W.P. Carey: Capitalizing on Market Dips

April 19, 2023

Trending News 🌥️

W. ($NYSE:WPC)P. Carey is a real estate investment trust company that has a long history of success in the industry. As an investor, I believe in the value of W.P. Carey and its potential for long-term success. Whenever the market dips and I see an opportunity to invest in W.P. Carey at a lower price, I take advantage of this and invest more in the company. Moreover, W.P. Carey has a variety of offerings for both institutional and individual investors, ranging from debt and equity investments to real estate funds and special purpose vehicles.

The company also offers a variety of services that support their investors, such as market research and asset management. This all makes W.P. Carey an attractive option for those looking to capitalize on market dips and take advantage of the current economic climate.

Market Price

On Monday, W. P. CAREY stock opened at $71.5 and closed at $72.6, marking a 1.8% increase from the previous closing price of $71.3. This growth was notably spurred by the company’s ability to capitalize on market dips and opportunities that arose over the course of the day. W. P. CAREY is renowned for their disciplined approach to investment and keen eye for recognizing potential.

This strategy has allowed the company to consistently remain ahead of the competition, even in volatile market conditions. Despite the uncertainty of the current economic climate, investors can take comfort in knowing that W. P. CAREY is well positioned to continue to make smart investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WPC. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 599.14 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WPC. More…

| Operations | Investing | Financing |

| 1k | -1.05k | 57.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WPC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.1k | 9.09k | 42.7 |

Key Ratios Snapshot

Some of the financial key ratios for WPC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 47.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

