Ternium S.a Stock Fair Value Calculation – Ternium Mexico to Invest US$1.94 Billion in Expansion of Steel Plant

May 17, 2023

Trending News 🌥️

Ternium ($NYSE:TX) S.A., a leading Latin American steel producer, announced that its subsidiary, Ternium Mexico, will be investing US$1.94 billion to expand its industrial center in the city of Monterrey. The announcement of the expansion comes as part of Ternium’s strategy to increase its presence in Mexico, one of the world’s largest steel markets. The move will further strengthen the company’s position as a leading provider of steel products to both the automotive and construction industries. In addition to the expansion of the production facility, Ternium Mexico plans to invest in the development of new technologies to improve the efficiency and competitiveness of its operations.

This includes the introduction of new automation systems, the use of advanced information technology systems, and the enhancement of safety standards. The investment in the expansion of the Monterrey plant is part of Ternium’s ongoing commitment to innovation and sustainability in its business operations. This commitment has enabled Ternium to become one of the world’s leading steel producers and is expected to further drive its growth in Mexico and beyond.

Price History

The expansion project is expected to create thousands of new jobs in the region and will be funded through the company’s own resources as well as external financing. TERNIUM S.A has already hired local contractors to carry out the project and has promised to use local suppliers wherever possible. The announcement had a minor impact on TERNIUM S.A’s stock, which opened at $39.1 and closed at $38.2, down by 1.7% from the prior closing price of 38.8. The stock remains one of the most attractive investments in Latin America due to its strong fundamentals and long-term growth potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ternium S.a. More…

| Total Revenues | Net Income | Net Margin |

| 15.73k | 1.37k | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ternium S.a. More…

| Operations | Investing | Financing |

| 2.67k | -2.15k | -1.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ternium S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.91k | 3.65k | 62.3 |

Key Ratios Snapshot

Some of the financial key ratios for Ternium S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | 44.6% | 13.1% |

