Rh Intrinsic Value – Investors Uncover a ‘Diamond in the Rough’ with RH: An Attractive Long-Term Opportunity

June 14, 2023

☀️Trending News

Investors have recently discovered a perceived ‘diamond in the rough’ in RH ($NYSE:RH), often referred to as RH. The stock has recently been trading at a lower price than its market peers, leading many investors to believe that it is undervalued and an attractive long-term investment opportunity. At first glance, RH might not seem like an ideal investment.

However, if investors take an in-depth look at the company’s fundamentals, they will uncover a diamond buried underneath the coarse exterior. RH’s financials appear to be in good health with steady revenue growth and moderate expenses. The company also has strong brand recognition and an impressive track record of transforming customer experiences. Overall, investors appear to be optimistic about RH’s future prospects. They believe that the company is poised to take advantage of the current market conditions and generate substantial returns in the long run. Investors are encouraged to look beyond the short-term volatility of RH’s stock price and focus on the company’s long-term potential.

Market Price

On Monday, RH (formerly known as Restoration Hardware) stock opened at $265.0 and closed at $269.6, giving it a 2.0% increase from its prior closing price of 264.3. RH has continued to demonstrate strong financial performance over the last few years, with its revenue and profitability increasing year over year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rh. rh&utm_title=Investors_Uncover_a_Diamond_in_the_Rough_with_RH_An_Attractive_Long-Term_Opportunity”>More…

| Total Revenues | Net Income | Net Margin |

| 3.37k | 369.82 | 11.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rh. rh&utm_title=Investors_Uncover_a_Diamond_in_the_Rough_with_RH_An_Attractive_Long-Term_Opportunity”>More…

| Operations | Investing | Financing |

| 354.48 | -207.91 | -871.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rh. rh&utm_title=Investors_Uncover_a_Diamond_in_the_Rough_with_RH_An_Attractive_Long-Term_Opportunity”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.32k | 4.48k | 35.59 |

Key Ratios Snapshot

Some of the financial key ratios for Rh are shown below. rh&utm_title=Investors_Uncover_a_Diamond_in_the_Rough_with_RH_An_Attractive_Long-Term_Opportunity”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 23.2% | 18.7% |

