WPC Intrinsic Value Calculator – Rating Upgrade: W. P. Carey Braces for Challenging Times Ahead

April 12, 2023

Trending News ☀️

W. P. Carey ($NYSE:WPC) Inc. has recently seen its rating upgraded, indicating that the company is bracing itself for the challenging times ahead. The recent upgrade of the company’s rating reflects the fact that W. P. Carey is well positioned to remain competitive in the uncertain economic environment of today. The company has a strong balance sheet with significant financial flexibility and a healthy liquidity position that will enable it to weather any economic downturns or other challenges ahead.

Additionally, the company has an experienced and capable management team that is experienced in managing through difficult economic cycles. The outlook for W. P. Carey remains positive, as the company is well positioned to take advantage of the opportunities that may arise in a challenging economic environment. With its strong balance sheet and experienced management team, W. P. Carey is well positioned to navigate any difficult times ahead and continue to provide value to its shareholders.

Stock Price

Monday marked a positive start for W. P. Carey, as their stock opened at $73.8 and closed at $74.6, representing a 1.0% increase from the prior closing price. This trend is a positive sign for the company, despite the fact that it is facing challenging times ahead. Despite the current challenges, the company is optimistic about their future prospects and is taking steps to ensure they remain competitive in the industry. With the rating upgrade, W. P. Carey is bracing itself for the challenging times ahead, and is gearing up to weather any economic downturns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WPC. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 599.14 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WPC. More…

| Operations | Investing | Financing |

| 1k | -1.05k | 57.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WPC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.1k | 9.09k | 42.7 |

Key Ratios Snapshot

Some of the financial key ratios for WPC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 47.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – WPC Intrinsic Value Calculator