| FCF Margin | ROE | ROA |

| 12.8% | 10.7% | 7.2% |

Analysis – Ternium S.a Stock Fair Value Calculation

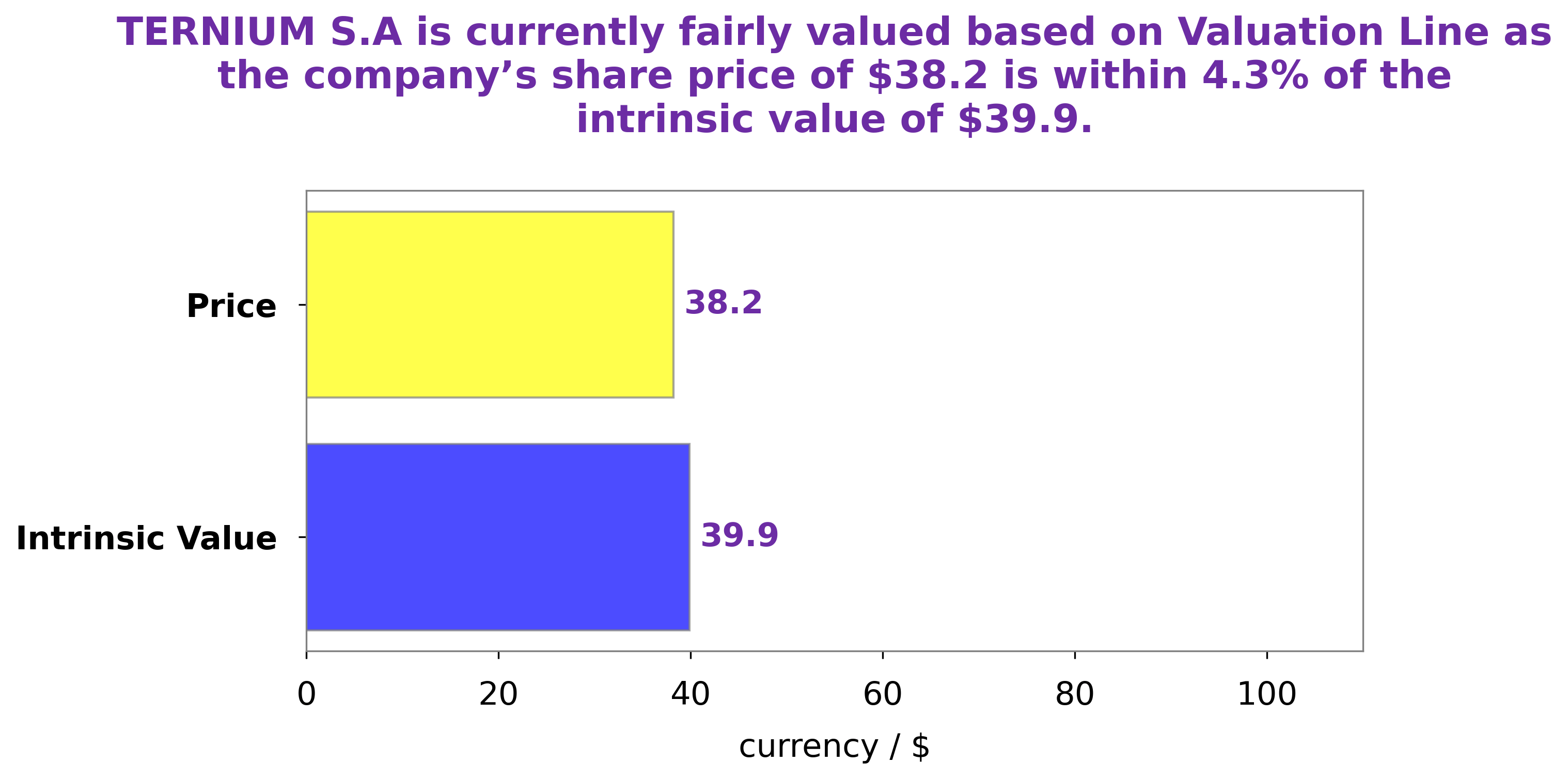

At GoodWhale, we have conducted an in-depth analysis of the fundamentals of TERNIUM S.A. Based on our proprietary Valuation Line, we have determined that the fair value of TERNIUM S.A’s share should be around $39.9. However, currently TERNIUM S.A stock is trading at $38.2, which is a fair price but one that is undervalued by 4.3%. This presents an opportunity for investors to purchase the stock at a discounted rate while still anticipating a potential return on their investment in the future. More…

Peers

In recent years, the Chinese steel industry has been undergoing a period of intense competition, with a number of major players vying for market share. Among them, Ternium SA has emerged as a key competitor, particularly in the production of high-quality steel products. The company has invested heavily in research and development in order to maintain its position as a leading player in the industry, and this has paid off in terms of both market share and profitability. While Ternium faces stiff competition from a number of other major Chinese steel producers, it is well-positioned to continue its growth in the years ahead.

– Lingyuan Iron & Steel Co Ltd ($SHSE:600231)

Lingyuan Iron & Steel Co Ltd is a Chinese steel producer with a market cap of $5.88B as of 2022. The company has a Return on Equity of -2.8%. Lingyuan Iron & Steel Co Ltd produces a variety of steel products including pipes, plates, and coils. The company has over 3,500 employees and operates in China, Europe, and the United States.

– Daehan Steel Co Ltd ($KOSE:084010)

Daehan Steel Co Ltd is a South Korean steel manufacturer. The company has a market cap of 232.09B as of 2022 and a Return on Equity of 28.52%. Daehan Steel Co Ltd is a leading manufacturer of steel products in South Korea. The company produces a wide range of steel products, including hot rolled coils, cold rolled coils, galvanized steel coils, and pre-painted steel coils.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd is a Chinese steel company with a market cap of 5.72 billion as of 2022. The company has a Return on Equity of -24.16%. The company is involved in the production of iron and steel products.

Summary

TERNIUM S.A is an international steel company with operations in Mexico, Central and South America. The company has recently announced its plans to invest US$1.94 billion in the construction of a new steel plant in Mexico. This investment is expected to significantly increase their industrial production capacity and create jobs in the area.

Additionally, the plant is estimated to bring in additional revenues for the company from the sale of semi-finished and finished products. With this expansion, Ternium is looking to expand its presence in the region and improve its competitive position in the global steel industry.

Recent Posts