B. Riley Securities Reiterates “Buy” Rating for ARMOUR Residential REIT [NYSE: ARR], Sets New Price Target at $9.50

April 14, 2023

Trending News ☀️

B. Riley Securities has reiterated their “Buy” rating for ARMOUR ($NYSE:ARR) Residential REIT Inc. NYSE: ARR, and has set a new price target at $9.50. Despite this bullish sentiment, the stock still dropped -2.23% at the close of Monday’s trading session, closing at a price of $5.25 per share. ARMOUR Residential REIT Inc. is a publicly traded REIT dedicated to investing in residential mortgage-backed securities in the United States. The company is primarily focused on the acquisition, holding and management of residential mortgage-backed securities backed by adjustable-rate, hybrid adjustable-rate, fixed-rate and inverse floating rate mortgage loans issued by U.S. government agencies or government-sponsored enterprises. The company also invests in other mortgage-backed securities and non-agency residential mortgage-related investments.

Stock Price

On Wednesday, ARMOUR RESIDENTIAL REIT Inc. (NYSE: ARR) opened at $5.3 and closed at $5.3, up by 1.5% from its prior closing price of 5.2. The firm believes the strong current performance of the stock, combined with its potential for future growth, makes it an attractive long-term investment opportunity. It focuses on investments related to residential mortgage-backed securities and other related investments and is headquartered in Virginia Beach, Virginia.

The company’s financial position is strong, with solid cash flow and no debt on its balance sheet. The company has been consistently profitable over the past few years and is well-positioned to continue to deliver strong returns to investors over the long term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ARR. More…

| Total Revenues | Net Income | Net Margin |

| -225.87 | -241.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ARR. More…

| Operations | Investing | Financing |

| 124.08 | -3.89k | 3.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ARR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.44k | 8.32k | 6.83 |

Key Ratios Snapshot

Some of the financial key ratios for ARR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

