Sovos Brands Intrinsic Value Calculation – Stephens & Co. Downgrades Sovos Brands from Overweight to Equal-Weight

August 15, 2023

🌧️Trending News

Sovos Brands ($NASDAQ:SOVO), a publicly-traded consumer packaged goods company, recently experienced a downgrade from Overweight to Equal-Weight by Stephens & Co. analyst Jim Salera on August 8, 2023. In the downgrade, Salera pointed to a deceleration in organic growth and margin stagnation as reasons for his decision. The downgrade comes at a time of uncertainty for Sovos Brands, as the company’s stock has been volatile over the past several months. In the first quarter of 2023, Sovos Brands had reported a 1% decline in organic growth, a sharp reversal from the 8% rate of growth the company had seen in the fourth quarter of 2022.

In addition, the company’s margins have been relatively flat, with no growth in the first quarter of 2023. In light of this recent news, investors may want to exercise caution when considering an investment in Sovos Brands. The company’s current financial performance has not been encouraging, and the downgrade from Stephens & Co. serves as a reminder that there are risks associated with investing in the company. Those looking at investing in Sovos Brands should consider other factors such as long-term growth potential and management’s ability to turn things around before making a decision.

Price History

This caused the stock to open at $22.6 and close at $22.5, a decrease of 0.2% from its prior closing price of 22.6. While this has been seen as a negative impact on the stock price, investors should note that the downgrade may not be indicative of the company’s long term performance and should exercise caution before making any decisions based solely on the downgrade. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sovos Brands. More…

| Total Revenues | Net Income | Net Margin |

| 941.43 | -13.99 | 1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sovos Brands. More…

| Operations | Investing | Financing |

| 63.7 | 33.34 | -0.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sovos Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.17k | 664.33 | 4.95 |

Key Ratios Snapshot

Some of the financial key ratios for Sovos Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.3% | – | 2.2% |

