Sempra Stock Closes 0.24% Higher Despite Market Rally

January 17, 2023

Trending News 🌥️

Sempra ($NYSE:SRE) is a Fortune 500 energy services holding company based in San Diego, California. It is one of the largest natural gas and electric utilities in the United States and Mexico. On Tuesday, Sempra stock closed 0.24% higher despite a market rally. The S&P 500 Index rose 2.16% to 3,934.83, while Sempra stock only slightly increased, closing at $157.51. The general market rally was driven by optimism surrounding the US economy and the Biden administration’s plans for more stimulus spending. Investors are hoping that more relief will help businesses, particularly those in the energy sector, recover from the economic downturn caused by the pandemic.

Sempra’s performance on Tuesday suggests that investors are still confident in the company’s ability to weather the storm and maintain its solid financial position. The company has been able to successfully diversify its businesses, allowing it to remain resilient despite the difficult economic environment. In addition to the market rally, Sempra has also been benefiting from its investments in renewable energy projects and its recent acquisition of Oncor, a Texas-based electric utility. The company’s ongoing efforts to expand its operations in Texas are expected to continue to drive growth in the near future. As a result, investors appear confident that Sempra’s stock will continue to perform well over the long term.

Stock Price

On Wednesday, SEMPRA stock opened at $158.0 and closed at a higher price of $162.1, up by 2.9 % from its previous closing price of $157.5. This was despite a broad market rally throughout the day. SEMPRA is an energy company based in San Diego, California, with operations in the United States, Mexico, South America, and the Caribbean. It also owns natural gas and power plants, and generates electricity from renewable sources.

The closing of SEMPRA stock at a higher price than its opening suggests a positive sentiment among investors in the company’s prospects. This could be attributed to the company’s strong financial performance in recent years, which has resulted in higher dividends for shareholders. Investors should continue to monitor the stock’s performance over the coming weeks to gain further insight into the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sempra. More…

| Total Revenues | Net Income | Net Margin |

| 14.83k | 2.26k | 18.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sempra. More…

| Operations | Investing | Financing |

| 3.95k | -5.51k | 1.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sempra. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 75.56k | 46.27k | 86.15 |

Key Ratios Snapshot

Some of the financial key ratios for Sempra are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 3.9% | 11.0% |

