Baird Adjusts Price Target for ESAB to $70, Maintaining Outperform Rating

May 5, 2023

Trending News 🌥️

Baird has recently adjusted their price target for ESAB ($NYSE:ESAB) Corporation (ESAB) to $70, maintaining their Outperform Rating. ESAB is a leading multi-national manufacturer and distributor of welding and cutting products and equipment. Baird’s decision to keep their Outperform Rating and increase the price target to $70 is a reflection of the company’s strong performance in recent quarters.

Year to date, ESAB’s stock has seen steady growth, with some analyst predicting that the stock will continue to rise. With their wide range of products and extensive global presence, analysts believe that the company is well-positioned for future success.

Share Price

Following this announcement, the stock opened at $59.9 and closed at $58.8, which was a 2.0% decrease from its previous closing price of $59.9. This adjustment follows a series of decreases over the past few weeks, as the company struggles to stay afloat amidst the current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Esab Corp. More…

| Total Revenues | Net Income | Net Margin |

| 2.63k | 200.21 | 8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Esab Corp. More…

| Operations | Investing | Financing |

| 236.34 | -207.01 | 0.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Esab Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.85k | 2.39k | 23.58 |

Key Ratios Snapshot

Some of the financial key ratios for Esab Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | 12.8% | 13.8% |

| FCF Margin | ROE | ROA |

| 7.4% | 16.4% | 5.9% |

Analysis

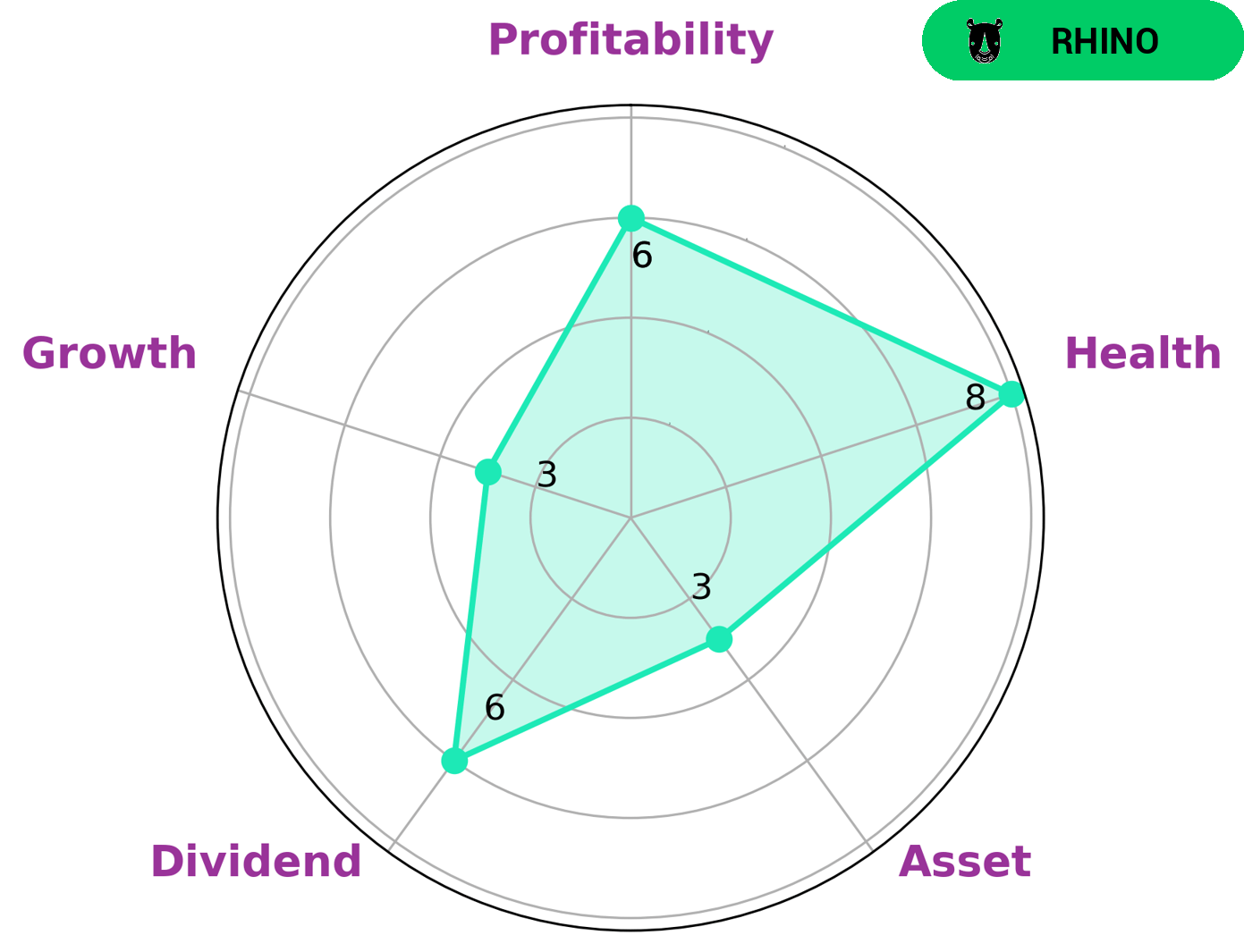

We at GoodWhale have analyzed ESAB CORP‘s financials and based on our Star Chart, their performance is strong in, medium in dividend, profitability and weak in asset, growth. With a health score of 8/10 with regard to cashflows and debt, ESAB CORP is capable of paying off debt and funding future operations. Based on our analysis of their performance, we classify ESAB CORP as “rhino”, a company that has achieved moderate revenue or earnings growth. Investors who are looking for steady, moderate returns may be interested in investing in ESAB CORP due to their stable cashflows, low debt, and moderate growth. Those looking for a higher risk, higher reward investment may find ESAB CORP to be an interesting opportunity as well. More…

Peers

