SCHN Intrinsic Value – Shell Asset Management Co. Reduces Stake in Schnitzer Steel Industries,

May 18, 2023

Trending News ☀️

Schnitzer Steel Industries ($NASDAQ:SCHN), Inc. is a publicly traded metal recycler and manufacturer of finished steel products. With operations in the United States and Guam, the company is one of the largest recyclers of ferrous and non-ferrous metals, supplying recycled metals to mills and foundries worldwide. Analysts are watching the stock closely to see how it will respond to these developments and what effect they will have on the company’s long-term performance.

Market Price

On Friday, shares of Schnitzer Steel Industries, Inc. (SCHN) opened at $28.1 and closed at $28.1, up by 0.9% from the previous closing price of $27.9. Its primary products are finished steel goods, recycled metals, and auto parts. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SCHN. More…

| Total Revenues | Net Income | Net Margin |

| 3.26k | 71.55 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SCHN. More…

| Operations | Investing | Financing |

| 209.79 | -316.15 | 94.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SCHN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.78k | 852.66 | 33.79 |

Key Ratios Snapshot

Some of the financial key ratios for SCHN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.9% | 31.1% | 3.1% |

| FCF Margin | ROE | ROA |

| 1.6% | 6.9% | 3.6% |

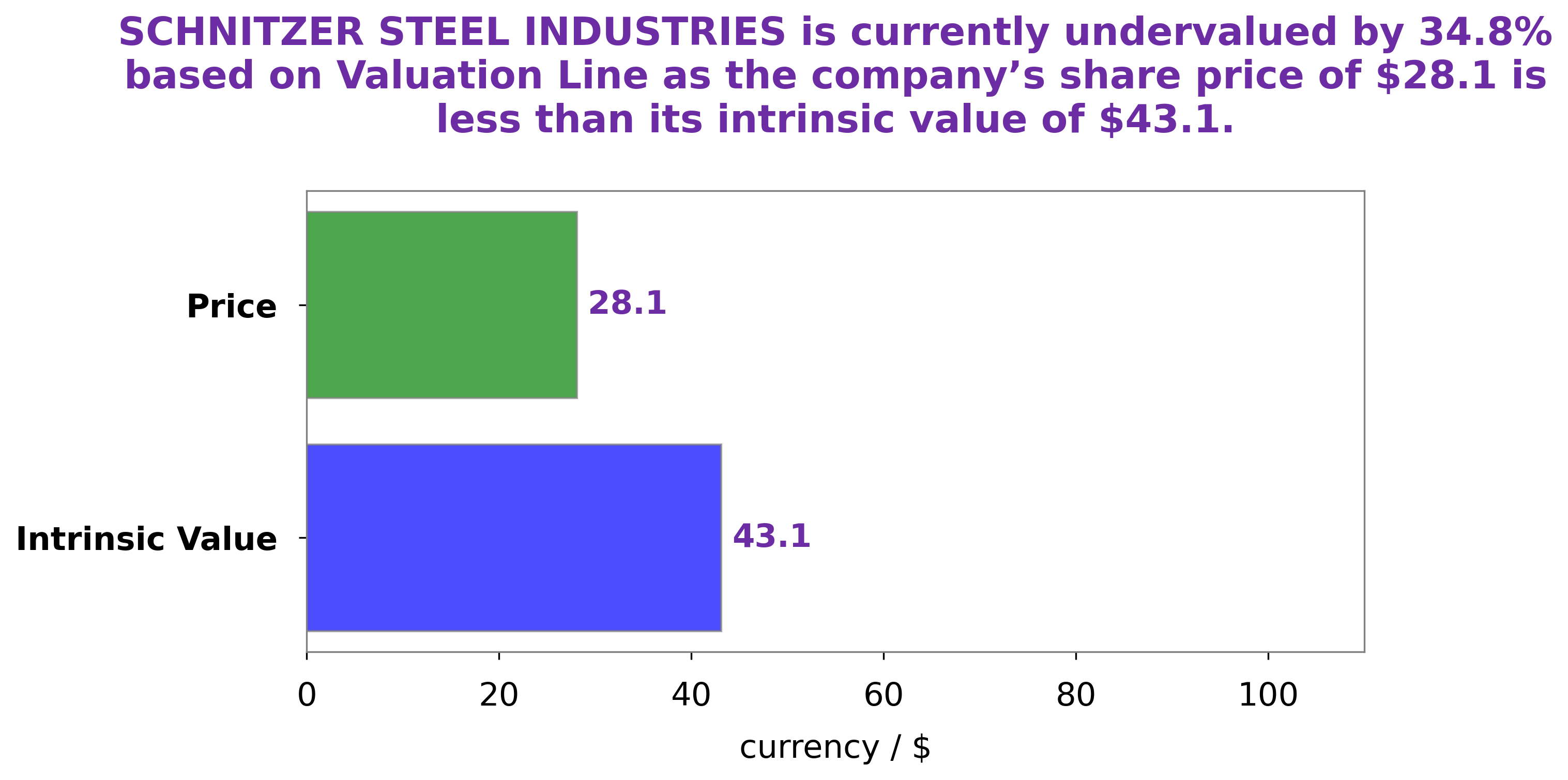

Analysis – SCHN Intrinsic Value

At GoodWhale, we’ve done a deep dive analysis of SCHNITZER STEEL INDUSTRIES’ financials using our proprietary Valuation Line. After assessing the fundamentals of the company, we’ve determined that the intrinsic value of its stock is around $43.1. This means that the current trading price of $28.1 for SCHNITZER STEEL INDUSTRIES stock is undervalued by 34.8%. Therefore, we believe it is a great opportunity to buy SCHNITZER STEEL INDUSTRIES’ stock while it is still undervalued. More…

Peers

Schnitzer Steel Industries Inc is one of the largest steel producers in the world. Its competitors include Daido Steel Co Ltd, FENG HSIN STEEL CO LTD, and Bengang Steel Plates Co Ltd.

– Daido Steel Co Ltd ($TSE:5471)

