Hour Glass Stock Earnings Growth Rate Falls Behind 58% CAGR for Shareholders

May 6, 2023

Trending News ☀️

Shareholders of Hour Glass ($SGX:AGS) have seen their returns lag behind the 58% Compound Annual Growth Rate (CAGR) that has been promised. Hour Glass is a multinational luxury goods company that produces and distributes watches, jewelry, and accessories. The company has been struggling to maintain its competitive advantage in the luxury goods markets, as competitors have been able to keep up with the latest trends and technological advancements. This has resulted in a decrease in demand for Hour Glass’ products, thus causing their earnings growth rate to fall short of the promised CAGR to shareholders.

Hour Glass is attempting to combat this by investing in research and development, as well as marketing and advertising campaigns to drive demand for their products. Despite these efforts, the company has still not been able to reach the 58% CAGR that was promised to shareholders. As a result, investors may be hesitant to invest in Hour Glass in the near future.

Analysis

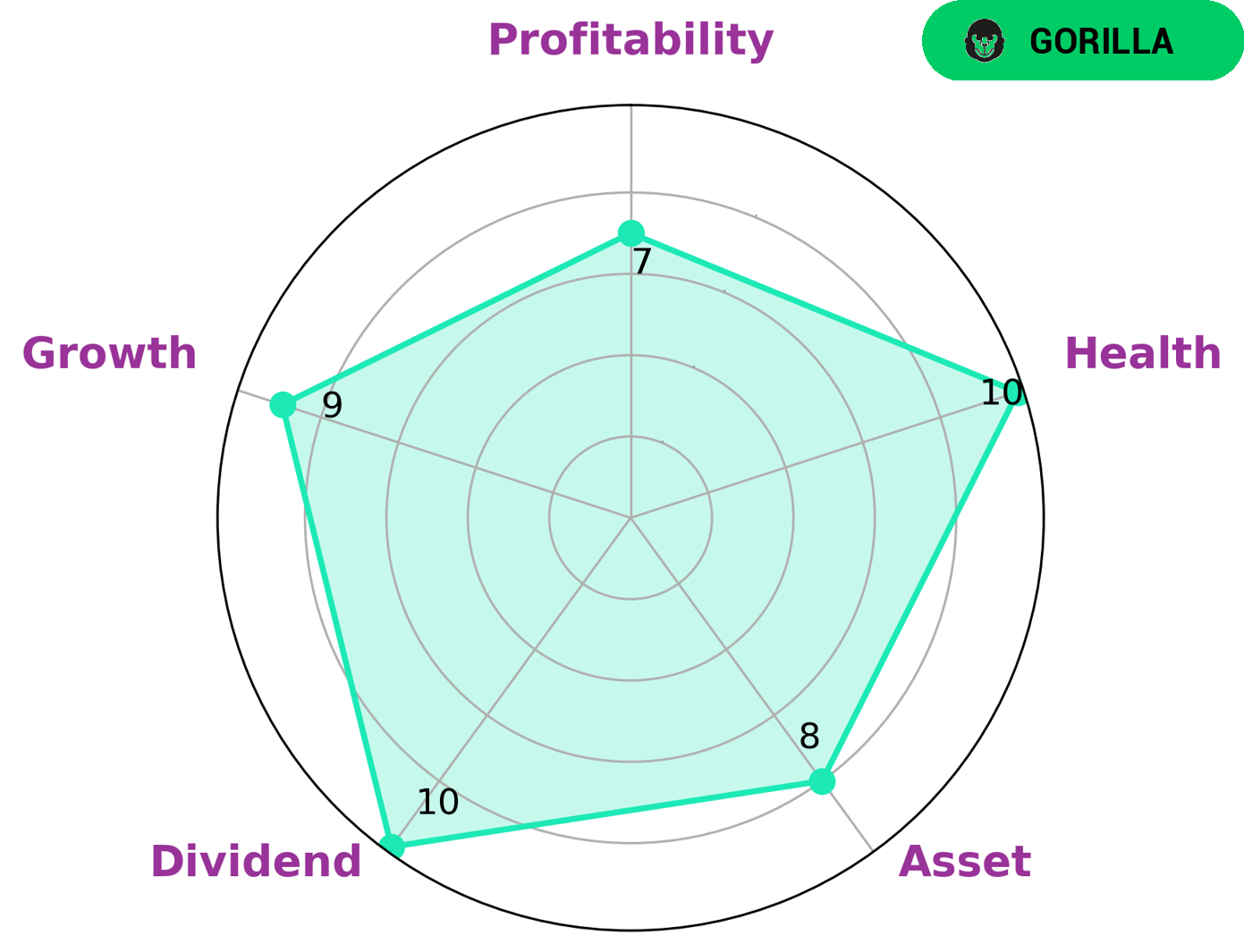

This type of company has achieved stable and high revenue or earning growth due its strong competitive advantage. Investors who are interested in such companies will be pleased to know that HOUR GLASS possesses a high health score of 10/10, taking into account its cashflows and debt. This means it is capable of riding out any crisis without the risk of bankruptcy. In addition, HOUR GLASS is strong in various other parameters such as asset, dividend, growth, and profitability. This suggests that this company can provide investors with a healthy return on their investment. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hour Glass. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | 176.69 | 16.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hour Glass. More…

| Operations | Investing | Financing |

| 211.63 | -91.34 | -143.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hour Glass. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.04k | 308.98 | 1.08 |

Key Ratios Snapshot

Some of the financial key ratios for Hour Glass are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 35.0% | 21.3% |

| FCF Margin | ROE | ROA |

| 10.2% | 20.3% | 14.3% |

Peers

The Hour Glass Ltd is in fierce competition with its competitors, Asian Star Co Ltd, Stamford Tyres Corp Ltd, and Guess? Inc. All four companies strive to be the leader in their respective industries, offering unique products and services to their customers. As a result, they are constantly innovating, developing new strategies, and making adjustments to stay ahead of the competition.

