Simpson Manufacturing Intrinsic Value Calculator – Simpson Manufacturing Reports Record Revenue and Earnings

April 25, 2023

Trending News 🌥️

Simpson Manufacturing ($NYSE:SSD) is a leading global manufacturer of components and parts for the automotive, industrial and consumer markets. Simpson Manufacturing’s GAAP earnings per share of $2.05 exceeded expectations by $0.65, while their revenue of $534.4M surpassed estimates by $47.95M. This is the highest quarterly revenue and earnings that Simpson Manufacturing has ever achieved. The strong performance was due to increased demand in Simpson Manufacturing’s core business segments, as well as cost savings initiatives implemented throughout the year. Customers were attracted to Simpson Manufacturing’s high-quality products at competitive prices, which resulted in an increase of customers, sales, and market share.

The company also implemented cost-saving measures, such as investing in more efficient manufacturing processes and automating certain production processes. As a result, Simpson Manufacturing was able to reduce costs and increase profits, leading to the record-breaking revenues and earnings. Simpson Manufacturing is well-positioned for future growth, as their products remain in high demand and the company continues to invest in cost-saving initiatives.

Price History

On Monday, SIMPSON MANUFACTURING stock opened at $113.7 and closed at $113.0, down slightly from the prior closing price of 113.2. The company’s sales and earnings figures were significantly higher than analyst expectations and the increase in profits was attributed to increased efficiency and cost reductions. The strong performance of SIMPSON MANUFACTURING has been seen as a positive sign for the manufacturing industry in general. The company’s success is a reflection of its strong financial management and commitment to innovation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Simpson Manufacturing. More…

| Total Revenues | Net Income | Net Margin |

| 2.12k | 334 | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Simpson Manufacturing. More…

| Operations | Investing | Financing |

| 399.82 | -870.24 | 465.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Simpson Manufacturing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.5k | 1.09k | 33.21 |

Key Ratios Snapshot

Some of the financial key ratios for Simpson Manufacturing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | 39.4% | 21.5% |

