Ternium S.a Intrinsic Value Calculation – Investment

April 13, 2023

Trending News 🌥️

Ternium ($NYSE:TX) S.A. is a multinational steel manufacturing company headquartered in Buenos Aires, Argentina. The company is listed on the NYSE and is one of the world’s leading steel producers, with a strong presence in the Latin American steel market. Ternium’s stock has been an attractive investment for those looking to capitalize on the recent rebound of steel prices. As one of the largest steel companies in the world, Ternium offers investors a unique opportunity to benefit from their expertise in the steel industry. The company has demonstrated a consistent financial performance, and its stock has shown a steady appreciation over the past few years. As an investor, one can take advantage of Ternium’s expertise and experience to reap the rewards of a value stock in a booming sector.

Furthermore, Ternium’s stock is seen as a low-risk option for those who wish to invest in a steel-producing giant. The company has an impressive track record of making strategic investments and creating value for its shareholders. It also has the financial strength to weather any economic downturns and has established itself as a reliable and profitable company. Ternium’s stock is an attractive investment option for those looking to capitalize on the ongoing trend of increasing steel prices. With its lower debt-to-equity ratio and strong financial performance, Ternium provides investors with an excellent opportunity to ride the wave of steel price increases for maximum returns.

Market Price

Ternium S.A, a steel manufacturer based in Argentina and Mexico, is a great investment opportunity. On Wednesday, TERNIUM S.A’s stock opened at $42.2 and closed at $41.8, up by 0.3% from prior closing price of 41.7. This small increase is reflective of the company’s ability to increase returns even when steel prices are fluctuating, an indication that the company is riding the wave of steel price increases for maximum returns. The company has shown consistent growth in the past few years and its outlook for the future remains positive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ternium S.a. More…

| Total Revenues | Net Income | Net Margin |

| 16.41k | 1.77k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ternium S.a. More…

| Operations | Investing | Financing |

| 2.75k | -1.32k | -1.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ternium S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.49k | 3.72k | 60.34 |

Key Ratios Snapshot

Some of the financial key ratios for Ternium S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 47.9% | 16.5% |

