UHT Intrinsic Stock Value – Universal Health Realty: Invest Wisely and Enjoy Generous Returns

April 15, 2023

Trending News ☀️

Universal Health Realty ($NYSE:UHT) is a great investment opportunity for those looking to gain generous returns in the long run. The company focuses on providing the latest health care and medical services to meet the needs of its customers. Its strategic investments across its various sectors ensure that it maintains a competitive edge in the industry. The company seeks to deliver innovative solutions to address the ever-changing needs of its customers. With a diversified portfolio of investments and world-class support system, Universal Health Realty is well-positioned to deliver superior returns for its shareholders. Its stock is considered to be a safe and reliable option for investors looking for high returns in the long run. Universal Health Realty is focused on delivering long-term returns for its investors.

Its impressive track record and sound financial management provide investors with a secure platform to grow their wealth. Investors can benefit from a wide range of features such as historically high dividend yields and a low risk profile that makes it attractive to investors of all types. Universal Health Realty offers investors a unique opportunity to gain generous returns while investing in a reliable and sound company. With its strong balance sheet and sound financials, Universal Health Realty provides a secure and reliable platform for investors to make their money work for them. Investing in this company can provide investors with substantial returns in the long run, making it an ideal option for those looking to enjoy generous returns safely and securely.

Share Price

Universal Health Realty (UHR) has become a favored stock among investors with its strong performance on the stock market. On Friday, UHR stock opened at $47.3 and closed at $46.7, a decline of 0.9% from its last closing price of $47.1. Despite this short-term fluctuation, many experienced investors still believe that UHR’s long-term success is assured. For those looking to invest in UHR, now is the time to do so as it offers generous returns and minimal risk. UHR has a strong track record of providing reliable dividends, and it has seen strong growth over the past year.

Additionally, UHR’s long-term financial outlook is positive, making it an ideal stock for those seeking to benefit from successful investing over the longer term. With UHR, investors can enjoy generous returns while minimizing their risks. Invest wisely and reap the rewards of a successful stock investment with Universal Health Realty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for UHT. More…

| Total Revenues | Net Income | Net Margin |

| 90.62 | 21.1 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for UHT. More…

| Operations | Investing | Financing |

| 46.8 | -36.67 | -25.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for UHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 607.54 | 378.44 | 17.07 |

Key Ratios Snapshot

Some of the financial key ratios for UHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 33.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – UHT Intrinsic Stock Value

