Ufp Industries Intrinsic Stock Value – UFP INDUSTRIES Sees Major Reduction in Holdings by Exchange Traded Concepts LLC

April 20, 2023

Trending News 🌥️

UFP ($NASDAQ:UFPI) Industries, Inc. is a leading manufacturer and distributor of components for the construction and industrial markets. The company specializes in the production of a variety of products, such as particleboard, plywood, and other wood-based products. In addition to its production, UFP Industries also provides services in kitchen cabinet manufacturing and assembly, as well as engineering and design services.

However, the company recently saw a major reduction in holdings by Exchange Traded Concepts LLC. According to its most recent filing with the Securities and Exchange Commission, the LLC decreased its holdings of UFP Industries, Inc. shares by 74.6% in the fourth quarter. Despite this news, the company’s stock has remained relatively stable since the filing was released. It is possible that the firm had an unfavorable outlook on the future of the company or felt that it could obtain better terms from another issuer. Nevertheless, this news could present a potential opportunity for investors looking to take advantage of a potentially undervalued asset.

Share Price

Despite this, UFP INDUSTRIES stock opened at $79.7 and closed at $80.1, a 0.4% increase from the prior closing price of $79.7. This indicates that the market is not primarily concerned with the reduction in holdings and still remains optimistic about UFP INDUSTRIES’ future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ufp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 9.63k | 665.16 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ufp Industries. More…

| Operations | Investing | Financing |

| 831.57 | -353.94 | -210.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ufp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.67k | 1.07k | 41.61 |

Key Ratios Snapshot

Some of the financial key ratios for Ufp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.7% | 56.8% | 9.9% |

| FCF Margin | ROE | ROA |

| 6.8% | 23.7% | 16.1% |

Analysis – Ufp Industries Intrinsic Stock Value

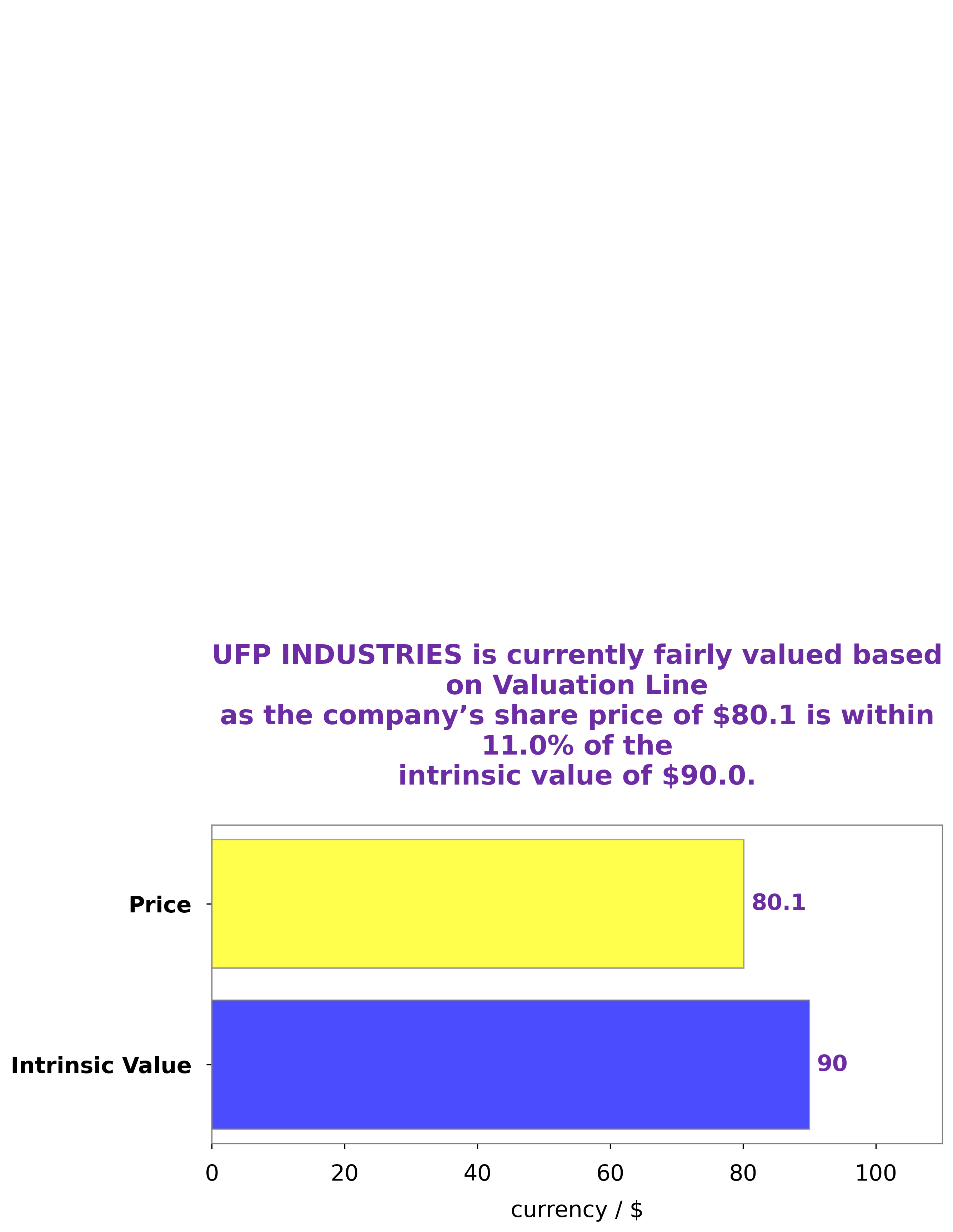

At GoodWhale, we have conducted a thorough analysis of UFP INDUSTRIES‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of UFP INDUSTRIES share to be around $90.0. However, the stock is currently traded at $80.1, indicating a fair price that is 11.0% undervalued. This presents a great opportunity for investors to purchase the stock at a discounted rate and benefit from the potential upside. More…

Peers

UFP Industries Inc is one of the largest producers of wood products in North America. The company’s competitors include Blue Star Opportunities Corp, Interfor Corp, and West Fraser Timber Co. Ltd.

– Blue Star Opportunities Corp ($OTCPK:BSTO)

Interfor Corp is a Canadian forestry company with operations in British Columbia, Washington state, and Oregon. The company has a market cap of 1.23 billion Canadian dollars as of 2022. The company’s return on equity is 34.77%. Interfor Corp is engaged in the business of growing and harvesting trees, and manufacturing and selling lumber and wood products. The company’s products are used in the construction, industrial, and retail markets.

– Interfor Corp ($TSX:IFP)

As of 2022, West Fraser Timber Co. Ltd. had a market capitalization of $8.54 billion. The company had a return on equity of 26.74%. West Fraser Timber Co. Ltd. is a forest products company that produces lumber, wood chips, and other forest products. The company was founded in 1955 and is headquartered in Vancouver, Canada.

Summary

Investors have recently taken a closer look at UFP Industries, Inc. as Exchange Traded Concepts LLC significantly reduced their holdings in the company by 74.6%. By analyzing financial reports, news releases, and other relevant data, investors are able to gain insight into the potential of investing in the company. This includes studying their financial health, growth potential, profitability, and current market trends to make informed decisions on their investments. It is important to conduct thorough research on UFP Industries before investing to ensure that it is the right fit for your portfolio.

Recent Posts