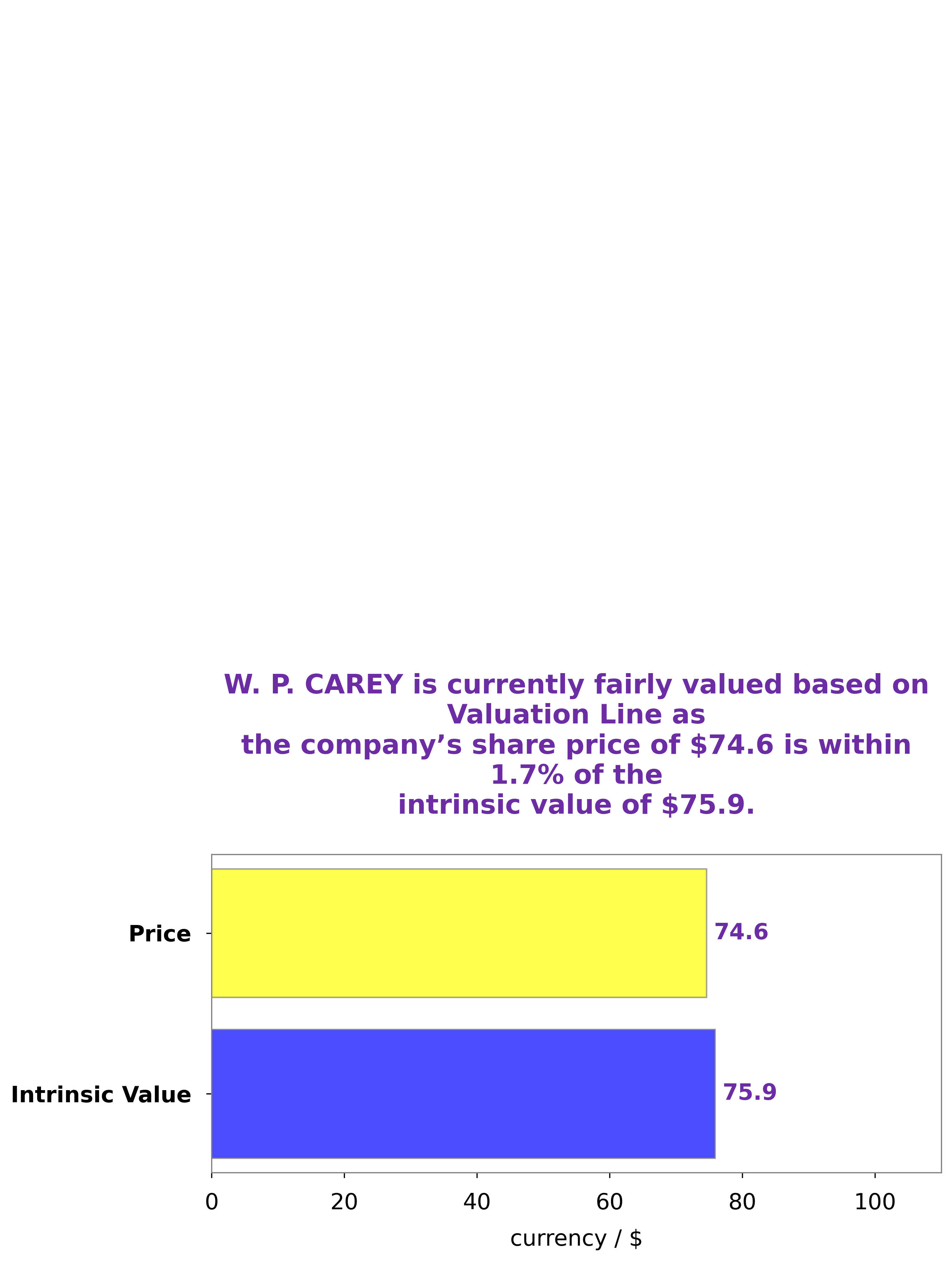

At GoodWhale, we have conducted an analysis of W. P. Carey’s key fundamentals. Our proprietary Valuation Line has determined an intrinsic value of W. P. Carey’s stock to be around $75.9. Currently, the stock is trading at $74.6, making it a fair price that is 1.7% undervalued. This presents a great opportunity for investors who are looking to purchase W. P. Carey’s stock at a discounted price. We believe that the stock is a great buy at its current price and could result in a strong return on investment if held for a long enough period of time. More…

Peers

It’s one of the largest owners and operators of single-tenant commercial properties in the U.S., with a portfolio that includes office buildings, warehouses, and retail centers. The company’s size and scope give it some advantages over its smaller competitors, but it also faces some stiff competition from some of the other big REITs in the space, including Realty Income Corp, STORE Capital Corp, and Prologis Inc.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a publicly traded real estate investment trust that invests in commercial real estate properties in the United States. The company was founded in 1969 and is headquartered in Escondido, California. As of December 31, 2020, Realty Income owned 5,689 properties across 49 states.

– STORE Capital Corp ($NYSE:STOR)

STORE Capital Corp is a real estate investment trust that focuses on acquiring, financing, and owning net-leased properties. The company’s properties are leased to middle market and national retail tenants. As of December 31, 2020, STORE Capital owned 1,847 properties in 48 states.

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust that owns, operates, and develops warehouses and distribution centers around the world. As of 2022, it has a market capitalization of $94.6 billion. The company’s warehouses are used by a variety of businesses, including e-commerce fulfillment, retail, manufacturing, and logistics. Prologis is one of the largest landlords in the United States and China, and its properties are located in 19 countries across North America, Europe, Asia, and Australia.

Summary

Investment analysts at W. P. Carey recently upgraded their rating to a “Buy”, indicating a more positive outlook on the company. The upgrade was based on a few key factors, including stronger balance sheet liquidity, improved operational performance, and underlying real estate assets.

Additionally, management has made strategic decisions to increase profitability of their leased buildings. Furthermore, real estate assets have been revalued upward due to increased demand, which benefits W. P. Carey’s portfolio. Analysts expect the company to continue to grow in the future with these improvements, making it an attractive option for investors.

Recent Posts