Sportsman’s Warehouse Intrinsic Value – Sportsman’s Warehouse Expands Locations: Analysts Weigh Pros and Cons

April 19, 2023

Trending News ☀️

Sportsman’s Warehouse ($NASDAQ:SPWH), a leading retailer of outdoor gear and apparel, has recently announced their plans to expand the number of their stores across the United States. As the company continues to grow and strengthen its position in the outdoor recreation market, analysts have begun to weigh the pros and cons of the expansion on Sportsman’s Warehouse’s overall prospects. The company offers a wide selection of outdoor apparel and equipment for winter sports, camping and hiking, fishing, and hunting. With the increasing popularity of outdoor sports, the demand for quality products has also increased, making Sportsman’s Warehouse one of the most trusted sources for outdoor gear. The potential for growth due to an expansion of Sportsman’s Warehouse is unquestionable; however, there are some risks. The company will need to invest more in advertising to build brand awareness in new markets, as well as additional capital to open and operate the new stores.

Additionally, as the company grows, they may also face increased competition from other retailers. Ultimately, while the expansion of Sportsman’s Warehouse presents many opportunities, it is important that the company carefully considers all aspects before moving forward with their plans. With careful planning and thoughtful execution, Sportsman’s Warehouse can continue to be a leader in the outdoor recreation industry.

Stock Price

On Monday, SPORTSMAN’S WAREHOUSE unveiled plans to expand their locations, sending shockwaves through the industry. The news caused their stock to open at $7.2 and close at $6.6, a drop of 8.4% from the previous closing price. Analysts have weighed the pros and cons of the decision and seem to be divided on its outcome. The primary pro of their growth is the potential for increased profits from the new locations, as well as the possible addition of new customers to the SPORTSMAN’S WAREHOUSE family. This could lead to greater brand recognition and awareness in new markets, providing more opportunities for further growth.

On the other hand, analysts worry that the company could be stretching itself too thin by attempting to open too many new locations at once, leading to diminished customer service and quality control issues. It remains to be seen how this decision will affect Sportsman’s Warehouse in the long run. As they continue to expand, analysts will be watching closely to see if the pros outweigh the cons, or if they have bitten off more than they can chew. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sportsman’s Warehouse. More…

| Total Revenues | Net Income | Net Margin |

| 1.4k | 40.52 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sportsman’s Warehouse. More…

| Operations | Investing | Financing |

| 46.79 | -60.59 | -40.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sportsman’s Warehouse. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 858.96 | 565.85 | 7.81 |

Key Ratios Snapshot

Some of the financial key ratios for Sportsman’s Warehouse are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 20.2% | 4.1% |

