Simpson Manufacturing Intrinsic Stock Value – FourThought Financial Partners LLC Invests in Simpson Manufacturing Co., Amid Positive Results.

May 4, 2023

Trending News ☀️

FourThought Financial Partners LLC recently announced their investment in Simpson Manufacturing ($NYSE:SSD) Co., Inc., a company that is making waves in the industry. The company is renowned for their innovative products, services, and strategies and has consistently exceeded expectations. Simpson Manufacturing Co., Inc. is a leader in manufacturing construction products, such as steel connections, fasteners, and anchors. They offer a wide variety of products with competitive prices and are committed to providing customers with the highest quality product. They have experienced substantial growth in their revenue and profits, and their stock price has been steadily climbing.

Their success is a testament to their commitment to excellence and the dedication of their hardworking team of professionals. This is an exciting new chapter for the company and its future looks very promising. With this new partnership, Simpson Manufacturing Co., Inc. looks forward to expanding their reach and furthering their success.

Stock Price

On Tuesday, FourThought Financial Partners LLC announced their investment in Simpson Manufacturing Co., Inc. The stock opened at $125.9 and closed at $124.4, down 1.2% from last closing price of $125.9. Despite the drop in stock prices, the company reported positive results with an increase in revenue and profits, creating a strong investment opportunity for FourThought Financial Partners LLC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Simpson Manufacturing. More…

| Total Revenues | Net Income | Net Margin |

| 2.16k | 327.37 | 15.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Simpson Manufacturing. More…

| Operations | Investing | Financing |

| 399.82 | -870.24 | 465.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Simpson Manufacturing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.56k | 1.07k | 33.13 |

Key Ratios Snapshot

Some of the financial key ratios for Simpson Manufacturing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.9% | 33.7% | 20.8% |