| FCF Margin | ROE | ROA |

| 13.2% | 14.3% | 9.7% |

Analysis – Ternium S.a Intrinsic Value Calculation

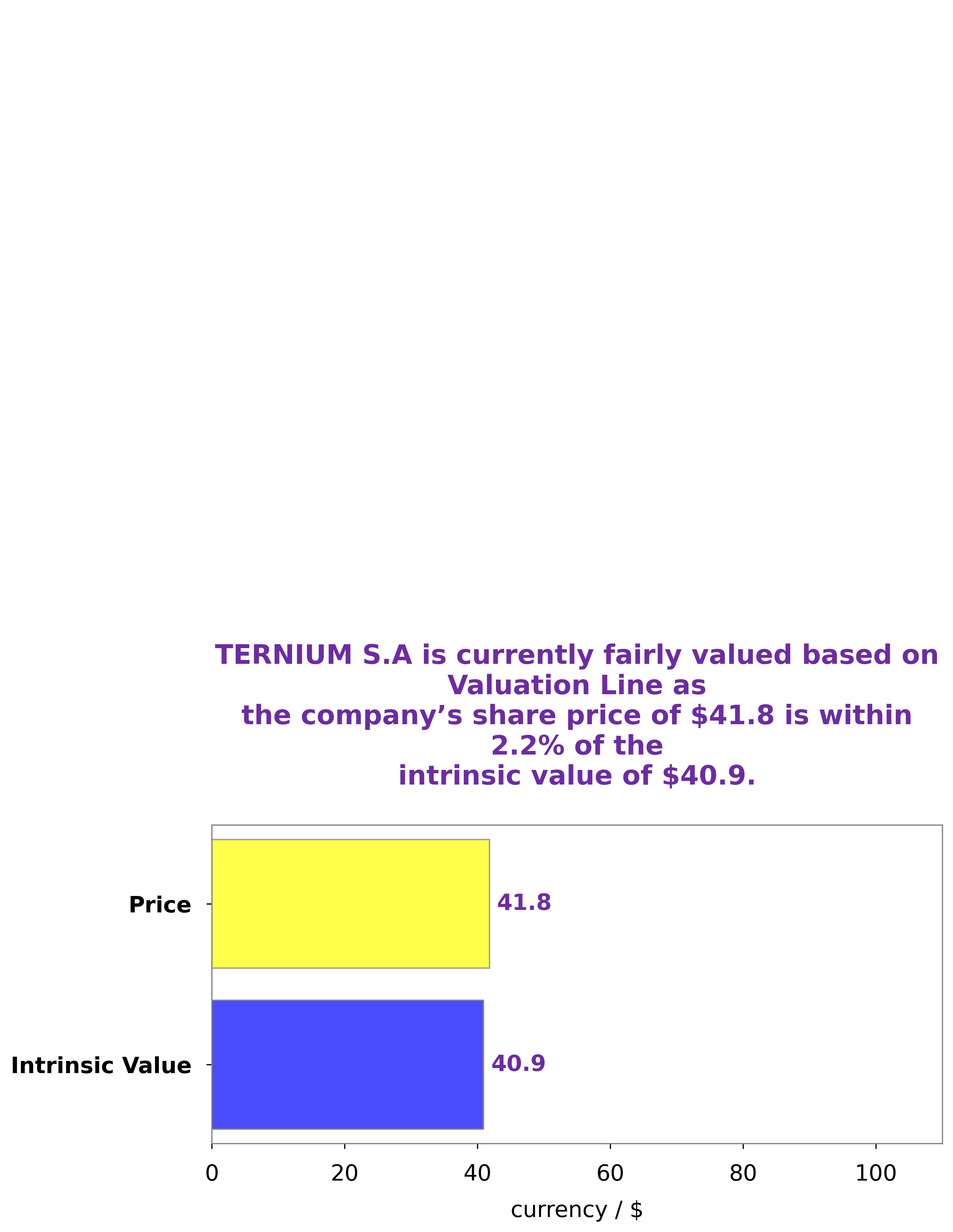

At GoodWhale, we have been analyzing the fundamentals of TERNIUM S.A. and have come to the conclusion that its intrinsic value is around $40.9, calculated by our proprietary Valuation Line. As of now, the stock is trading at a price of $41.8, slightly overvalued by 2.2%. We believe that this is still a fair price and suggest investing in TERNIUM S.A. at the current price. More…

Peers

In recent years, the Chinese steel industry has been undergoing a period of intense competition, with a number of major players vying for market share. Among them, Ternium SA has emerged as a key competitor, particularly in the production of high-quality steel products. The company has invested heavily in research and development in order to maintain its position as a leading player in the industry, and this has paid off in terms of both market share and profitability. While Ternium faces stiff competition from a number of other major Chinese steel producers, it is well-positioned to continue its growth in the years ahead.

– Lingyuan Iron & Steel Co Ltd ($SHSE:600231)

Lingyuan Iron & Steel Co Ltd is a Chinese steel producer with a market cap of $5.88B as of 2022. The company has a Return on Equity of -2.8%. Lingyuan Iron & Steel Co Ltd produces a variety of steel products including pipes, plates, and coils. The company has over 3,500 employees and operates in China, Europe, and the United States.

– Daehan Steel Co Ltd ($KOSE:084010)

Daehan Steel Co Ltd is a South Korean steel manufacturer. The company has a market cap of 232.09B as of 2022 and a Return on Equity of 28.52%. Daehan Steel Co Ltd is a leading manufacturer of steel products in South Korea. The company produces a wide range of steel products, including hot rolled coils, cold rolled coils, galvanized steel coils, and pre-painted steel coils.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd is a Chinese steel company with a market cap of 5.72 billion as of 2022. The company has a Return on Equity of -24.16%. The company is involved in the production of iron and steel products.

Summary

Ternium S.A. is a steel company based in Luxembourg that is seen by many analysts as an attractive value play. Analysts see the potential for strong returns as the company continues to execute on its initiatives. Ternium also benefits from its geographic diversity, operating across Latin America but with a presence in Europe, North America and Asia. With a strategic focus on sustainability and industry-leading innovation, Ternium is well-positioned to capitalize on the rebound in steel prices and could be an attractive investment opportunity.

Recent Posts