VAC Intrinsic Stock Value – Pacer Advisors Makes New Investment in Marriott Vacations Worldwide Co.

May 6, 2023

Trending News 🌥️

Marriott Vacations Worldwide ($NYSE:VAC) Co., a leading provider of vacation experiences and services, recently announced that Pacer Advisors Inc. has taken a stake in the company. Their portfolio of products is tailored to meet the needs of individual travelers and families while providing a luxurious experience and added value. Marriott Vacations Worldwide Co. delivers exceptional experiences through their unique approach to vacation rental management, which includes access to a wide range of resorts and activities in some of the world’s most desirable locations. They are dedicated to providing unforgettable experiences for their customers, with attentive service and high-quality amenities for each stay.

Through their commitment to excellence, Marriott Vacations Worldwide Co. has earned a reputation as one of the premier global providers of vacation experiences. The new investment by Pacer Advisors Inc. in Marriott Vacations Worldwide Co. is part of their ongoing efforts to expand their portfolio offerings, and provides even more opportunities for travelers to explore the world in style. With a focus on providing luxury experiences, Marriott Vacations Worldwide Co. is poised to continue making an impact in the travel industry for years to come.

Stock Price

The investment comes as the hospitality giant prepares to expand its reach in the global travel and leisure industry. The stock opened at $135.4 and closed at $135.7, down 0.5% from the previous day’s closing price of 136.4. At this rate, the company is well-positioned to become one of the leading players in the vacation rental and hospitality industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VAC. More…

| Total Revenues | Net Income | Net Margin |

| 4.77k | 420 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VAC. More…

| Operations | Investing | Financing |

| 343 | -11 | -408 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VAC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.6k | 7.12k | 66.84 |

Key Ratios Snapshot

Some of the financial key ratios for VAC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | 18.2% | 15.6% |

