Uber Technologies Intrinsic Value Calculation – Uber Reveals the Strangest Lost and Found Items – Ranking the Most Forgetful Cities

May 4, 2023

Trending News 🌧️

Uber Technologies ($NYSE:UBER), the global ride-hailing giant, has released its seventh annual report on lost and found items left behind in its passengers’ cars. The report reveals some of the stranger items left behind by forgetful passengers, as well as the cities that have been the most forgetful. It has come to light that some of the weirdest objects listed in the report are a taxidermied squirrel, a giant banana, and a live chicken.

Uber Technologies is a technology company that specializes in ride-hailing services. Uber also offers food delivery, bike-sharing, and micromobility services, allowing customers to access a wide range of options for their travelling needs.

Market Price

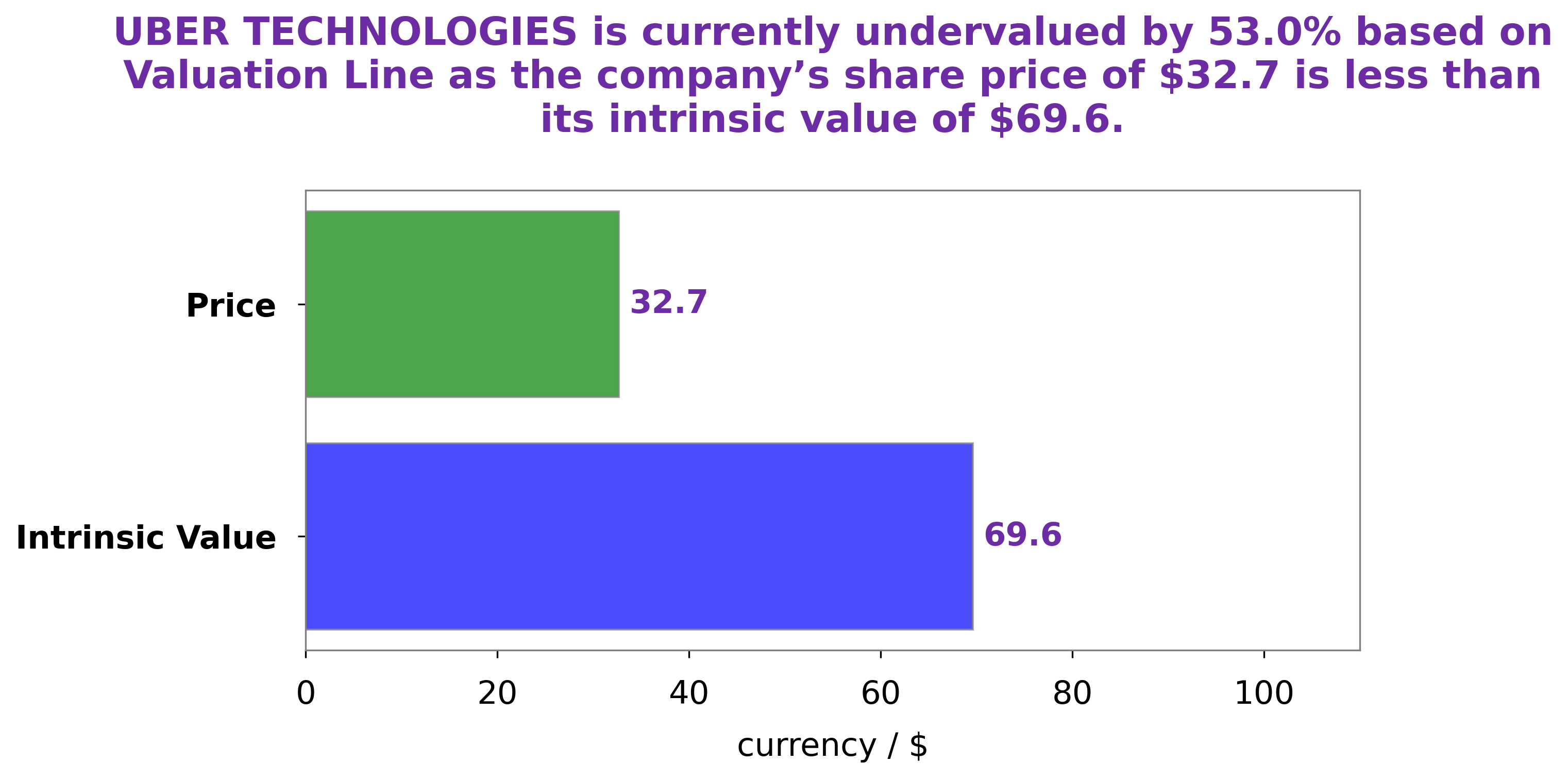

Monday saw a 5.4% rise in shares of UBER TECHNOLOGIES, with the stock opening at $32.0 and closing at $32.7, compared to the previous closing price of 31.0. In line with this, UBER TECHNOLOGIES have recently released details of the most forgetful cities in the world, based on the strangest lost and found items they have collected over the years. As part of this analysis, they have revealed some of the most peculiar items that have been left behind by passengers in their vehicles. From a yoga mat in New York City to a plantain slicer in Miami, there is clearly no limit to what passengers can forget in an UBER.

Other remarkable items include a pair of skis in Seattle, a teddy bear in Los Angeles and a mini-stove in Chicago. Overall, this serves as a reminder of how forgetful people can be, and how important it is to always check for any personal belongings before exiting an UBER vehicle. Not only will this ensure that your items are not forgotten, but you may also get some interesting stories to tell along the way! Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uber Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 33.85k | -3.37k | -7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uber Technologies. More…

| Operations | Investing | Financing |

| 1.23k | -1.9k | 21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uber Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 32.45k | 23.78k | 3.73 |

Key Ratios Snapshot

Some of the financial key ratios for Uber Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.4% | – | -8.2% |

| FCF Margin | ROE | ROA |

| 2.9% | -23.5% | -5.4% |

Analysis – Uber Technologies Intrinsic Value Calculation