ESAB Corp is in competition with Nordson Corp, Graco Inc, and Lincoln Electric Holdings Inc. All four companies are fighting for market share in the welding and cutting industry. ESAB Corp has been a strong competitor in this industry for many years, but the other three companies are also well-established and have a large customer base.

– Nordson Corp ($NASDAQ:NDSN)

Nordson Corporation is a publicly traded company with a market capitalization of $12.47 billion as of 2022. The company has a return on equity of 18.05%. Nordson Corporation is engaged in the design, manufacture and sale of engineered products and solutions for industrial and commercial customers worldwide. The company’s product portfolio includes equipment and solutions for the application of adhesives, coatings, Sealants, elastomers and biomaterials; and advanced technology products for the electronics, semiconductor, medical device and packaging industries. Nordson Corporation is headquartered in Westlake, Ohio, United States.

– Graco Inc ($NYSE:GGG)

Graco Inc is a publicly traded company with a market capitalization of $11.44 billion as of 2022. The company has a return on equity of 19.47%. Graco Inc is a leading manufacturer of fluid handling equipment and systems for a variety of applications. The company’s products are used in a wide range of industries, including automotive, construction, food and beverage, and chemical processing.

– Lincoln Electric Holdings Inc ($NASDAQ:LECO)

Lincoln Electric Holdings Inc. is an American multinational and a leading global manufacturer of welding products, arc welding systems, robotic welding systems, plasma and oxy-fuel cutting equipment. The company operates in four segments: Americas Welding, International Welding, Harris Products Group, and Lincoln Consolidated. The company has a market cap of $8.13B and a ROE of 37.76%.

Summary

ESAB CORP, a manufacturer and distributor of welding and cutting products, has been receiving a strong rating from Baird. The firm has adjusted its price target on ESAB to $70 from $68 and has maintained its Outperform rating. This updated price target is based on their belief that ESAB is set to benefit from long-term trends in the industry, such as increased automation, improved efficiency, and manufacturing digitization.

In addition, they are forecasting growth in ESAB’s end markets, while its balance sheet remains strong. Despite its positive outlook, investors should remain aware of risks that could affect the company’s performance, such as a decline in demand for its products due to economic conditions.

Recent Posts