Squarespace Intrinsic Value Calculation – Squarespace Helps Businesses Navigate the Complex Online Presence Landscape

May 4, 2023

Trending News ☀️

Squarespace ($NYSE:SQSP), Inc. is a leader in the field of digital presence management, offering businesses a comprehensive platform to navigate the ever-evolving landscape of online marketing. The company offers a wide range of services and products, from website-building tools to analytics, free hosting and more. Their user-friendly and intuitive platform provides businesses with the ability to create an effective and engaging online presence. For business owners with limited technical skills, Squarespace makes it easy to create and maintain a stunning website, blog or store without the need for coding. For those with more advanced skills, they also offer helpful tools and tutorials to customize every aspect of the website.

Beyond website creation, Squarespace also provides businesses with powerful analytics tools to track and measure their online performance. This includes information about website visitors, customers and more, helping businesses make informed decisions about their online marketing strategy. In short, Squarespace is an invaluable resource for businesses looking to establish a presence in the digital world. From website design and hosting to analytics and optimization, Squarespace provides the tools and guidance businesses need to navigate the ever-changing landscape of online presence.

Share Price

In today’s digital age, having an online presence is a vital component of any successful business. The challenge, however, is navigating the complex landscape of online presence. This is where Squarespace comes in. Squarespace offers an array of features and services that make it easier for businesses to manage their web presence.

This includes hosting, ecommerce, design templates and more. On Wednesday, SQUARESPACE stock opened at $30.5 and closed at $26.4, plummeting by 15.2% from the prior closing price of 31.1. Despite this drop, Squarespace remains a powerful tool for businesses to take control of their online presence, helping them stay ahead in an ever-changing digital world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Squarespace. More…

| Total Revenues | Net Income | Net Margin |

| 866.97 | -252.22 | -13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Squarespace. More…

| Operations | Investing | Financing |

| 164.22 | -12.03 | -152.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Squarespace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 730.52 | 1.03k | -2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Squarespace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.4% | -39.9% | -23.9% |

