First Republic Investment Management Increases Investment in Choice Hotels International,

February 14, 2023

Trending News 🌥️

First Republic Investment Management Inc. recently announced that their stake in the hotel chain, Choice Hotels International ($NYSE:CHH), Inc., has increased. This news marks a significant investment for the company, and is further testament to the trust and confidence that First Republic has in the Choice Hotels brand. The company is known for its quality accommodations and award-winning customer service, as well as its broad range of amenities and services. From budget-friendly economy hotels to luxurious suites, Choice Hotels provides travelers with a variety of options to fit their needs and budget. Their portfolio includes investments in companies across a diverse range of industries, including healthcare, technology, media, and hospitality.

With their increased stake in Choice Hotels International, Inc., First Republic has shown that they believe in the company’s long-term success. The increased investment will help to further solidify Choice Hotels’ position as one of the world’s top hospitality brands, allowing them to continue providing travelers with exceptional experiences. For First Republic, this serves as yet another successful investment that reinforces their commitment to diversifying their portfolio and making sound financial decisions.

Stock Price

On Thursday, First Republic Investment Management Inc. increased its investment in Choice Hotels International, Inc. According to the trading activity on the NYSE, Choice Hotels’ stock opened at $126.2 and closed at $124.3, down by 0.6% from last closing price of 125.0. It is a US-based company that offers financial services such as wealth management and private banking. Choice Hotels International is one of the largest hotel chains in the world. It has earned a reputation for providing quality accommodations at an affordable rate and is renowned for its excellent customer service. This investment will likely provide a boost of confidence to other potential investors who may be considering investing in Choice Hotels International.

This move by First Republic Investment Management Inc. is a sign of their confidence that Choice Hotels International will continue to be a successful investment for them. It also illustrates their commitment to supporting the growth of this major hotel chain across the globe. This increased investment signals that Choice Hotels International is likely to experience further success over the long-term as they expand into new markets and continue to provide quality accommodations to their customers around the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CHH. More…

| Total Revenues | Net Income | Net Margin |

| 1.32k | 340.51 | 24.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CHH. More…

| Operations | Investing | Financing |

| 403.65 | -510.02 | -255.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CHH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.19k | 1.9k | 7.72 |

Key Ratios Snapshot

Some of the financial key ratios for CHH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 15.3% | 37.3% |

