Cvent Holding Exploring Potential $4B+ Sale, Soaring 15% in Market Reaction

February 1, 2023

Trending News 🌥️

Cvent Holding ($NASDAQ:CVT), a leading cloud-based event-software company, has been exploring a potential sale with a potential value of more than $4 billion, according to a Wall Street Journal report. As a result, the company’s shares have soared 15% in reaction to the news. Private equity firms such as Blackstone have expressed interest in the potential sale, yet it remains uncertain whether a deal will be made. The company provides event management and marketing software, including registration, meeting and event management, event marketing, and mobile and analytics solutions. The potential sale of Cvent Holding is yet another example of the increasing value of cloud-based technology companies. With its strong customer base and innovative technology platform, Cvent Holding could attract potential buyers looking to capitalize on its growth potential.

However, whether or not a sale will be made remains uncertain at this time.

Share Price

At the time of writing, media coverage of Cvent Holding is mostly positive. On Tuesday, the stock opened at $6.6 and closed at $8.1, soaring by 22.8% from the last closing price of $6.6. This significant jump in stock price is likely due to the potential of a $4 billion plus sale of the company. Although nothing has been officially confirmed, speculation is rampant that Cvent Holding is exploring potential buyers for the company. The news has been met with an overwhelmingly positive reaction from the market with CVENT HOLDING stock soaring in value and shares increasing in volume. Investors are excited by the possibilities that the sale would bring and the potential for a large payday should Cvent Holding be successful in finding a buyer. In addition, the sale could open up new opportunities for the company and its shareholders, such as access to capital and strategic partnerships.

However, it remains to be seen if the sale will actually take place. There are still many unknowns, including who the potential buyers are, how much they are willing to pay, and whether or not negotiations will be successful. Until then, investors and traders will continue to speculate on how the sale might affect Cvent Holding’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cvent Holding. More…

| Total Revenues | Net Income | Net Margin |

| 604.29 | -102.67 | -16.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cvent Holding. More…

| Operations | Investing | Financing |

| 141.79 | -60.31 | -74.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cvent Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.21k | 613.43 | 3.29 |

Key Ratios Snapshot

Some of the financial key ratios for Cvent Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | – | -13.8% |