| FCF Margin | ROE | ROA |

| -6.8% | 6.8% | 2.4% |

VI Analysis

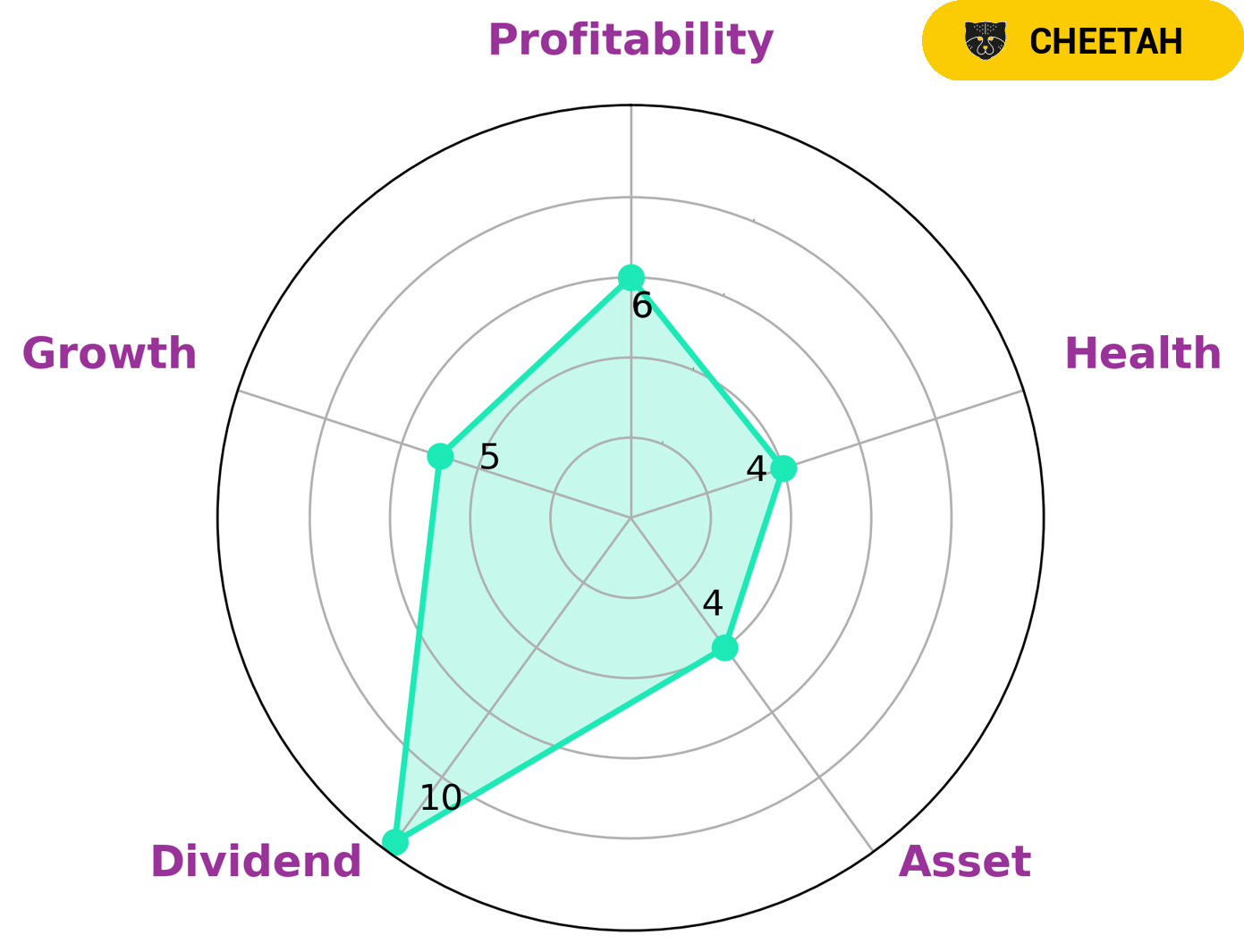

SEMPRA is a company whose fundamentals reflect its long term potential. According to the VI Star Chart, SEMPRA has an intermediate health score of 4/10, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. With regards to its performance, SEMPRA is strong in dividend, and medium in asset growth, profitability, and financial stability. It is classified as a ‘cheetah’, which is a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the company’s relatively low health score, investors looking for long-term, safe investments should look elsewhere. However, those with higher risk tolerance who are looking for short-term gains may be interested in SEMPRA. These investors may be drawn to SEMPRA’s potential for high earnings growth or dividend payments. They may also be looking for companies that are less established and therefore have the potential to generate higher returns if the company does well. In conclusion, SEMPRA is a company that has potential for high returns but is considered less stable due to lower profitability. Investors with higher risk tolerance who are looking for short-term gains may be interested in this company. More…

VI Peers

Sempra Energy is a Fortune 500 energy services holding company based in San Diego, California. The Sempra Energy companies’ 15,000 employees serve approximately 32 million consumers worldwide. Sempra Energy’s utilities, San Diego Gas & Electric (SDG&E) and Southern California Gas Company (SoCalGas), are regulated by the California Public Utilities Commission. Sempra Energy’s other businesses include Sempra Commodities, Sempra Generation and Sempra LNG.

– Atmos Energy Corp ($NYSE:ATO)

Atmos Energy Corporation is an American natural gas and electricity company headquartered in Dallas, Texas. The company’s operations include natural gas production, transmission and distribution, as well as electricity generation and distribution. As of December 31, 2020, Atmos Energy Corporation operated in 11 states and served approximately 3.6 million natural gas and electricity customers.

Atmos Energy Corporation’s market capitalization is $14.27 billion as of 2022. The company’s return on equity is 6.28%.

Atmos Energy Corporation is one of the largest natural gas and electricity companies in the United States. The company is headquartered in Dallas, Texas and operates in 11 states. As of December 31, 2020, Atmos Energy Corporation served approximately 3.6 million natural gas and electricity customers.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portugal-based holding company engaged in the electricity and gas sector. The Company operates in three segments: Gas and Electricity Transmission, Distribution and Supply, and Renewable Energy. The Gas and Electricity Transmission segment includes the transport of electricity and natural gas through high-voltage lines and pipelines, respectively. The Distribution and Supply segment handles the distribution of electricity and natural gas to end customers, as well as the resale of energy to energy suppliers. The Renewable Energy segment focuses on the generation of electricity from renewable sources, such as wind, solar and hydro power. As of December 31, 2011, REN-Redes Energeticas Nacionais SGPS SA operated through a network of 12,955 kilometers of high voltage lines and 8,290 kilometers of pipelines.

– Alliant Energy Corp ($NASDAQ:LNT)

Alliant Energy Corp is a utility company that generates and distributes electric and natural gas services to customers in the Midwest region of the United States. As of 2022, the company had a market capitalization of $12.63 billion and a return on equity of 9.62%. Alliant Energy Corp is headquartered in Madison, Wisconsin.

Summary

Investing in Sempra can be a good way to diversify a portfolio as the company is relatively resilient to market volatility. On Tuesday, the stock closed 0.24% higher despite a rally in the broader market. Analysts cite Sempra’s strong financial fundamentals, such as its stable earnings and cash flows, as reasons for its attractiveness as an investment. Furthermore, the company has a consistent dividend policy and has consistently grown its dividend payments over the years.

Additionally, Sempra has a strong balance sheet with no debt and a healthy cash reserve. These factors make it an attractive option for long-term investors looking for security and potential returns.

Recent Posts