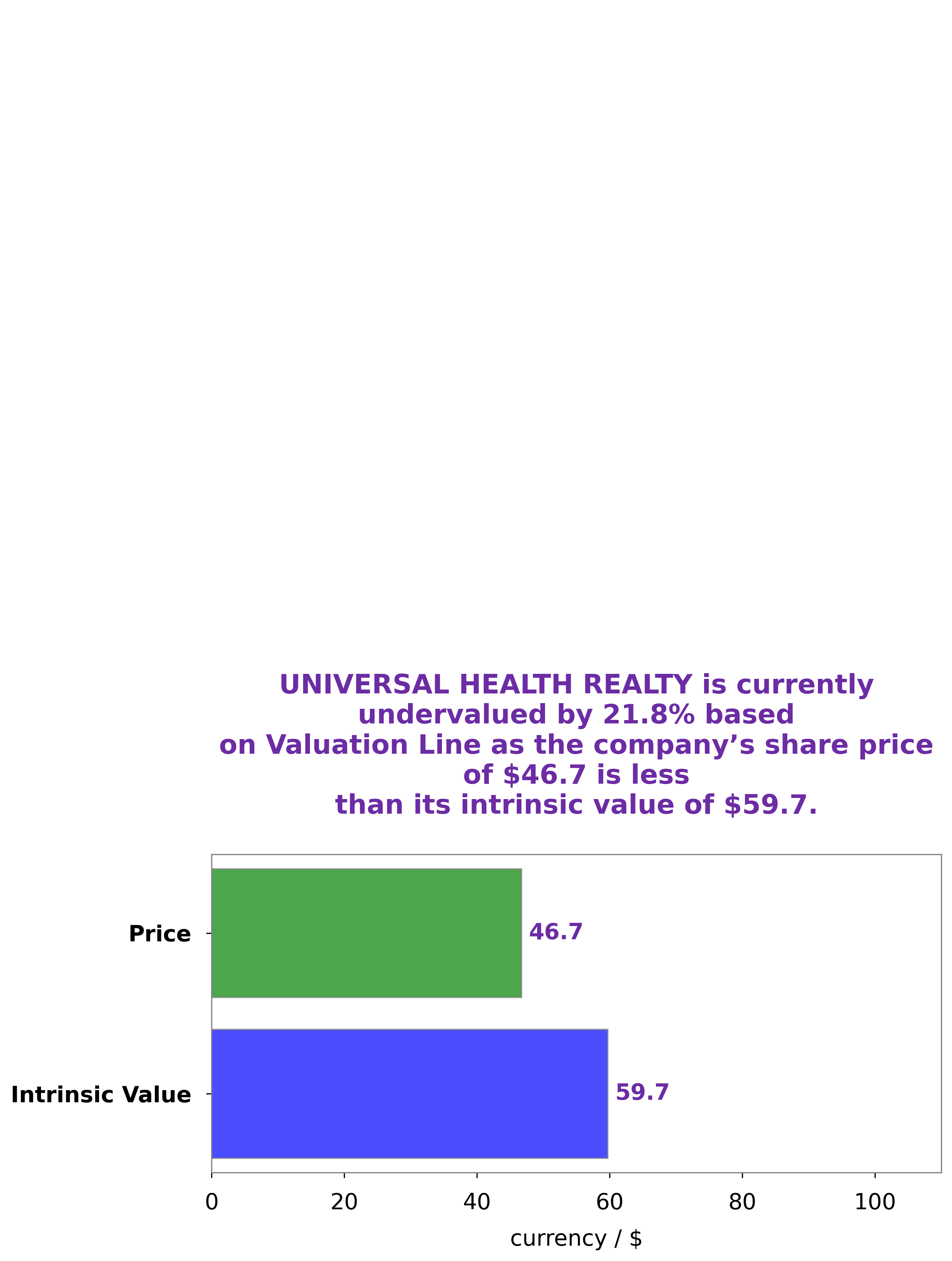

At GoodWhale, we conducted an extensive analysis of UNIVERSAL HEALTH REALTY’s health and wellbeing. Our proprietary Valuation Line enabled us to accurately determine the intrinsic value of UNIVERSAL HEALTH REALTY shares, which came in around $59.7. However, the stock is currently being traded at $46.7, meaning it is currently undervalued by 21.7%. It is our opinion that this presents a compelling opportunity for investors who are looking for a bargain. More…

Peers

The company’s portfolio consists of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Physicians Realty Trust is a similar company that also invests in healthcare real estate. Healthcare Trust of America, Inc. is another healthcare real estate investment trust with a portfolio of hospitals, medical office buildings, senior housing, and other healthcare-related properties. Global Medical REIT Inc. is a healthcare real estate investment trust that focuses on owning and leasing net-leased healthcare facilities.

– Physicians Realty Trust ($NYSE:DOC)

As of 2022, Physicians Realty Trust has a market cap of 3.31B. The company is a healthcare real estate investment trust that primarily acquires, owns, manages and develops healthcare properties that are leased to physicians, hospitals and healthcare delivery systems.

– Healthcare Trust of America Inc ($NYSE:GMRE)

Global Medical REIT is a publicly traded real estate investment trust focused on owning and operating properties leased to clinical healthcare providers. As of December 31, 2020, the Company’s portfolio consisted of 126 net-leased medical facilities across the United States. The Company’s portfolio includes medical office buildings, outpatient surgery centers, freestanding emergency departments, specialty hospitals, acute care hospitals, and other healthcare facilities.

Summary

Universal Health Realty is an excellent choice for investors looking for a low-risk stock with steady returns. The company specializes in investing in healthcare real estate, primarily in the form of medical office buildings, outpatient facilities, and senior housing. In addition, it offers generous dividend yields and a strong track record of dividend growth, with dividend increases in the past two years. With the healthcare sector continuing to expand, Universal Health Realty is well-positioned to benefit from this growth and provide investors with attractive returns.

Recent Posts