has a moderate amount of debt but is likely to not be in danger of bankruptcy in the near future. On the other hand, GT STEEL CONSTRUCTION is strong in its asset management, medium in profitability and weak in dividend and growth. As such, investors looking for dividends and potential high growth may not find this company as an ideal investment opportunity. More…

Peers

The competition between GT Steel Construction Group Ltd and its competitors, Tung Ho Steel Enterprise Corp, PT Betonjaya Manunggal Tbk, and VNSTEEL – VICASA JSC, is fierce. Companies in this sector are constantly innovating to stay ahead in the ever-changing market, striving to offer the best products and services to their customers. As the competition intensifies, these four companies continue to push each other to become more efficient and cost-effective.

– Tung Ho Steel Enterprise Corp ($TWSE:2006)

Tung Ho Steel Enterprise Corp is a Taiwanese steel producer and distributor. The company serves the construction, automotive, and appliance markets. As of 2023, the company has a market cap of 45.27B, which makes it one of the largest steel companies in the world. Additionally, the company has a strong Return on Equity of 12.37%, indicating that it is efficiently using its assets to generate profits for investors. Tung Ho Steel Enterprise Corp is well-positioned for future growth and profitability.

– PT Betonjaya Manunggal Tbk ($IDX:BTON)

PT Betonjaya Manunggal Tbk is a leading Indonesian construction and engineering company. It specializes in the construction of infrastructure such as bridges, roads, and ports. The company has a market cap of 288B as of 2023, making it one of the most valuable companies in Indonesia. Its Return on Equity stands at 1.93%, which is impressive considering the size of the company and the fact that ROE is a measure of how efficiently a company utilizes its equity capital to generate profits. This suggests that the company is efficiently utilizing its resources to generate returns for its investors.

Summary

GT STEEL CONSTRUCTION is a Hong Kong-based stock that has recently seen a large fluctuation of 50.23%. The company’s last recorded price was HK$1.91. News coverage regarding the stock generally appears to be positive, however the stock dropped on the same day. Investors should consider the risk and potential rewards carefully when considering this stock.

They should pay close attention to news relating to the company and its performance, as well as its performance compared to competitors in the sector. A thorough analysis of the company’s financials, as well as potential effects of macro-economic trends, could also be beneficial when deciding whether or not this stock is a suitable investment.

Recent Posts