– Asian Star Co Ltd ($BSE:531847)

Asian Star Co Ltd is a large-scale international conglomerate with a market capitalization of 11.86B as of 2022. The company operates in a number of industries, including technology, finance, and real estate. The company has achieved strong financial performance, with a return on equity of 5.77%, indicating a high degree of profitability. The company’s success can be attributed to its focus on innovation, capitalizing on technology and digital disruption. Asian Star Co Ltd has been able to successfully capitalize on the global economy and has grown to become one of the largest companies in the world.

– Stamford Tyres Corp Ltd ($SGX:S29)

Stamford Tyres Corp Ltd is a leading provider of tyres, wheels, and automotive accessories. The company has a market cap of 44.39M as of 2022, indicating a strong presence in the industry. Stamford Tyres Corp Ltd also boasts a Return on Equity of 6.75%, which demonstrates the company’s ability to effectively utilize its equity to generate profits. The company has been successful due to its dedication to providing quality products and services to customers. Stamford Tyres Corp Ltd is a reliable and trusted partner for those seeking reliable automotive products and services.

– Guess? Inc ($NYSE:GES)

Guess? Inc is a lifestyle fashion company that designs, markets, and distributes apparel and accessories for men, women, and children. As of 2022, the company has a market cap of 1.07B, which is an indication of the brand’s strong financial standing. Guess? Inc also boasts a high return on equity (ROE) of 32.06%, indicating that the company is making the most of its available resources and increasing shareholder value.

Summary

Investing in Hour Glass is a risky proposition, as the company’s earnings growth rate has struggled to keep pace with the 58% CAGR delivered to shareholders. While the company may have other potential upsides, potential investors should be aware that the rate of growth has been slower than expected and may not be a good fit for their portfolio. On the other hand, those with a higher risk appetite could find Hour Glass an attractive investment due to its potential for growth, as well as its strong financials and track record. Ultimately, potential investors should carefully weigh both the risks and rewards when considering Hour Glass.

Recent Posts