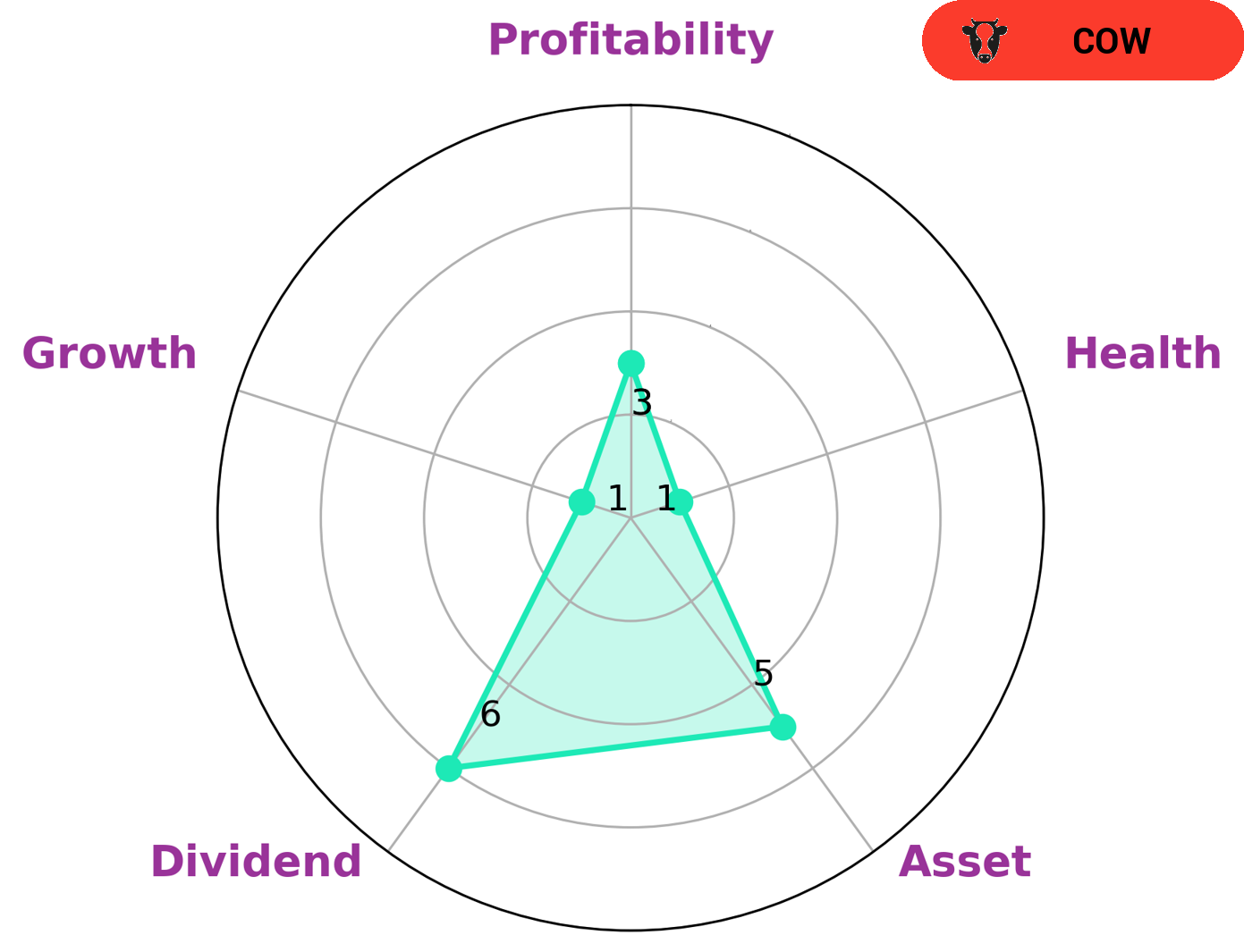

GoodWhale’s analysis of ARMOUR RESIDENTIAL REIT’s health has revealed that the company fits into the ‘cow’ classification. This type of company is known to have a track record of paying out consistent and sustainable dividends. As a result, investors who are looking for a steady income may be interested in this type of company. Our Star Chart has also shown that ARMOUR RESIDENTIAL REIT is strong in medium in asset and dividend, but weak in growth and profitability. Furthermore, its low health score of 1/10 indicates that the company is less likely to be able to pay off its debt and fund its future operations. Therefore, investors might want to consider these factors when deciding whether to invest in this company. More…

Peers

The company is headquartered in Boca Raton, Florida and was founded in 2006. ARMOUR operates as a holding company that owns subsidiaries which are engaged in the business of acquiring, investing in, and managing residential mortgage-backed securities. The company competes against Chimera Investment Corp, Dynex Capital Inc, and Annaly Capital Management Inc.

– Chimera Investment Corp ($NYSE:CIM)

Chimera Investment Corporation is a real estate investment trust that primarily invests in adjustable-rate and fixed-rate residential mortgage loans, commercial mortgage loans, real estate-related securities, and other asset classes. The company has a market cap of $1.57 billion as of 2022.

– Dynex Capital Inc ($NYSE:DX)

Dynex Capital, Inc. is a publicly traded real estate investment trust. The company invests in a variety of real estate-related assets, including commercial mortgage loans, commercial mortgage-backed securities, and other real estate-related investments.

– Annaly Capital Management Inc ($NYSE:NLY)

Analysts have estimated that Annaly Capital Management Inc’s market cap would be around 10.08B as of 2022. The company’s main focus is on providing mortgage financing and servicing to the US residential and commercial real estate markets. In recent years, the company has expanded its operations into other areas such as healthcare and student housing.

Summary

B. Riley Securities recently reiterated their price target for ARMOUR Residential REIT Inc. NYSE: ARR, setting a new target of $9.50 per share. The stock has been slipping lately, closing Monday at $5.25, down 2.23% from the previous day. Investors should take this as an opportunity to consider investing in ARMOUR Residential REIT, as they may be able to capitalize on the current price and potential long-term benefits offered by the REIT. It is important to research the company and perform due diligence before investing.

Recent Posts