| FCF Margin | ROE | ROA |

| 5.2% | 50.2% | 7.4% |

Analysis – Rh Intrinsic Value

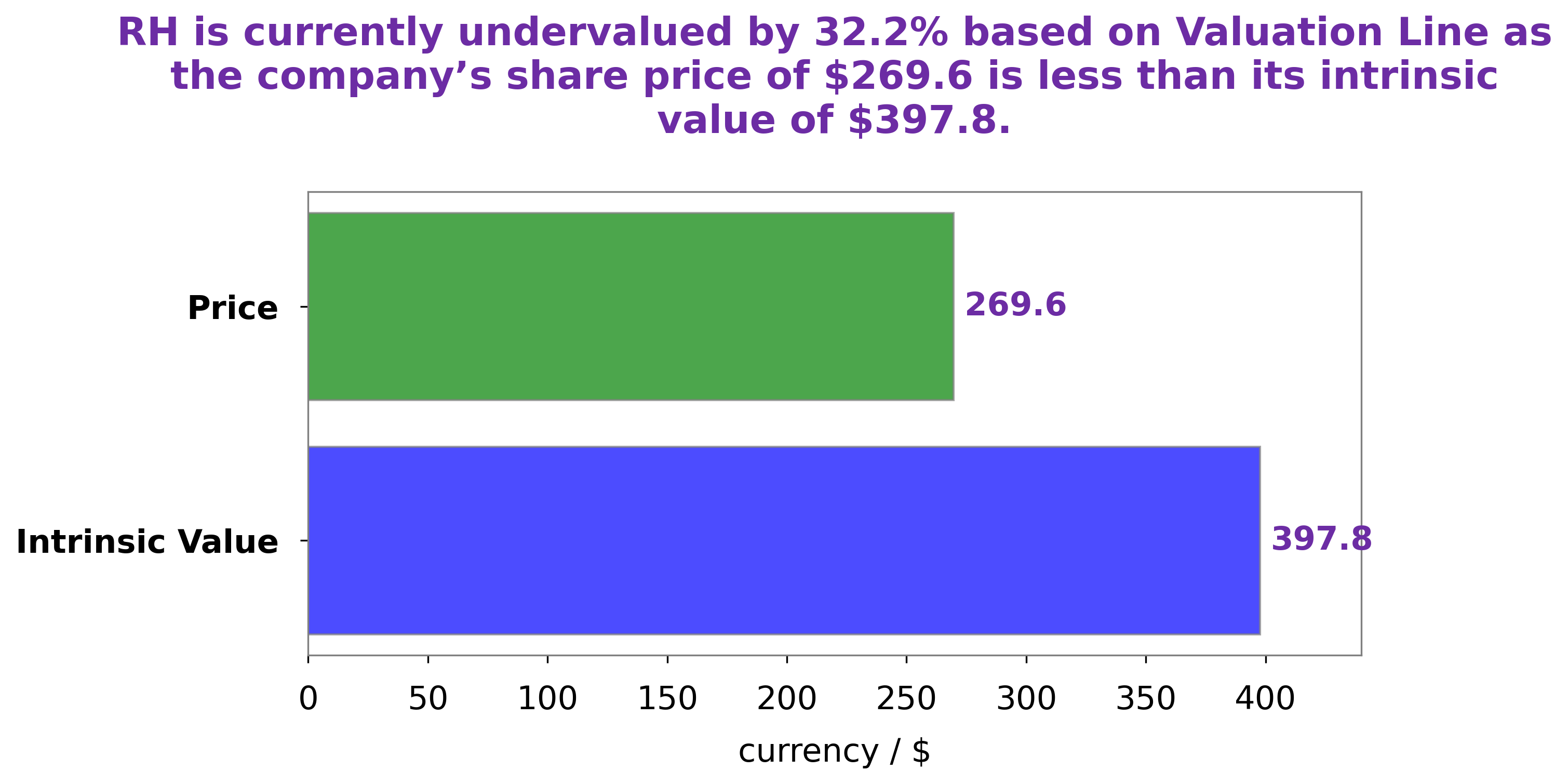

GoodWhale has conducted an analysis of RH‘s fundamentals to evaluate its intrinsic value. Based on our proprietary Valuation Line methodology, we have determined that the intrinsic value of RH shares is around $397.8. Currently, RH is trading at $269.6, which implies that it is currently undervalued by 32.2%. This represents a great opportunity for investors to get into a quality company at a discounted price. More…

Peers

Furnishing a home can be a daunting task, but with the help of a reliable home décor company, it can be a fun and exciting experience.

However, RH is not the only home décor company out there. Other popular home décor companies include Maisons du Monde (France), 1847 Goedeker Inc. (USA), and BHG Group AB (Sweden).

– Maisons du Monde France SA ($BER:ZMM)

As of 2022, Maisons du Monde France SA has a market cap of 484.17M and a Return on Equity of 9.35%. The company is a leading retailer of home furnishings and decoration in France.

– 1847 Goedeker Inc ($NYSEAM:GOED)

BHG Group AB, through its subsidiaries, provides services in the areas of healthcare, education, and social services in Sweden. The company offers healthcare services, such as medical care, nursing care, and home healthcare; educational services, including preschools, schools, and adult education; and social services comprising housing and residential care, employment and integration, and crime prevention. As of 2022, the company had a market cap of 2.87B and a ROE of 0.01%.

Summary

Investing in RH (formerly Restoration Hardware) can be a sound long-term option, as it offers a diamond in the rough. Analysts point to the company’s various lines of products and ongoing capital investments as reasons for positive growth. The company has also increased its online presence, which has allowed it to grow customer loyalty and reach a much wider audience.

Additionally, RH has seen success in the introduction of new products such as the RH Modern line, which further reinforces their expansion. With an increase in new markets, a larger customer base, and a multitude of offerings, RH appears poised for continued growth and success in the long run.

Recent Posts