| FCF Margin | ROE | ROA |

| 23.1% | 74.2% | 14.1% |

Analysis

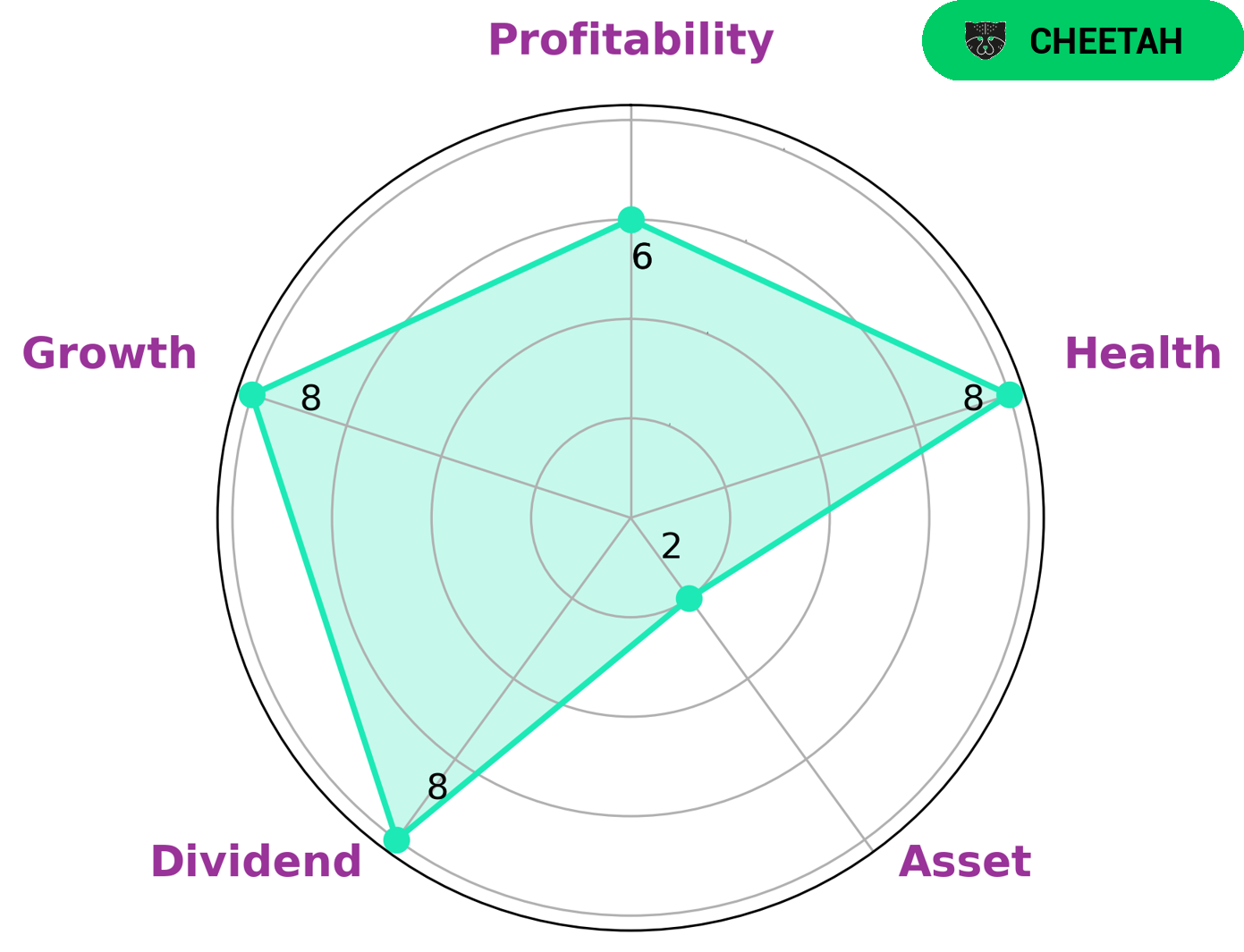

Analyzing CHOICE HOTELS INTERNATIONAL fundamentals, GoodWhale has established that it has a strong dividend, high growth, and medium profitability. However, it is weak in terms of assets. As a result, this company is classified as a ‘cheetah’ – a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this assessment, investors looking for companies with high growth potential may be interested in CHOICE HOTELS INTERNATIONAL. The company also has a high health score of 8/10 with regard to its cashflows and debt, suggesting it is likely to sustain future operations in times of crisis. However, the higher than average risk should be taken into account when considering investing in CHOICE HOTELS INTERNATIONAL. In addition to the above, investors should also consider the long-term prospects of CHOICE HOTELS INTERNATIONAL and its financial statements before making any investments. Furthermore, investors should keep track of the company’s performance in the industry and the market in order to ensure their investment is profitable. Lastly, diversification is key when investing in any company, whether it is a cheetah or not. More…

Peers

Choice Hotels International, Inc. is one of the world’s largest hotel companies. With over 6,300 hotels across more than 35 countries and territories, Choice Hotels International offers a wide variety of lodging options to suit any need. Wyndham Hotels & Resorts, Hilton Worldwide Holdings, and Marriott International are all major competitors in the hotel industry.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is one of the largest hotel companies in the world, with over 7,500 hotels across more than 80 countries. The company offers a wide range of hotel brands, from economy to luxury, and its portfolio includes some of the most well-known hotel brands in the world, such as Wyndham, Ramada, Days Inn, and Super 8. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey.

The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc. is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. The company operates in three segments: Owned and Leased Hotels, Management and Franchise, and Timeshare. As of December 31, 2020, it owned, leased, or managed 2,084 properties with 883,944 rooms. Hilton Worldwide Holdings Inc. was founded in 1919 and is headquartered in McLean, Virginia.

– Marriott International Inc ($NASDAQ:MAR)

Marriott International is one of the world’s largest hotel companies, with more than 6,000 properties in over 120 countries and territories. Marriott operates and franchises hotels and timeshare properties under 30 brands, including Marriott, Ritz-Carlton, Sheraton, and Westin. The company also has a vacation ownership division, Marriott Vacations Worldwide. Marriott was founded in 1927 by J. Willard Marriott and Frank J. Taylor.

Summary

First Republic Investment Management Inc. has increased its investment in Choice Hotels International, Inc. by more than 10%, confirming the company’s strong potential as an attractive investment opportunity. The company is in the hospitality sector, and its stock has appreciated significantly over the last twelve months due to increased consumer interest and positive financial results. The company has also made strategic acquisitions and partnerships to expand its operations and remain competitive in the market.

Analysts have pointed to Choice Hotels’ strong balance sheet, experienced management team, and attractive price-to-earnings ratio as reasons for the increased investment. Investors should be aware that this sector is highly competitive and subject to changing consumer preferences.

Recent Posts