Thrivent Financial for Lutherans Sells 476 Shares of UFP Industries,

May 17, 2023

Trending News ☀️

Thrivent Financial for Lutherans recently sold 476 shares of UFP ($NASDAQ:UFPI) Industries, Inc. at Defense World. This company is a leading global manufacturer of engineered wood products and building materials. UFP Industries provides products to a variety of industries, including construction, industrial, recreational vehicle, agricultural and residential markets. The company’s product portfolio includes products such as softwood lumber, composite panels and specialty components. UFP Industries is committed to providing innovative and value-added products and services to its customers.

UFP Industries is also a publicly traded company on the NASDAQ stock exchange under the ticker symbol “UFPI”. The company is renowned for its commitment to sustainability, and it is active in a number of initiatives that promote corporate social responsibility and environmental conservation. With its well-diversified product line and commitment to sustainability, UFP Industries is well-positioned for future success.

Stock Price

On Monday, UFP INDUSTRIES, Inc., a manufacturer of building materials and custom products, saw its stock open at $81.8 and close at $82.9. This was an increase of 1.7% from the prior closing price of $81.5. With a focus on innovation and exceeding customer expectations, UFP Industries, Inc. has become a leader in the industry. This latest transaction is yet another sign of the company’s strong performance and potential for future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ufp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 8.96k | 608.34 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ufp Industries. More…

| Operations | Investing | Financing |

| 1.04k | -336.06 | -355.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ufp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.7k | 984.35 | 43.68 |

Key Ratios Snapshot

Some of the financial key ratios for Ufp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.4% | 49.6% | 9.5% |

| FCF Margin | ROE | ROA |

| 9.6% | 20.2% | 14.4% |

Analysis

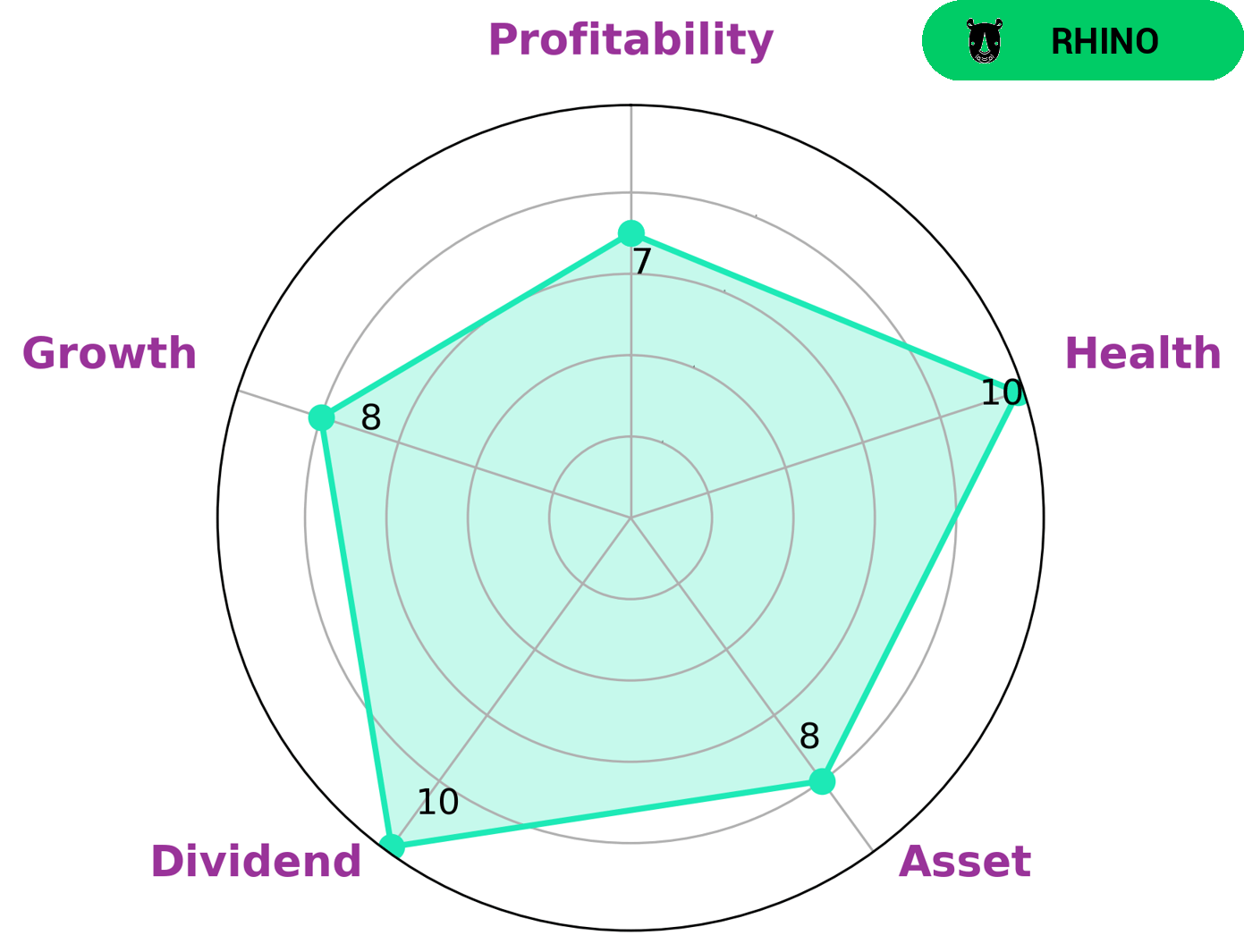

GoodWhale has performed a thorough analysis of UFP INDUSTRIES‘s financials and concluded that it is strong in areas such as asset, dividend, growth, and profitability. The company also has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. From our analysis, we have classified UFP INDUSTRIES as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Considering these factors, we believe that UFP INDUSTRIES may be an attractive option for long-term investors seeking stable returns and capital appreciation. Furthermore, the company may also be of interest to those looking for dividend income and strong asset performance. More…

Peers

UFP Industries Inc is one of the largest producers of wood products in North America. The company’s competitors include Blue Star Opportunities Corp, Interfor Corp, and West Fraser Timber Co. Ltd.

– Blue Star Opportunities Corp ($OTCPK:BSTO)

Interfor Corp is a Canadian forestry company with operations in British Columbia, Washington state, and Oregon. The company has a market cap of 1.23 billion Canadian dollars as of 2022. The company’s return on equity is 34.77%. Interfor Corp is engaged in the business of growing and harvesting trees, and manufacturing and selling lumber and wood products. The company’s products are used in the construction, industrial, and retail markets.

– Interfor Corp ($TSX:IFP)

As of 2022, West Fraser Timber Co. Ltd. had a market capitalization of $8.54 billion. The company had a return on equity of 26.74%. West Fraser Timber Co. Ltd. is a forest products company that produces lumber, wood chips, and other forest products. The company was founded in 1955 and is headquartered in Vancouver, Canada.

Summary

Thrivent Financial for Lutherans recently sold 476 shares of UFP Industries, Inc. (UFPI). This investment decision indicates the company’s overall opinion of the stock’s performance. Analyzing the stock in terms of its four key metrics (price-to-earnings ratio, price-to-book ratio, dividend yield and return on equity) reveals that UFPI is undervalued in comparison to the industry average. Based on this analysis, Thrivent Financial for Lutherans’ decision to sell 476 shares of UFPI makes sense and should be considered by other investors.

Recent Posts