| FCF Margin | ROE | ROA |

| 14.1% | -3.3% | -2.4% |

VI Analysis

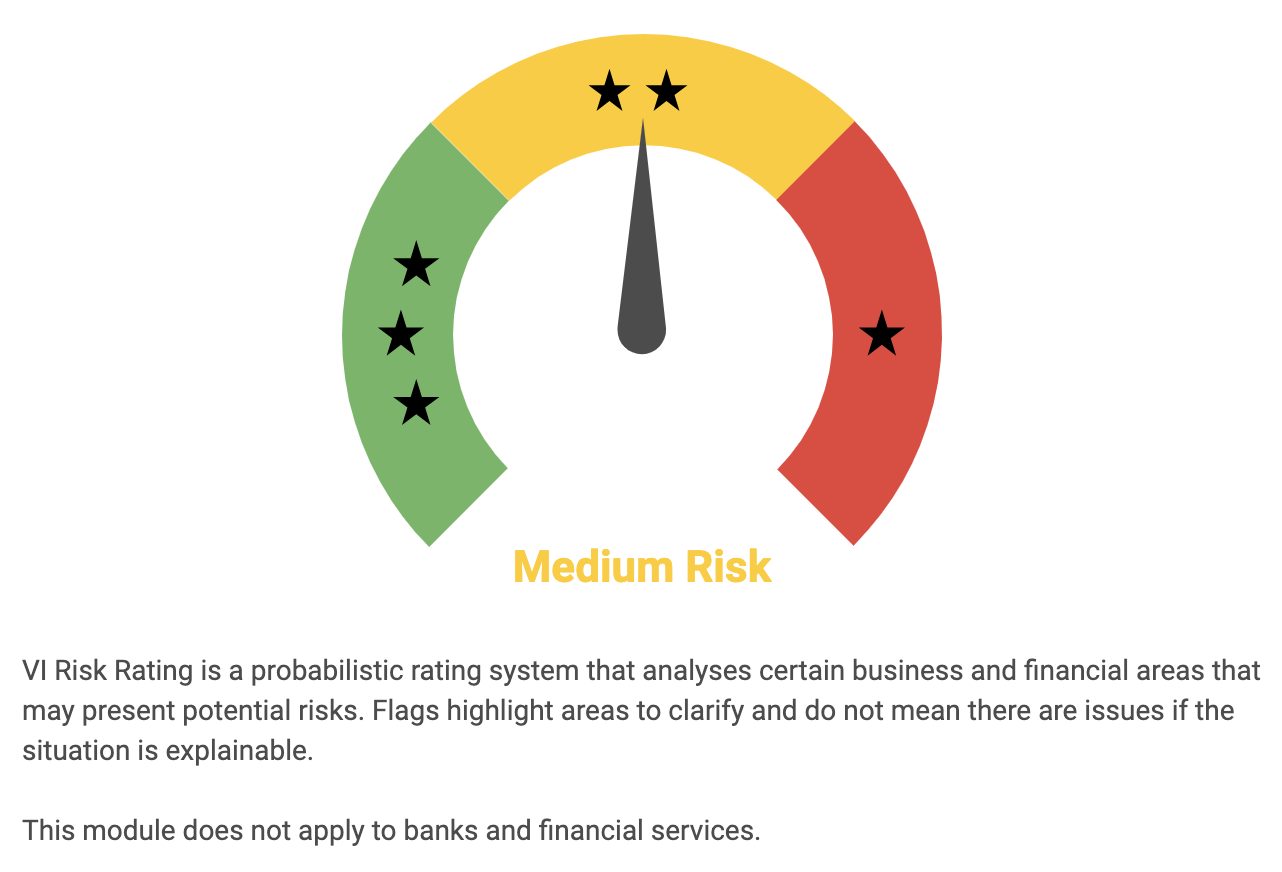

The VI App is a great tool for investors looking to analyze the fundamentals of Cvent Holding. It provides an easy-to-understand visual representation of the company’s financials, allowing users to get a sense of the company’s long-term potential. According to the VI Risk Rating, Cvent Holding is classified as a medium risk investment. The app has detected one risk warning in the balance sheet, which registered users can access and investigate further. The VI App also offers additional insights into the company’s operations such as its revenue growth, operating efficiency and profitability, which can help investors make informed decisions. Furthermore, it provides an overview of the company’s debt structure and cash flow, enabling users to assess Cvent Holding’s overall financial health. Overall, the VI App is a great tool for investors who are looking to analyze Cvent Holding’s fundamentals. It provides an easy-to-understand visual representation of the company’s financials, as well as additional insights into its operations and financial health. This can help potential investors make informed decisions about their investments. More…

VI Peers

The company was founded in 1999 and is headquartered in Tysons Corner, Virginia. Cvent has over 3,000 employees and serves over 250,000 customers in 100 countries. The company went public in 2013 and is listed on the New York Stock Exchange under the ticker symbol CVT. Cvent’s main competitors are Salesforce, Cistera Networks, and Tintri.

– Salesforce Inc ($NYSE:CRM)

Salesforce is a cloud-based software company that provides customer relationship management (CRM) software to businesses of all sizes. Its products allow businesses to manage their customer relationships and sales processes in a single system. The company’s market cap is $160.17 billion and its ROE is 0.08%.

– Cistera Networks Inc ($OTCPK:CNWT)

Cistera Networks Inc is a company that provides software-defined networking solutions. The company has a market capitalization of 1.12 million as of 2022 and a return on equity of 3.67%. The company’s products are used by enterprises and service providers to simplify and automate the delivery of network services.

– Tintri Inc ($OTCPK:TNTRQ)

Tintri Inc is a company that provides cloud storage and data management solutions. It has a market cap of 675.02k and a ROE of 116.12%. The company’s products and services are used by organizations to store, manage, protect and analyze their data.

Summary

Cvent Holding has been exploring a potential sale of the company, which has sent shares soaring 15% in market reaction. At the time of writing, media coverage has been mostly positive, with the stock price having increased on the same day. Investors may want to take a closer look at Cvent Holding as a potential investment opportunity.

The company has a long history of success and could be a great addition to any portfolio. It is important to analyze the risks and rewards associated with any potential investment, as well as to stay up-to-date on news and developments related to Cvent Holding.

Recent Posts