Daido Steel Co Ltd is a Japanese steel manufacturer with a market cap of 154.52B as of 2022. The company has a Return on Equity of 7.71%. Daido Steel Co Ltd produces a wide range of steel products, including stainless steel, carbon steel, and alloy steel. The company also manufactures and sells steel products for use in construction, shipbuilding, automotive, and other industries.

– FENG HSIN STEEL CO LTD ($TWSE:2015)

FENG HSIN STEEL CO LTD is a steel manufacturer based in Taiwan. The company has a market capitalization of 34.08 billion as of 2022 and a return on equity of 15.9%. Feng Hsin Steel Co Ltd produces a variety of steel products including hot rolled coils, cold rolled coils, and hot dip galvanized coils. The company also produces steel pipes and tubes, wire rods, and other steel products. Feng Hsin Steel Co Ltd has a production capacity of 2.8 million tons of steel products per year.

– Bengang Steel Plates Co Ltd ($SZSE:000761)

Bengang Steel Plates Co Ltd is a leading steel producer in China with a market cap of 12.33B as of 2022. The company has a Return on Equity of 5.86%. Bengang Steel Plates Co Ltd produces a variety of steel products including plates, coils, sheets, and pipes. The company is vertically integrated and has a diversified customer base.

Summary

Schnitzer Steel Industries is an American metal recycling and manufacturing company. Analysts have been showing a bullish sentiment towards SCHNITZER, as Shell Asset Management Co. recently trimmed its stake in the company. This could be seen as a sign of confidence in the long-term prospects of the firm. Other notable investors have also continued to show faith in SCHNITZER, indicating that the company may be a good investment opportunity. Analysts are optimistic about the company’s ability to grow and accumulate more revenue in the coming months.

The company has seen an increase in sales, suggesting that it is in a good position to increase its profits and expand its operations. With its strong balance sheet, its potential for future growth looks promising. Investors have been encouraged to keep an eye on SCHNITZER going forward as it could present a good investment opportunity.

Recent Posts