| FCF Margin | ROE | ROA |

| 5.2% | 18.7% | 4.8% |

Analysis – VAC Intrinsic Stock Value

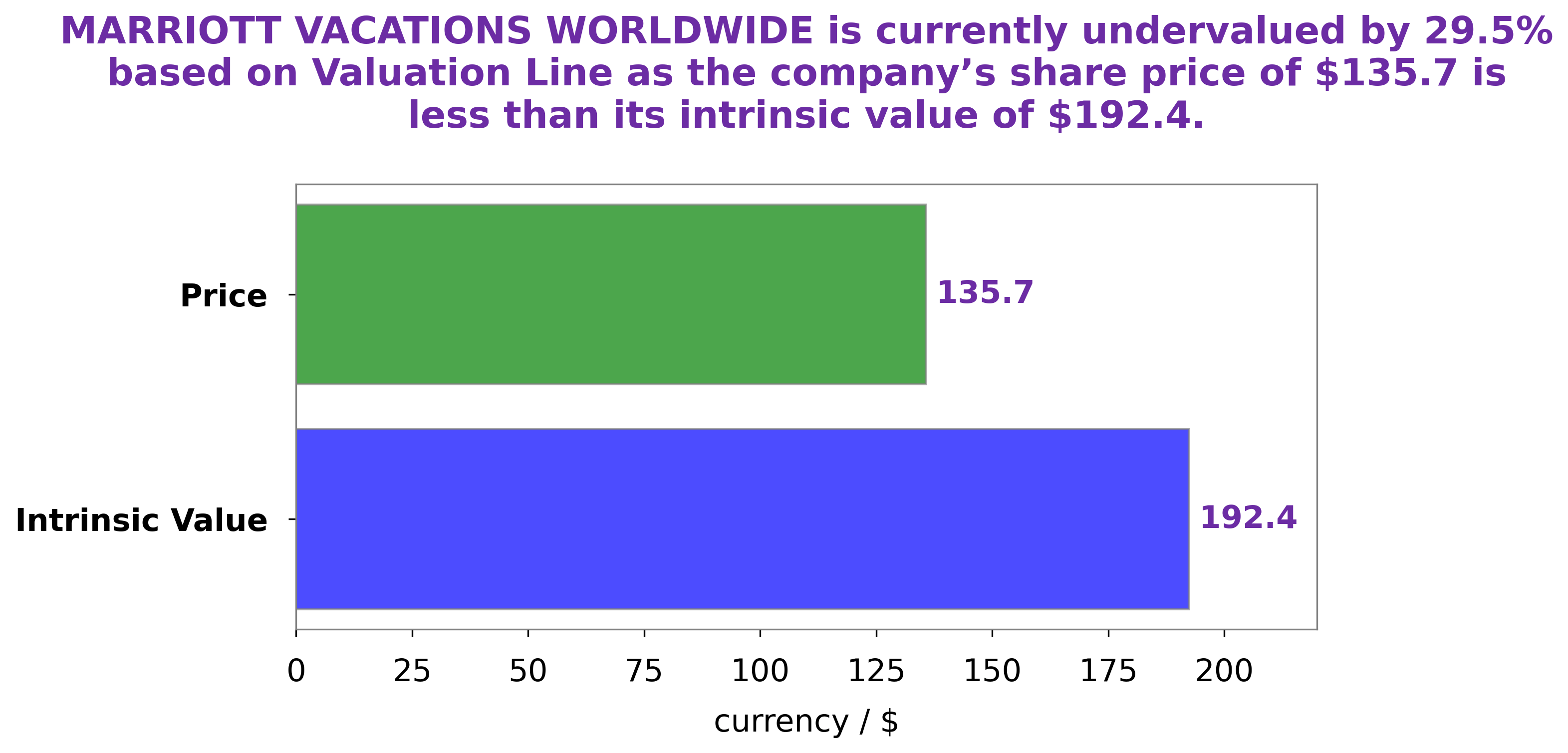

GoodWhale has conducted an analysis of MARRIOTT VACATIONS WORLDWIDE’s financials and, based on our proprietary Valuation Line, have calculated the fair value of MARRIOTT VACATIONS WORLDWIDE share to be around $192.4. This is significantly higher than the current market price, with MARRIOTT VACATIONS WORLDWIDE currently being traded at $135.7 – a discount of 29.5%. We believe this presents an opportunity for investors to purchase an undervalued stock. More…

Peers

In the vacation ownership and timeshare industry, Marriott Vacations Worldwide Corp is one of the largest and most well-known companies.

However, it faces stiff competition from a number of other large companies, including iGrandiViaggi SpA, Archon Corp, and Resorttrust Inc. While each of these companies has its own strengths and weaknesses, Marriott has been able to stay ahead of the competition by offering a wide variety of vacation ownership products and experiences that appeal to a broad range of customers.

– iGrandiViaggi SpA ($LTS:0R8E)

Hai Grandi Viaggi SpA is a company that provides travel services. It has a market capitalization of 36.65 million as of 2022 and a return on equity of 0.08%. The company offers a variety of travel-related services, including air travel, hotel accommodations, car rentals, and cruises.

– Archon Corp ($OTCPK:ARHN)

Archon Corporation is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the business of real estate investment, development, management, construction, and brokerage.

– Resorttrust Inc ($TSE:4681)

Resorttrust Inc is a Japanese company that operates resorts and hotels. As of 2022, the company had a market capitalization of 248.83 billion yen and a return on equity of 11.02%. The company operates a total of 74 hotels and resorts, including 57 in Japan and 17 overseas. In addition to hotel and resort operations, the company also provides a range of services such as golf course management, real estate development, and food and beverage operations.

Summary

Marriott Vacations Worldwide Corporation (VAC) has recently become the target of investment by Pacer Advisors Inc. VAC is a leading global vacation company that develops, markets, and sells vacation ownership products under the Marriott Vacation Club and Grand Residences by Marriott brands. It offers a variety of product choices and experiences, including resort villas and condominiums, points-based ownership, traditional fractional ownership, and membership programs. It also offers hotel, air travel, car rental, and other travel-related services. The company has experienced solid growth in terms of sales and profits over the past few years and is expected to continue to do so in the future. Despite its strong fundamentals, the stock has seen some volatility in recent months due to the pandemic, resulting in an attractive entry for investors.

However, it still carries some risks including the possibility of a further economic downturn and rising competition in the industry. Ultimately, investors who decide to take a position will need to take into account both the potential upside and the risk associated with VAC.

Recent Posts