Johnson Outdoors Reports Q1 GAAP EPS of $0.57, Revenue of $178.3M Beats by $10.75M with Cash and Short-Term Investments of $103.4M.

February 7, 2023

Trending News 🌥️

Johnson Outdoors ($NASDAQ:JOUT) Inc. is a leading global outdoor recreation company that designs, manufactures, and markets a portfolio of winning, consumer-preferred brands across four categories: marine electronics, outdoor equipment, watercraft and diving. Johnson Outdoors reported Q1 GAAP EPS of $0.57, in-line with expectations. Revenue for the quarter came in at $178.3M, beating estimates by $10.75M. Gross margin decreased from 39.5% in the prior year quarter to 35.2%. As of December 30, 2022, the company reported having $103.4M in cash and short-term investments. Johnson Outdoors is well-positioned to continue to capitalize on the growth in the outdoor recreation market with its strong portfolio of brands and products. The company is investing in digital marketing and e-commerce capabilities to further enhance its competitive position and customer engagement.

In addition, the company is focused on continuing to expand its global presence and launching new products to drive future growth and profitability.

Stock Price

Till now, the news seems to be positive for the company. On Friday, JOHNSON OUTDOORS stock opened at $71.2, and closed at $67.7, a drop of 5.3% from the previous closing price of 71.5. The company’s portfolio includes multiple brands such as Old Town, Minn Kota, Humminbird, and Cannon. Johnson Outdoors is well-known for its high-quality products and its commitment to sustainability. The company’s Q1 results were driven by strong performance across its core product categories, including marine electronics, fishing gear, and watercraft accessories.

The company also benefited from strong demand for its products in Europe and Asia-Pacific regions. Going forward, Johnson Outdoors is focusing on growing its global presence and expanding its product portfolio to meet the changing needs of customers. Overall, Johnson Outdoors reported solid Q1 results and is well-positioned to continue its growth trajectory in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Johnson Outdoors. More…

| Total Revenues | Net Income | Net Margin |

| 768.17 | 39.51 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Johnson Outdoors. More…

| Operations | Investing | Financing |

| -16.94 | -32.08 | -12.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Johnson Outdoors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.1 | 194.88 | 48.26 |

Key Ratios Snapshot

Some of the financial key ratios for Johnson Outdoors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | -3.5% | 6.8% |

