Sterling Check Stock Fair Value – Analysts Give Sterling Check Corp Moderate Buy Rating Amid Positive Financial Outlook

June 1, 2023

☀️Trending News

Analysts have given Sterling Check ($NASDAQ:STER) Corporation a moderate “buy” recommendation in light of its financial outlook. The company, which provides financial and payroll services, has had a positive year so far and is expected to continue its trajectory of success. Its stock has shown consistent growth and is anticipated to experience further gains in the future. Sterling Check Corporation is a leading provider of financial and payroll services for businesses of all sizes. With decades of experience in the industry, the company has been able to leverage its expertise to develop innovative solutions for its customers. The company also strives to provide the best customer service possible, aiming to simplify complex financial processes. As a result, it has become a trusted partner by many businesses.

The moderate “buy” recommendation from analysts is based on the company’s positive financial performance and outlook. Sterling Check Corporation has shown consistent growth this year and is expected to continue this pattern in the future. Its stock has been steadily rising and is projected to reach even higher levels in the coming months. The company has also been investing in new technologies and strategies to further improve its service offerings. The company is expected to continue its success in the coming months and years, making it a wise investment opportunity. Investors should consider the potential benefits of purchasing shares in Sterling Check Corporation, as it may be a profitable venture in the long-term.

Market Price

The stock opened at $13.3 and, despite some fluctuations throughout the day, closed at the same price, down 0.2% from its last closing price. Despite the slight dip, analysts remain optimistic about the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sterling Check. More…

| Total Revenues | Net Income | Net Margin |

| 754.08 | 13.77 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sterling Check. More…

| Operations | Investing | Financing |

| 112.1 | -67.96 | -34.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sterling Check. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.41k | 679.78 | 7.47 |

Key Ratios Snapshot

Some of the financial key ratios for Sterling Check are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | – | 6.8% |

