Peter F. Way, CFA: Simpson Manufacturing Offers Best Prospects for Capital Gains in Building Industry

February 14, 2023

Trending News ☀️

In his article “Simpson Manufacturing ($NYSE:SSD): The Best Nearby Building Industry Capital Gain Prospect”, Peter F. Way, CFA, provides an overview of Simpson Manufacturing and why it is the best choice for investors looking to capitalize on the building industry. This article can be found on Seeking Alpha’s website. Simpson Manufacturing is a leading manufacturer of building products used in both residential and commercial construction. Its products are used in a wide range of applications and have become industry standards for quality and reliability. It has demonstrated consistent growth over the years and has proven to be a reliable source of income for investors. Its share price has consistently been among the top performers in the building industry and its long-term prospects remain strong. The company has recently embarked on an expansion plan that will see them introduce new products and services to meet the changing needs of the industry.

This is expected to keep Simpson Manufacturing at the forefront of innovation and help to drive further growth in the sector. In addition to providing investors with solid capital gains potential, Simpson Manufacturing also offers a wide range of investment options. Investors can choose from long-term investments or short-term stock trading options. This flexibility makes Simpson Manufacturing an attractive option for those looking to make a significant return on their investments in the building industry. With its long-term dependability, innovative products, and wide range of investment options, Simpson Manufacturing is set to continue to be a leader in the sector for many years to come.

Price History

This suggestion comes as Simpson Manufacturing has seen mostly positive media coverage. On Monday, the stock opened at $109.8 and closed at $112.8, a gain of 2.8% from its prior closing price of $109.7. It focuses on offering products that are tailored to the local markets and offers services such as product design and engineering, assembly and installation. The company is also focused on sustainability and the environment, striving to reduce energy consumption and waste generation. Investors have been bullish on Simpson Manufacturing due to its strong customer base and diversified product line-up. Its products are used in many industries such as medical, transportation and leisure, so it is well-placed to benefit from economic growth. The company is also expanding its operations into Asia, which should further strengthen its market presence.

Simpson Manufacturing has also been investing heavily in research and development to bring new products to the market. These investments have allowed the company to remain competitive in the industry and have been a major factor in its success. The company has been able to capitalize on new innovations in the industry, allowing it to stay ahead of the competition. The outlook for Simpson Manufacturing looks positive, with analysts expecting further growth in the future. With its strong customer base and diversified product line-up, it seems likely that the company will continue to offer investors with attractive capital gains opportunities in the building industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Simpson Manufacturing. More…

| Total Revenues | Net Income | Net Margin |

| 2.12k | 334 | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Simpson Manufacturing. More…

| Operations | Investing | Financing |

| 292.59 | -58.8 | -71.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Simpson Manufacturing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.51k | 1.09k | 31.4 |

Key Ratios Snapshot

Some of the financial key ratios for Simpson Manufacturing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | 39.4% | 21.5% |