| FCF Margin | ROE | ROA |

| -6.4% | 6.7% | 4.8% |

Analysis

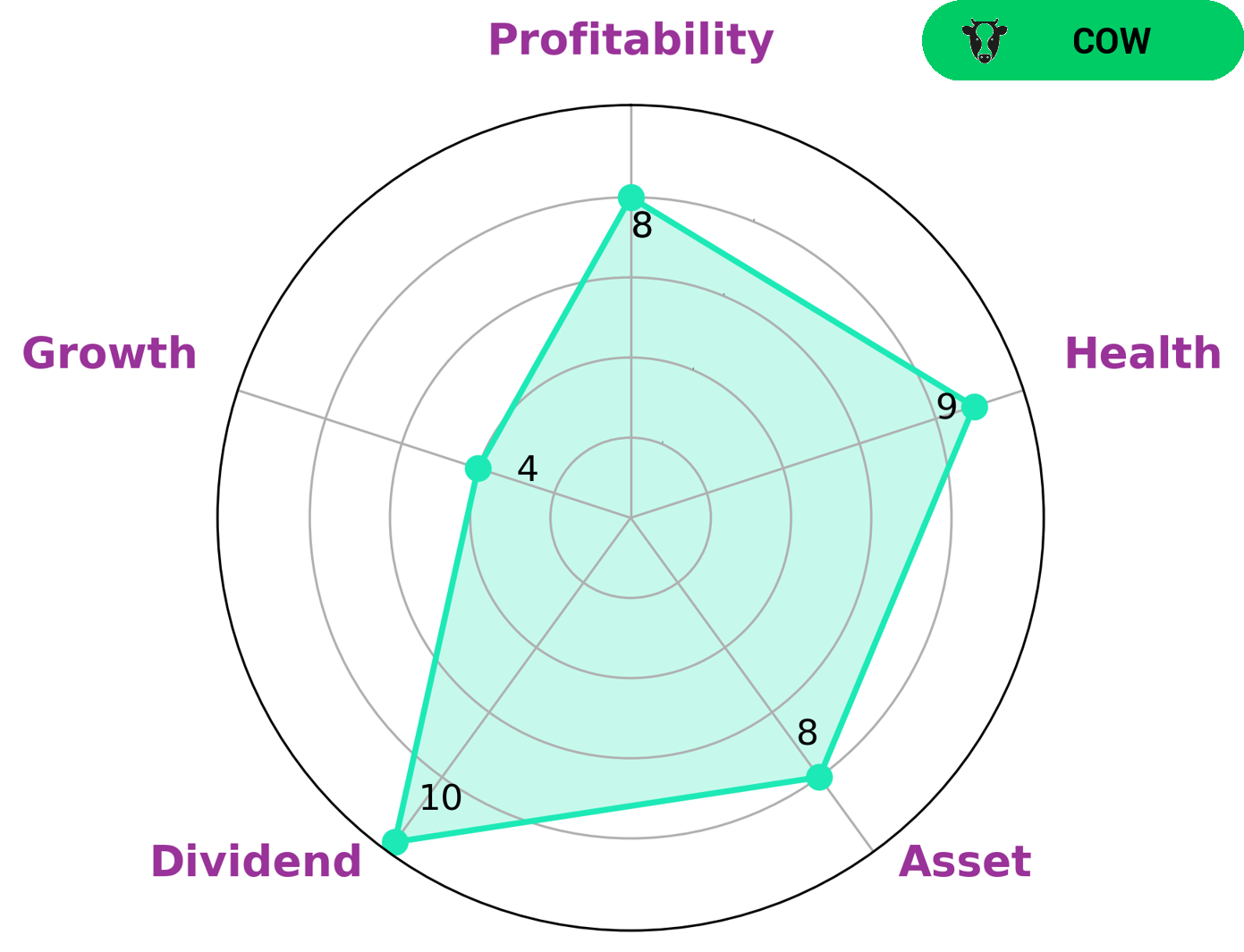

Investors looking for a safe and reliable option for their portfolio should consider JOHNSON OUTDOORS. GoodWhale’s analysis of the company’s financials shows a high health score of 9/10, indicating that it is able to ride out any crisis without the risk of bankruptcy. This is due to the company’s strong asset, dividend, and profitability, combined with moderate growth. The company is classified as a ‘cow’, meaning that it has a track record of providing steady and sustainable dividends. This makes JOHNSON OUTDOORS an ideal option for investors who are looking for a steady stream of income. It also offers long-term potential for those who are interested in capital appreciation and growth. Given the company’s strong financials and dividend track record, JOHNSON OUTDOORS is an attractive option for investors seeking a safe and reliable source of income and long-term growth potential. It is especially suited for those who are seeking a low-risk option to diversify their portfolios. More…

Peers

Johnson Outdoors Inc is one of the leading outdoor recreation companies in the world, known for its cutting-edge products and innovative designs. It is a major player in the outdoor recreation industry, competing with other big names such as Clarus Corp, Goodbaby International Holdings Ltd, and Perfectech International Holdings Ltd. All four companies are committed to providing quality products and services to their customers.

– Clarus Corp ($NASDAQ:CLAR)

Clarus Corporation is a provider of outdoor equipment and apparel products. Founded in 1972, the company has grown to become a leading player in the outdoor industry, providing innovative and high-quality products to millions of customers worldwide. The company has a current market capitalization of 290.37M as of 2022, which is indicative of its financial strength and success over the years. Additionally, Clarus Corporation has a Return on Equity of 4.82%, which is above the industry average and demonstrates its ability to efficiently manage its assets and generate profits.

– Goodbaby International Holdings Ltd ($SEHK:01086)

Goodbaby International Holdings Ltd is a leading manufacturer and distributor of juvenile products in the Asia-Pacific region. The company has a market capitalization of 1.05 billion dollars as of 2022. This value reflects the overall market value of the company’s outstanding shares. Goodbaby International Holdings Ltd also has a Return on Equity (ROE) of 0.8%. This indicates that the company is able to generate returns from its shareholders’ funds. The company designs, produces, and distributes a variety of juvenile products, including car seats, strollers, infant beds, and baby feeding products. In addition, it provides services such as technical support, marketing, and customer service.

– Perfectech International Holdings Ltd ($SEHK:00765)

Perfectech International Holdings Ltd is a Hong Kong-based company that primarily manufactures and sells precision industrial machinery and equipment. As of 2022, the company had a market capitalization of 209.23M, indicating the total value of its outstanding shares. Furthermore, its Return on Equity (ROE) was -0.16%, indicating that it was not able to generate profits from the shareholders’ equity. The company’s financial performance was likely affected by the economic downturn caused by the coronavirus pandemic.

Summary

Johnson Outdoors Inc. reported strong first quarter financial results, with GAAP earnings per share of $0.57, revenue of $178.3 million, and cash and short-term investments of $103.4 million. The revenue beat analyst estimates by $10.75 million. Despite the positive news, the stock price moved downward on the same day. For investors looking to make an investment decision, Johnson Outdoors appears to be a solid choice, given the company’s strong financials and consistent profitability.

The company has a strong balance sheet, and a diversified portfolio of products that have been successful across multiple markets. Given the strong fundamentals, investors should consider Johnson Outdoors as a potential long-term investment opportunity.

Recent Posts