ASML vs Sono-Tek: Which is the Better Investment?

September 21, 2022

Trending News ☀️

SONO-TEK($NASDAQ:SOTK): ASML and Sono-Tek are both computer and technology companies that are worth investing in. They are both leaders in their respective fields, but ASML is the better investment. ASML has a proven track record of success and is a more diversified company. Sono-Tek is a newer company and is less diversified.

Price History

Despite the recent sell-off, SONO remains one of the better-performing stocks in the market. The company reported strong quarterly results last week, with revenue and earnings coming in ahead of expectations. Investors may want to consider buying SONO on the dip, as the stock looks poised to continue its upward trajectory.

VI Analysis

A company’s fundamentals are a good reflection of its long term potential. The below analysis on SONO-TEK is made simple by VI app. Based on VI Star Chart, SONO-TEK is strong in asset, growth, profitability, and weak in dividend.

However, SONO-TEK has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. SONO-TEK is classified as ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. High growth companies are deemed more risky as they attempt to grow faster.

Summary

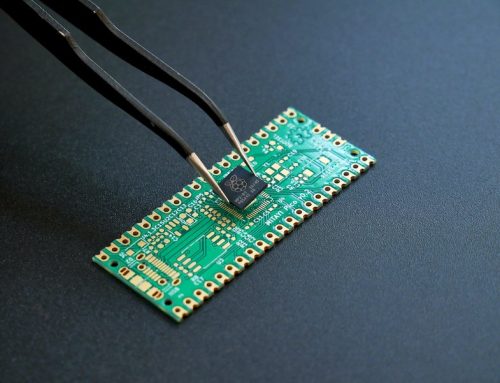

Sono-Tek is a technology company that specializes in the development and manufacturing of ultrasonic spraying systems. The company’s products are used in a variety of applications, including coating, cleaning, and bonding. ASML is a leading provider of lithography systems for the semiconductor industry. The company’s products are used in the manufacturing of integrated circuits . Both companies are leaders in their respective industries and offer investors attractive growth prospects.

However, Sono-Tek appears to be the better investment at this time. Sono-Tek’s ultrasonic spraying systems have a number of advantages over traditional spraying methods. The company’s products provide superior coverage, are more efficient, and result in less waste. In addition, Sono-Tek’s products are compatible with a wide range of materials, including difficult-to-coat surfaces. The company is also benefiting from strong demand for its products. This growth is being driven by increasing demand from the electronics, solar, and medical industries. ASML is also a well-positioned company with strong growth prospects. The semiconductor industry is in the midst of a multi-year growth cycle, and ASML is well-positioned to benefit from this trend. The company’s products are essential for the manufacturing of ICs, and demand for these products is growing at a healthy clip.

However, there are a few concerns with ASML. Firstly, the company is facing increasing competition from rivals such as Nikon and Canon. Secondly, ASML is heavily reliant on a small number of customers, such as Intel and Samsung. This concentration could pose a risk if one of these customers were to reduce their orders. Overall, Sono-Tek appears to be the better investment at this time. The company is benefiting from strong demand for its products and has a number of advantages over its competitors. While ASML is also a well-positioned company, it faces some headwinds that make Sono-Tek a more attractive investment option.

Recent Posts