| FCF Margin | ROE | ROA |

| 6.1% | 2.6% | 1.1% |

Analysis – Sovos Brands Intrinsic Value Calculation

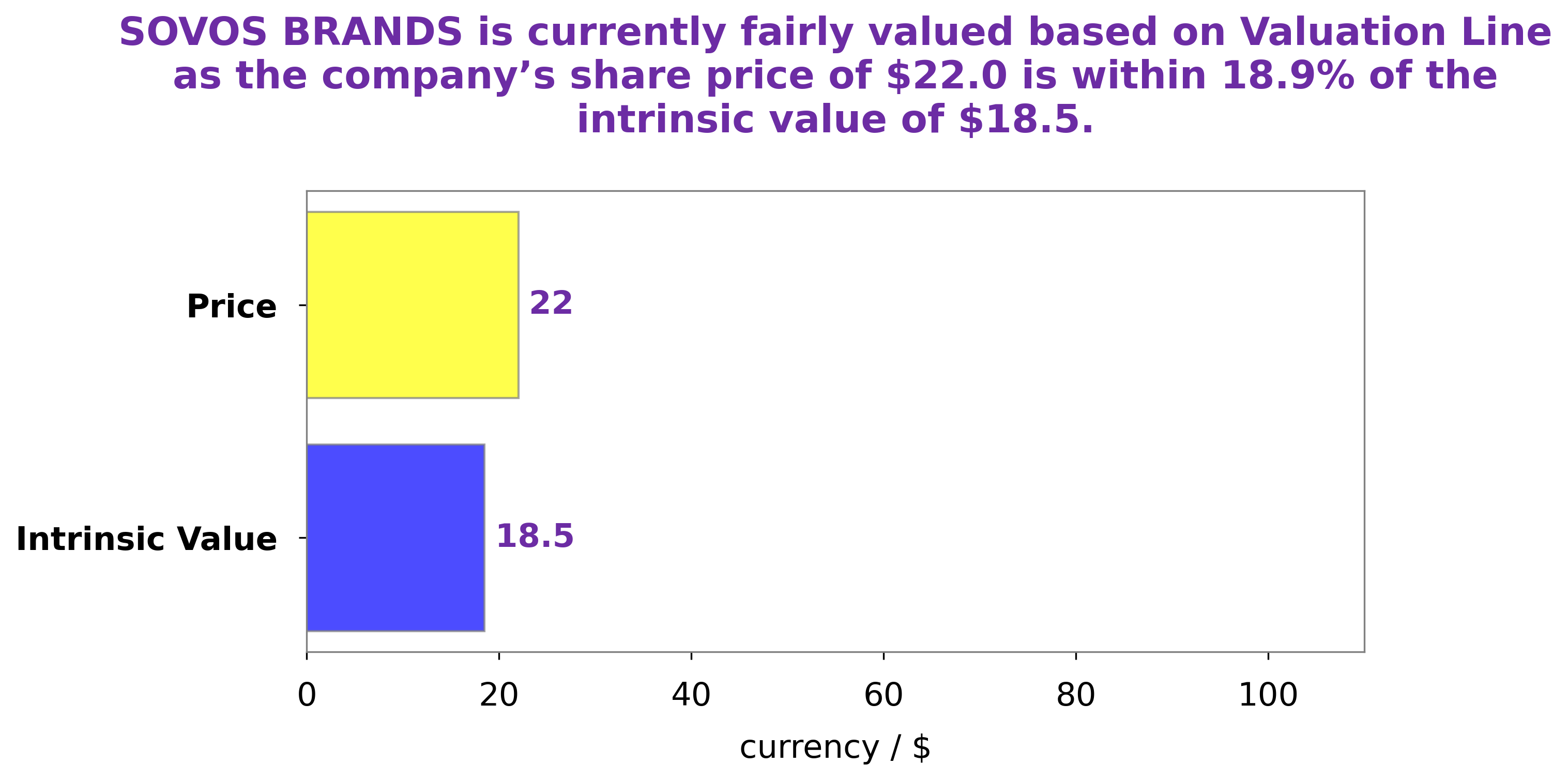

At GoodWhale, we have conducted a thorough analysis of SOVOS BRANDS‘s well being. Through our proprietary Valuation Line, we have calculated the intrinsic value of SOVOS BRANDS share to be around $17.0. However, the stock is currently trading at $22.5 which is overvalued by 32.6%. This is a good indication that investors may be overestimating the current market value of SOVOS BRANDS. Therefore, it is important to take into account this discrepancy between intrinsic and market value when deciding whether or not to invest in SOVOS BRANDS. More…

Peers

In the world of plant-based foods, there are many companies vying for market share. Sovos Brands Inc is one such company, and it competes with The Planting Hope Co Inc, Tattooed Chef Inc, and Tofutti Brands Inc, among others. Each company has its own unique products and strategies, and the competition between them is fierce.

– The Planting Hope Co Inc ($TSXV:MYLK)

The Planting Hope Co Inc. is a publicly traded company with a market capitalization of $53.57 million as of 2022. The company has a return on equity of -671.83%. The company is engaged in the business of providing services to the horticultural industry.

– Tattooed Chef Inc ($NASDAQ:TTCF)

Tattooed Chef Inc is a food and beverage company with a focus on healthy, sustainable, and delicious products. The company has a market capitalization of $362 million and a return on equity of -21.74%. Tattooed Chef Inc’s products are available in major retailers across the United States and Canada. The company’s mission is to provide consumers with healthy and delicious food and beverages that are sustainable and environmentally responsible.

– Tofutti Brands Inc ($OTCPK:TOFB)

Tofutti Brands Inc is a food company that manufactures and markets dairy-free and lactose-free food products. The company’s products include frozen desserts, cheese substitutes, and cream cheese substitutes. Tofutti Brands Inc’s products are available in the United States, Canada, Europe, and Asia. The company was founded in 1981 and is headquartered in Cranford, New Jersey.

Summary

Investment analysis of Sovos Brands in 2023 has been less than ideal. On August 8, analyst Jim Salera from Stephens & Co. downgraded the company from an Overweight rating to an Equal-Weight rating. This rating suggests that the company’s current performance is not expected to significantly outpace the overall market.

Investors should take this downgrade into consideration when making decisions regarding Sovos Brands stock. As of now, it is recommended that investors proceed with caution when investing in Sovos Brands.

Recent Posts