| FCF Margin | ROE | ROA |

| 11.0% | 21.3% | 11.3% |

Analysis

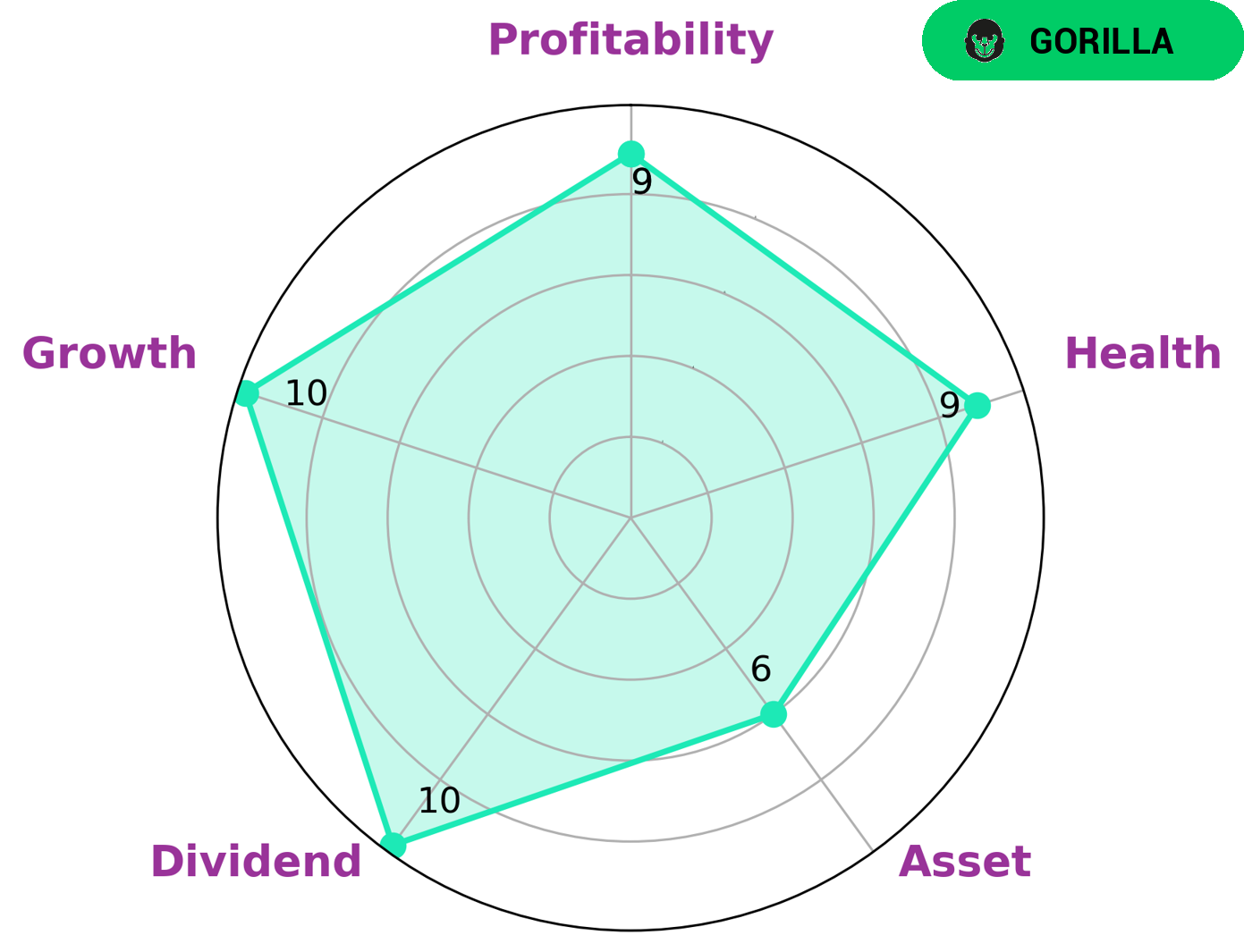

Simpson Manufacturing is a strong financial performer, as evidenced by its analysis with GoodWhale. According to the Star Chart, Simpson Manufacturing has high ratings in dividend, growth, profitability, and medium ratings in asset. The company also has an impressive health score of 9/10, indicating it is in a strong position to sustain operations in times of crisis. Furthermore, Simpson Manufacturing is classified as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. These combined points make Simpson Manufacturing an attractive option for various types of investors. Value investors who look for stocks that are undervalued compared to their intrinsic value would be interested in Simpson Manufacturing, as its financials suggest it is undervalued. Similarly, growth investors who seek companies with high potential growth would be interested in the company’s robust growth metrics, as well as its classifications as a ‘gorilla’. Income investors may also find Simpson Manufacturing attractive due to its high dividend rating. Finally, speculative investors may be interested in the potential of the company’s strong competitive edge to bring about future growth and high returns. More…

Peers

Simpson Manufacturing Co Inc is one of the largest manufacturers of building materials in the United States. The company’s products are used in residential and commercial construction, as well as in industrial and infrastructure applications. Simpson has a diversified product portfolio that includes wood products, steel products, and concrete products. The company’s products are sold through a network of distributors and retailers. Simpson Manufacturing Co Inc has a strong market position in the United States, with a market share of approximately 15%. Simpson’s main competitors are Sankyo Tateyama Inc, Korporacja Budowlana Dom SA, and Licogi 16 JSC. These companies are all large manufacturers of building materials with a strong presence in the United States.

– Sankyo Tateyama Inc ($TSE:5932)

Sankyo Tateyama Inc is a Japanese company that manufactures and sells pharmaceuticals and medical devices. The company has a market capitalization of 16.87 billion as of 2022 and a return on equity of 0.94%. Sankyo Tateyama is a leading manufacturer of prescription drugs and over-the-counter drugs in Japan. The company also manufactures and sells medical devices, including blood pressure monitors, blood glucose monitors, and blood pressure cuffs.

– Korporacja Budowlana Dom SA ($LTS:0LZA)

Korporacja Budowlana Dom SA is a construction company that operates in Poland. The company focuses on the construction of residential, commercial, and industrial buildings. As of 2022, the company has a market cap of 2.65M and a ROE of 4.11%.

Summary

Simpson Manufacturing Co. Inc. is a highly respected and well-established building industry company. It is renowned for its reliable product quality, efficient cost structure and experienced management team. Investors have been closely watching Simpson Manufacturing’s stock performance, as it has been delivering strong returns in recent years.

Media coverage of the company has been mostly positive, emphasizing its potential for steady growth and attractive returns. Investors looking to make informed decisions about investing in this sector should consider Simpson Manufacturing as a top choice for long-term success.

Recent Posts