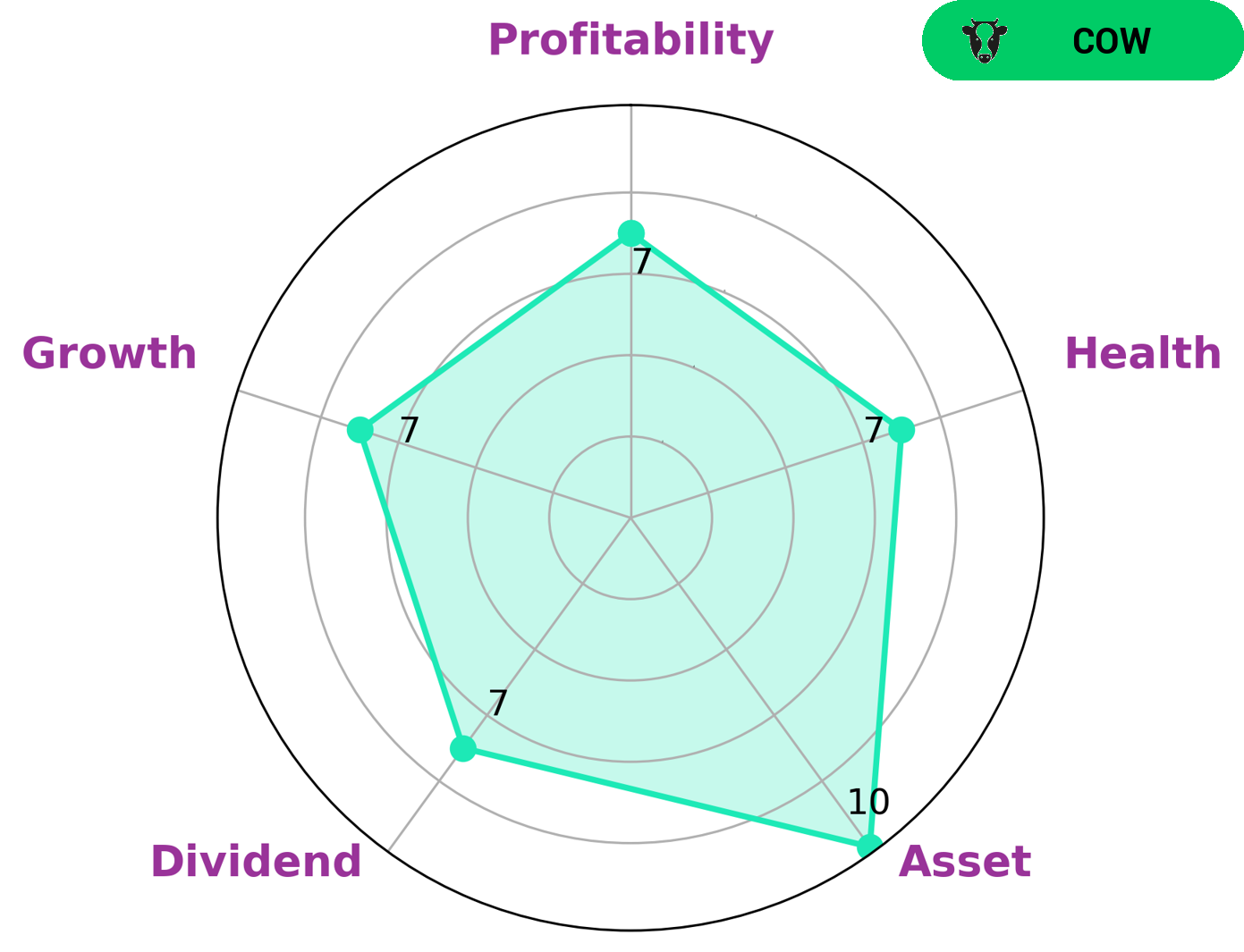

At GoodWhale, we recently performed an analysis of W. P. CAREY’s wellbeing. Our Star Chart indicated that W. P. CAREY has a high health score of 7/10 – this score is based on its cashflows and debt, and indicates that it is capable to safely ride out any crisis without the risk of bankruptcy. We classified W. P. CAREY as a ‘cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends. We believe W. P. CAREY is a great asset for investors looking for reliable returns. The company has strong metrics in asset, dividend, growth, and profitability, making it attractive to a variety of different types of investors. Whether you’re an investor looking for long-term capital gains, or someone just wanting a steady stream of dividend income, W. P. CAREY might be the right fit for you. More…

Peers

It’s one of the largest owners and operators of single-tenant commercial properties in the U.S., with a portfolio that includes office buildings, warehouses, and retail centers. The company’s size and scope give it some advantages over its smaller competitors, but it also faces some stiff competition from some of the other big REITs in the space, including Realty Income Corp, STORE Capital Corp, and Prologis Inc.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a publicly traded real estate investment trust that invests in commercial real estate properties in the United States. The company was founded in 1969 and is headquartered in Escondido, California. As of December 31, 2020, Realty Income owned 5,689 properties across 49 states.

– STORE Capital Corp ($NYSE:STOR)

STORE Capital Corp is a real estate investment trust that focuses on acquiring, financing, and owning net-leased properties. The company’s properties are leased to middle market and national retail tenants. As of December 31, 2020, STORE Capital owned 1,847 properties in 48 states.

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust that owns, operates, and develops warehouses and distribution centers around the world. As of 2022, it has a market capitalization of $94.6 billion. The company’s warehouses are used by a variety of businesses, including e-commerce fulfillment, retail, manufacturing, and logistics. Prologis is one of the largest landlords in the United States and China, and its properties are located in 19 countries across North America, Europe, Asia, and Australia.

Summary

W. P. Carey is a real estate investment trust that specializes in financing and owning income-generating real estate assets. Their strategy focuses on long-term investments, with an emphasis on capital preservation and steady cash flow. Their analysis of potential investments involves assessing the quality and sustainability of the tenant, the creditworthiness of the tenant’s lease, the quality of the asset, and the market and macroeconomic environment.

With this in mind, they look to acquire properties that have solid fundamentals, generate positive cash flow, and have a low risk of default. Investors can benefit from W. P. Carey’s track record of strong returns, making them an attractive option for those seeking long-term gains.

Recent Posts