| FCF Margin | ROE | ROA |

| 12.3% | 4.4% | 2.3% |

Analysis – Sterling Check Stock Fair Value

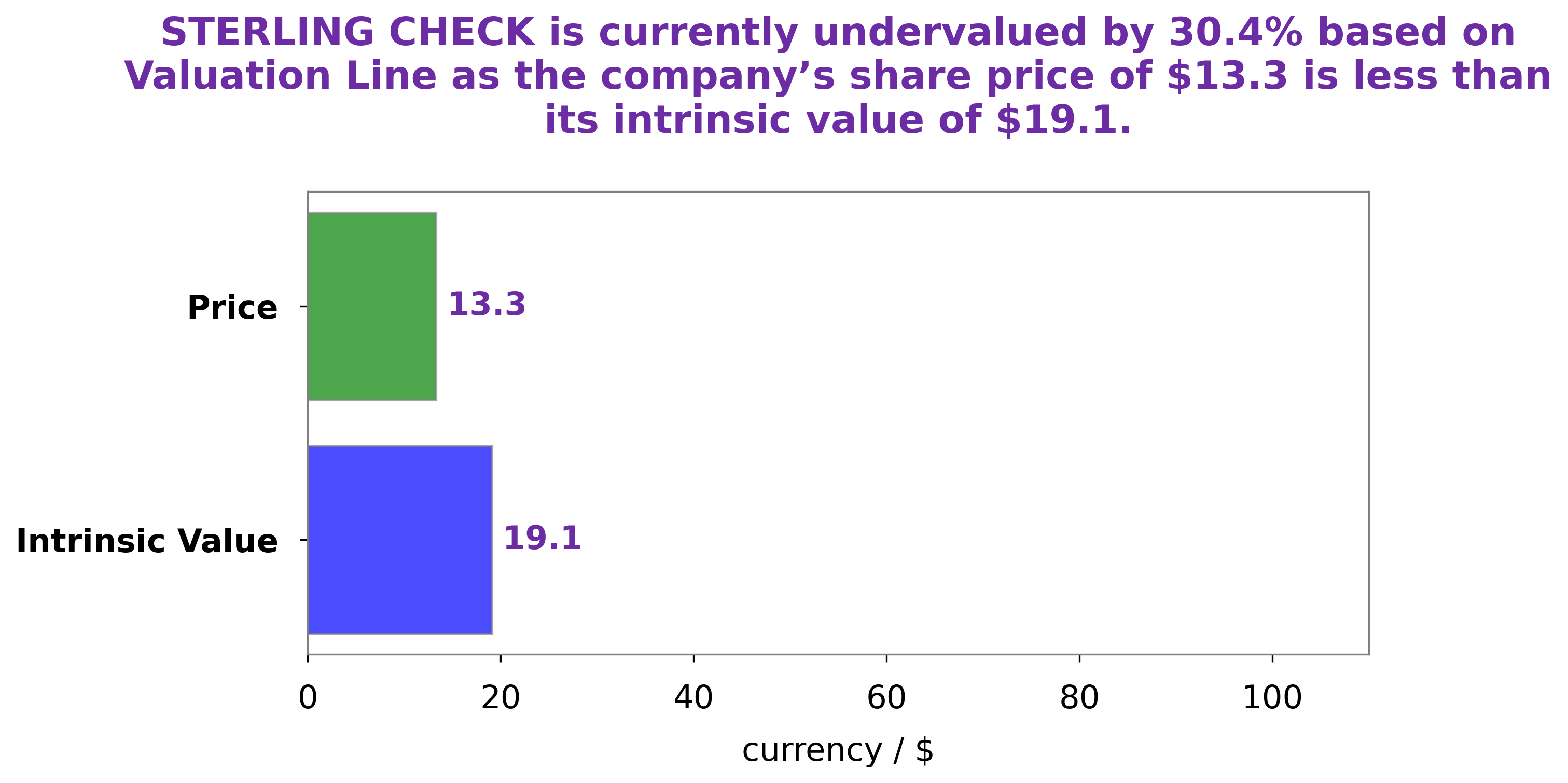

At GoodWhale, we performed an analysis on STERLING CHECK‘s fundamentals. According to our proprietary Valuation Line, the intrinsic value of STERLING CHECK share is estimated to be around $19.1. We have also observed that STERLING CHECK stock is currently traded at $13.3, which is undervalued by 30.4%. This means that the current stock price represents a good opportunity for potential investors to purchase STERLING CHECK shares at a discounted rate. More…

Peers

The competition among Sterling Check Corp and its competitors is intense. Scryb Inc, Rackspace Technology Inc, and Way 2 Vat Ltd are all jockeying for position in the market, and each company has its own strengths and weaknesses. Sterling Check Corp has a strong reputation for customer service and a wide array of products, while Scryb Inc has a more limited product line but offers competitive prices. Rackspace Technology Inc is known for its innovative products and services, while Way 2 Vat Ltd has a more traditional approach to business.

– Scryb Inc ($OTCPK:SCYRF)

Scryb Inc is a publicly traded company with a market capitalization of $16.73 million as of 2022. The company has a negative return on equity of 105.94%. Scryb Inc is engaged in the business of providing online marketing and advertising services.

– Rackspace Technology Inc ($NASDAQ:RXT)

Rackspace Technology, Inc. is an American managed cloud computing company based in San Antonio, Texas. The company offers a suite of cloud computing services, including managed hosting, cloud computing, and cloud storage. Rackspace was founded in 1998 and went public in 2008. As of 2018, it employed over 4,000 people.

– Way 2 Vat Ltd ($ASX:W2V)

Way 2 Vat Ltd is a company that provides VAT services. It has a market cap of 4.83M as of 2022. The company was founded in 2006 and is headquartered in London, United Kingdom.

Summary

Sterling Check Corp has recently been given a moderate buy rating by analysts, as promising financials indicate potential for an attractive return for investors. The company is expected to have a solid balance sheet, with ample liquidity to weather any economic downturn. Meanwhile, earnings per share growth is expected to remain steady and there is potential for improved profitability margins over the short to medium term. On the downside, a high debt to equity ratio and a significant amount of capital spending could pose a risk to investors.

However, the strong fundamentals and attractive return potential make Sterling Check Corp an intriguing investment opportunity.

Recent Posts