At GoodWhale, we have conducted an analysis of the wellbeing of UBER TECHNOLOGIES. We have used our proprietary Valuation Line to calculate the fair value of UBER TECHNOLOGIES shares to be around $69.6. This presents an attractive opportunity for investors who are looking to capitalize on the current undervaluation of UBER TECHNOLOGIES. More…

Peers

As the world progresses, new technologies are constantly emerging and reshaping the way we live. One of the most recent and influential technological advancements is the rise of ride-sharing apps, such as Uber Technologies Inc. These apps have changed the way we travel, and have had a profound impact on the taxi industry. While Uber has become the most well-known and successful ride-sharing app, it faces stiff competition from other companies, such as Trend Innovations Holding Inc, Waitr Holdings Inc, and Where Food Comes From Inc.

– Trend Innovations Holding Inc ($OTCPK:TREN)

Innovative Holding Inc is a publicly traded holding company with a focus on technology investments. The company’s market cap as of 2022 was 58.02M and its ROE was 81.69%. Innovative Holding Inc’s portfolio includes investments in companies such as AppDirect, Cloud Elements, and Icertis. These companies provide software that helps businesses manage their operations, customers, and suppliers.

– Waitr Holdings Inc ($NASDAQ:WTRH)

Waitr Holdings Inc is a food delivery service company. It operates in the United States and has a market cap of 26.59M as of 2022. The company has a Return on Equity of -127.21%.

Waitr Holdings Inc was founded in 2013 and is headquartered in Lake Charles, Louisiana. The company operates in the restaurant industry and provides food delivery services to its customers. It delivers food from local restaurants to its customers through its app. The company has a fleet of drivers who pick up and deliver food to its customers.

– Where Food Comes From Inc ($NASDAQ:WFCF)

Food Comes From Inc. is a company that helps farmers and food producers to connect with consumers and sell their products. The company has a market cap of 70.04M as of 2022 and a Return on Equity of 17.04%. The company has a strong focus on sustainability and works to promote sustainable practices among its farmers and food producers. The company also works to educate consumers about where their food comes from and the importance of supporting sustainable agriculture.

Summary

Analysts have attributed this to the company’s increasing penetration and reach in the ride-hailing market, as well as its efforts to develop and expand its food delivery service. Investor confidence has been further bolstered by Uber’s success in reducing operating costs and increasing earnings. Despite a volatile market, Uber remains an attractive and promising stock for investors who are looking to benefit from its growth potential in the near future.

Recent Posts