| FCF Margin | ROE | ROA |

| -1.2% | 12.6% | 4.2% |

Analysis – Sportsman’s Warehouse Intrinsic Value

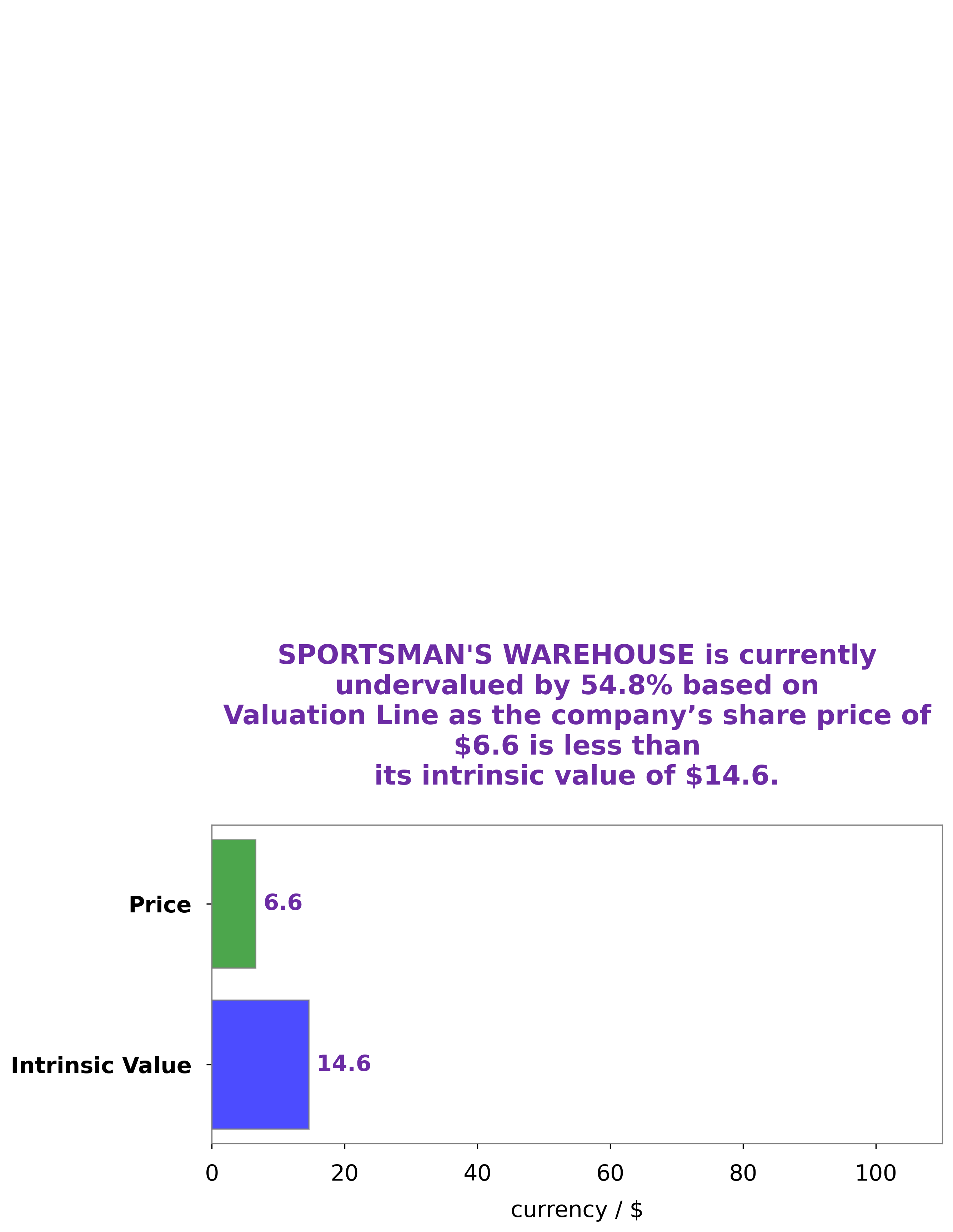

At GoodWhale, we recently conducted a fundamental analysis of SPORTSMAN’S WAREHOUSE. After careful consideration of all the financials, we have concluded that the intrinsic value of SPORTSMAN’S WAREHOUSE share is around $14.6. This value was calculated using our proprietary Valuation Line. As of now, SPORTSMAN’S WAREHOUSE stock is traded at $6.6. This indicates that the stock is undervalued by 54.9%. This makes it a good opportunity for investors to buy this stock at a discounted price given the intrinsic value estimated by us. More…

Peers

Headquartered in Midvale, Utah, the company operates over 90 stores across the United States. Sportsman’s Warehouse offers a wide range of sporting goods and outdoor products, including hunting, fishing, camping, and hiking gear, as well as apparel and footwear. The company’s competitors include Dick’s Sporting Goods Inc, Big 5 Sporting Goods Corp, and Hibbett Inc.

– Dick’s Sporting Goods Inc ($NYSE:DKS)

Dicks Sporting Goods is an American sporting goods retailer headquartered in Coraopolis, Pennsylvania. The company was founded in 1948 by Richard “Dick” Stack. As of 2019, it operates more than 850 stores in 47 states. The company offers a wide range of products, including apparel, footwear, and equipment for sports and fitness activities.

– Big 5 Sporting Goods Corp ($NASDAQ:BGFV)

Big 5 Sporting Goods Corp is a retailer of sporting goods and apparel in the United States. The company has a market cap of 280.08M as of 2022 and a Return on Equity of 19.14%. The company operates stores under the Big 5 Sporting Goods, Big 5 Sporting Goods Outlet, and Big 5 Trading Post banners. The company offers a wide variety of products, including athletic shoes, apparel, and accessories, as well as a variety of outdoor and recreational equipment.

– Hibbett Inc ($NASDAQ:HIBB)

Hibbett, Inc. is a publicly traded company with a market capitalization of 780.18 million as of 2022. The company operates in the retail sector and focuses on selling sporting goods and apparel. Hibbett has a return on equity of 27.86%.

Summary

Investors need to take a neutral view on Sportsman’s Warehouse following the announcement of increased store openings. Despite the potential to increase revenue, the stock price dropped on the same day as the news was released. This suggests that investors don’t believe this move will result in enough of a return to significantly improve share prices.

Short-term investors may want to consider these news events but should proceed with caution, as there are likely other factors at play that could influence the company’s future performance. Long-term investors will want to carefully assess the news and consider any accompanying analyst reports or sentiment before investing.

Recent Posts