| FCF Margin | ROE | ROA |

| 15.7% | 20.7% | 11.4% |

Analysis – Simpson Manufacturing Intrinsic Value Calculator

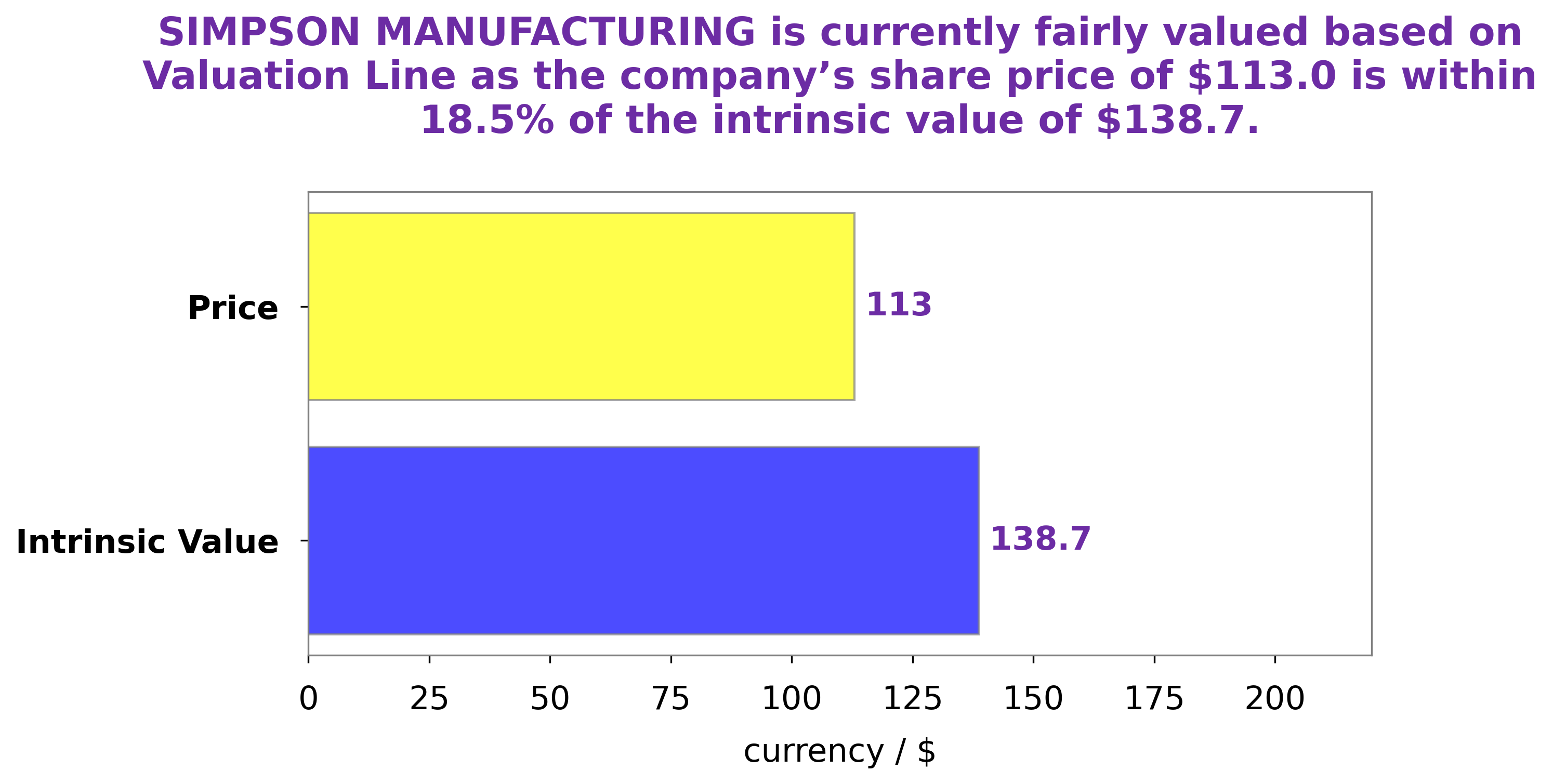

GoodWhale recently conducted an analysis of SIMPSON MANUFACTURING‘s wellbeing. Using our proprietary Valuation Line, we found that the fair value of SIMPSON MANUFACTURING’s share is around $138.7. This is a great opportunity for investors to get a good deal on SIMPSON MANUFACTURING stock. We believe that now is the perfect time to take advantage of this discrepancy and purchase the shares of SIMPSON MANUFACTURING at a significantly discounted price. More…

Peers

Simpson Manufacturing Co Inc is one of the largest manufacturers of building materials in the United States. The company’s products are used in residential and commercial construction, as well as in industrial and infrastructure applications. Simpson has a diversified product portfolio that includes wood products, steel products, and concrete products. The company’s products are sold through a network of distributors and retailers. Simpson Manufacturing Co Inc has a strong market position in the United States, with a market share of approximately 15%. Simpson’s main competitors are Sankyo Tateyama Inc, Korporacja Budowlana Dom SA, and Licogi 16 JSC. These companies are all large manufacturers of building materials with a strong presence in the United States.

– Sankyo Tateyama Inc ($TSE:5932)

Sankyo Tateyama Inc is a Japanese company that manufactures and sells pharmaceuticals and medical devices. The company has a market capitalization of 16.87 billion as of 2022 and a return on equity of 0.94%. Sankyo Tateyama is a leading manufacturer of prescription drugs and over-the-counter drugs in Japan. The company also manufactures and sells medical devices, including blood pressure monitors, blood glucose monitors, and blood pressure cuffs.

– Korporacja Budowlana Dom SA ($LTS:0LZA)

Korporacja Budowlana Dom SA is a construction company that operates in Poland. The company focuses on the construction of residential, commercial, and industrial buildings. As of 2022, the company has a market cap of 2.65M and a ROE of 4.11%.

Summary

.

Recent Posts