| FCF Margin | ROE | ROA |

| 15.4% | 19.9% | 11.0% |

Analysis – Simpson Manufacturing Intrinsic Stock Value

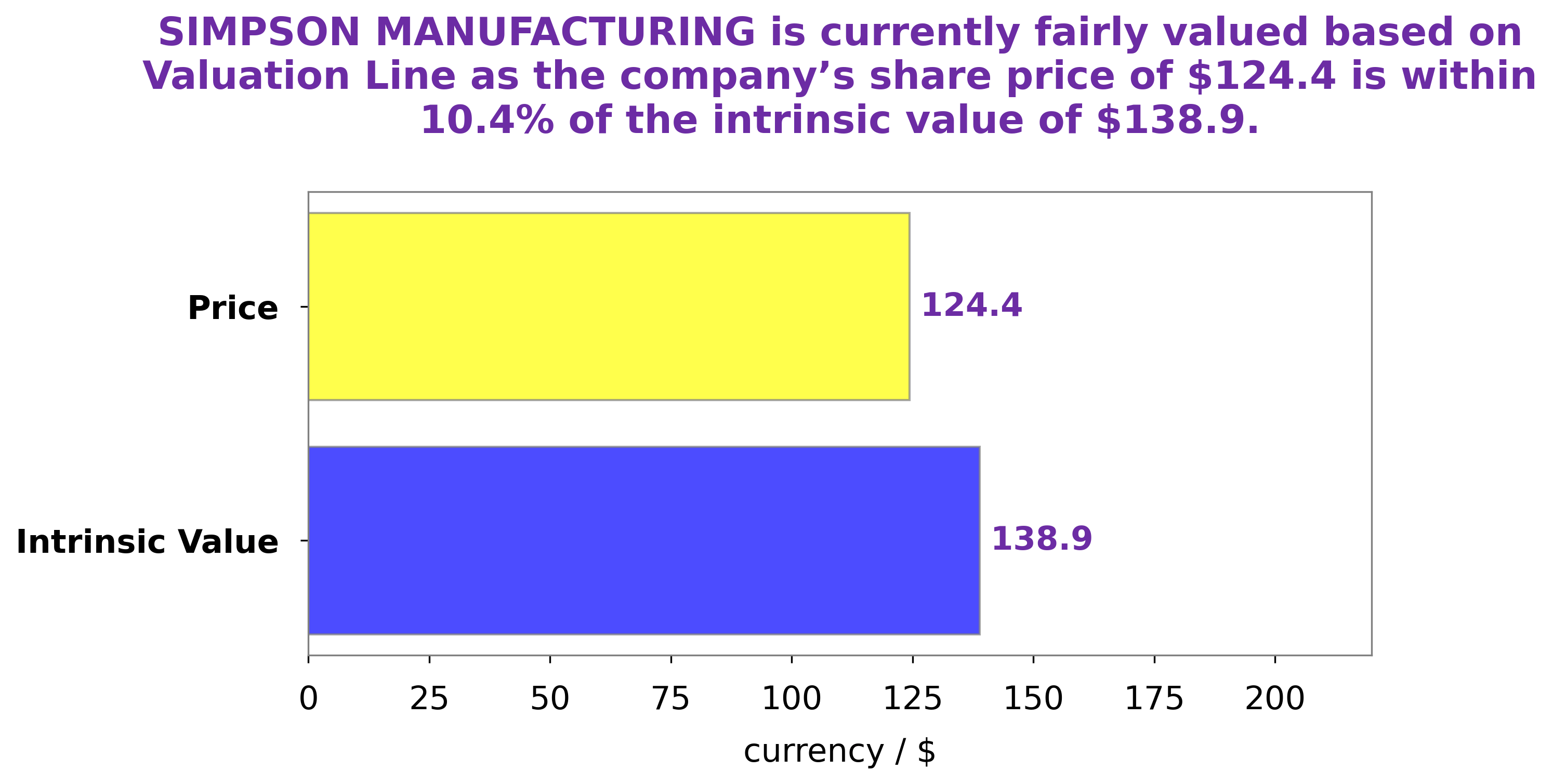

At GoodWhale, we believe in helping investors make informed decisions about their investments. That’s why we’ve taken a look at SIMPSON MANUFACTURING‘s wellbeing with our proprietary evaluating tool. Our findings show that the fair value of their shares is around $138.9. This is calculated by our proprietary Valuation Line that takes into account factors such as market sentiment, competitive landscape, and financial metrics. However, right now SIMPSON MANUFACTURING stock is trading at only $124.4, which is a fair price that is undervalued by 10.4%. This could indicate that it might be a good time to invest in the company’s stock. We believe that in long-term, the stock should appreciate and reach its fair value in due course of time. More…

Peers

Simpson Manufacturing Co Inc is one of the largest manufacturers of building materials in the United States. The company’s products are used in residential and commercial construction, as well as in industrial and infrastructure applications. Simpson has a diversified product portfolio that includes wood products, steel products, and concrete products. The company’s products are sold through a network of distributors and retailers. Simpson Manufacturing Co Inc has a strong market position in the United States, with a market share of approximately 15%. Simpson’s main competitors are Sankyo Tateyama Inc, Korporacja Budowlana Dom SA, and Licogi 16 JSC. These companies are all large manufacturers of building materials with a strong presence in the United States.

– Sankyo Tateyama Inc ($TSE:5932)

Sankyo Tateyama Inc is a Japanese company that manufactures and sells pharmaceuticals and medical devices. The company has a market capitalization of 16.87 billion as of 2022 and a return on equity of 0.94%. Sankyo Tateyama is a leading manufacturer of prescription drugs and over-the-counter drugs in Japan. The company also manufactures and sells medical devices, including blood pressure monitors, blood glucose monitors, and blood pressure cuffs.

– Korporacja Budowlana Dom SA ($LTS:0LZA)

Korporacja Budowlana Dom SA is a construction company that operates in Poland. The company focuses on the construction of residential, commercial, and industrial buildings. As of 2022, the company has a market cap of 2.65M and a ROE of 4.11%.

Summary

FourThought Financial Partners LLC recently acquired a new stake in Simpson Manufacturing Co., Inc., showing strong confidence in the company’s performance. Analysts expect the stock to continue to outperform the market, with an optimistic outlook for future growth. They cite the company’s strong competitive position and wide range of products as factors that are likely to contribute to long-term success. As the company continues to build on its strength, FourThought Financial Partners is likely to benefit from its stake in Simpson Manufacturing.

Recent Posts