| FCF Margin | ROE | ROA |

| 17.6% | 70.8% | -17.7% |

Analysis – Squarespace Intrinsic Value Calculation

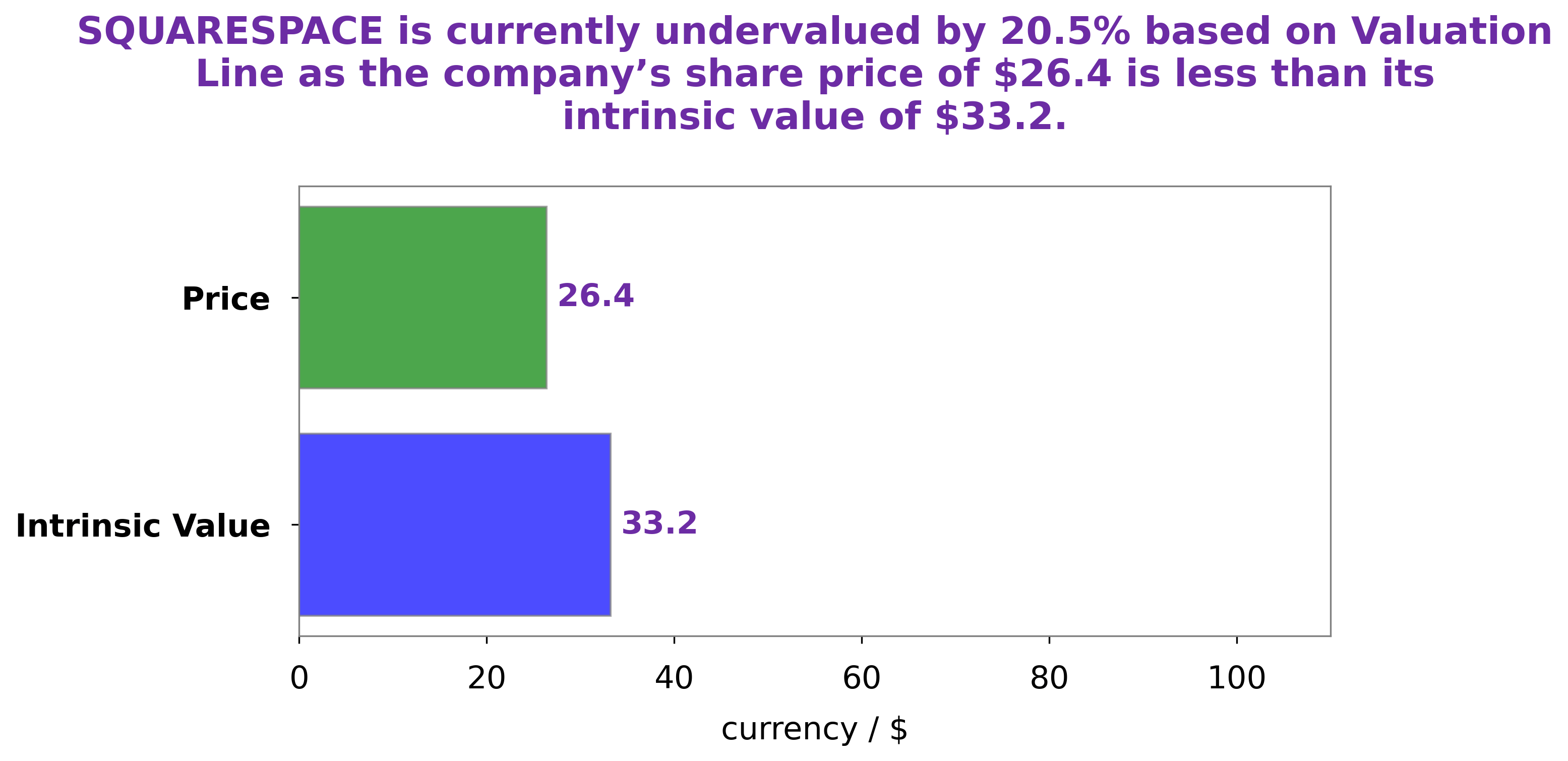

At GoodWhale, we recently conducted an analysis of SQUARESPACE‘s wellbeing. After careful review, we have determined that the intrinsic value of SQUARESPACE share is around $33.2, calculated by our proprietary Valuation Line. We are pleased to note that, despite the current market conditions, SQUARESPACE still has a strong fundamental value. This is evidenced by the fact that, despite currently being traded at $26.4, it is still undervalued by 20.5%. We believe this presents an attractive investment opportunity for those who are interested in taking advantage of the current market condition. More…

Peers

In the world of website design and hosting, there is stiff competition between Squarespace Inc and its competitors: Justsystems Corp, Marin Software Inc, and Autodesk Inc. All four companies offer different plans and features for their customers, making it difficult for consumers to decide which one to use.

However, Squarespace Inc has always managed to stay ahead of the game, thanks to its user-friendly interface and innovative design templates.

– Justsystems Corp ($TSE:4686)

Justsystems Corp is a Japanese software company that specializes in artificial intelligence and document processing. The company has a market cap of 211.94B as of 2022 and a Return on Equity of 14.99%. Justsystems was founded in 1981 and is headquartered in Tokyo, Japan.

– Marin Software Inc ($NASDAQ:MRIN)

Marin Software Inc is a publicly traded digital advertising company. The company has a market capitalization of 19.34 million as of 2022 and a return on equity of -36.28%. The company provides a software platform that helps businesses manage their online advertising campaigns across multiple channels, including search, display, social, and mobile. The company was founded in 2006 and is headquartered in San Francisco, California.

– Autodesk Inc ($NASDAQ:ADSK)

Autodesk, Inc. is an American multinational software corporation that makes software for the architecture, engineering, construction, manufacturing, media, and entertainment industries. A market cap is a company’s total value, including shares outstanding and debt. Autodesk’s market cap is $49.39B as of 2022. Return on equity (ROE) is a financial ratio that measures the profitability of a company in relation to its shareholders’ equity. Autodesk’s ROE is 71.49%.

Summary

Investors may want to take a close look at Squarespace, a leading player in the online presence management market. On the same day that the company released its financial results, its stock price moved down. Analysts suggest that this may be due to the company’s weak guidance and lack of profitability, as well as its heavy reliance on advertising revenue. Furthermore, the company faces stiff competition from other online presence management companies, including Facebook, Google, and Apple.

Despite this, Squarespace has managed to remain competitive due to its innovative platform and unique offerings, such as website design and hosting services. Investors should carefully consider these factors before investing in Squarespace.

Recent Posts