Peloton Interactive Stock Fair Value Calculator – PELOTON INTERACTIVE: Not Worth the Investment According to Experienced Investor

April 18, 2023

Trending News 🌧️

Peloton Interactive ($NASDAQ:PTON) has been the talk of the town lately, with investors eagerly trying to get their hands on a piece of the stock.

However, an experienced investor recently stated that he would not recommend investing in Peloton Interactive, claiming that if he had owned it, he would have sold it. This has caused some concern among potential buyers, who are now wary of putting their money into the company. Peloton Interactive is a fitness technology company that specializes in connected and interactive home fitness equipment. They offer a variety of products, such as treadmills, stationary bikes, and strength equipment, along with digital services such as subscription-based video classes and streaming content. Their goal is to give users a full-body workout in the comfort of their own home. Despite their wide appeal and innovative products, the investor who spoke out against Peloton Interactive claims that the stock is simply not worth the investment. He argues that although the company is performing well right now, it is not sustainable in the long-term, and thus he would not recommend investing in it. He also believes that there are better investments out there that will yield more returns on investment. Although his opinion is not shared by everyone, it is certainly something to consider before investing in Peloton Interactive. With so many other companies competing in the fitness technology space, it may be wise to look into other options before putting your hard-earned money into a stock with uncertain results.

Price History

On Monday, Peloton Interactive stock opened at $9.5 and closed at $9.8, up by 2.0% from its prior closing price of $9.6. Despite this small increase, one experienced investor has deemed that investing in Peloton Interactive is not worth the risk. This investor believes that the potential reward is not high enough to justify the risk of loss that comes with investing in Peloton Interactive. Therefore, they recommend that potential investors look elsewhere for more reliable and lucrative opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Peloton Interactive. More…

| Total Revenues | Net Income | Net Margin |

| 3.05k | -2.76k | -63.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Peloton Interactive. More…

| Operations | Investing | Financing |

| -1.3k | -195.8 | 755.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Peloton Interactive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.3k | 3.27k | 0.09 |

Key Ratios Snapshot

Some of the financial key ratios for Peloton Interactive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.2% | – | -87.5% |

| FCF Margin | ROE | ROA |

| -49.1% | -1155.1% | -50.6% |

Analysis – Peloton Interactive Stock Fair Value Calculator

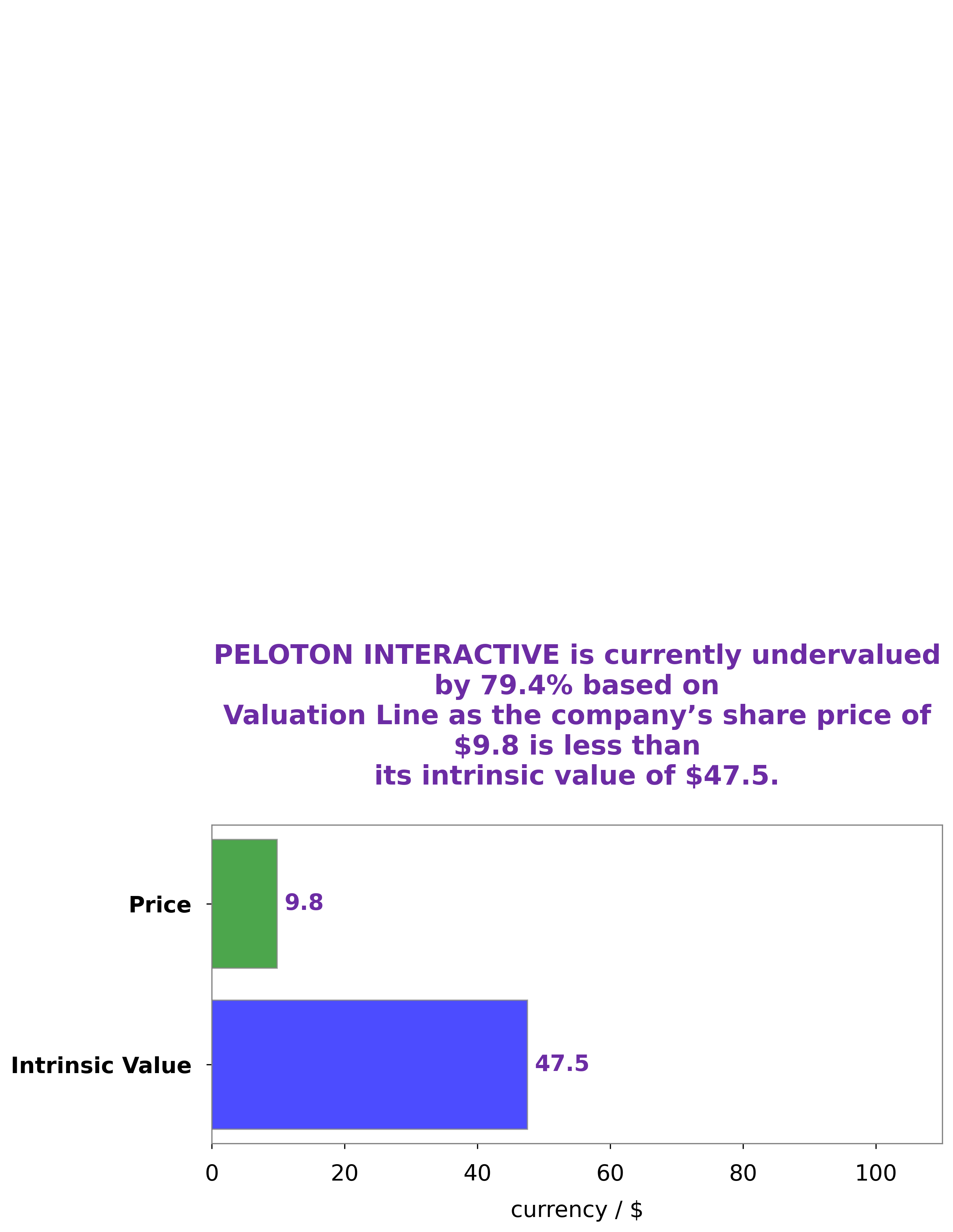

At GoodWhale, we have evaluated the wellbeing of PELOTON INTERACTIVE, and come to the conclusion that their stock is significantly undervalued. Our proprietary Valuation Line estimates the intrinsic value of PELOTON INTERACTIVE share to be around $47.5. In comparison, the stock is currently traded at only $9.8, which is a 79.4% undervaluation. This presents a great opportunity for potential investors who are willing to take the risk associated with investing in an undervalued stock. More…

Peers

Peloton Interactive Inc is a company that designs, manufactures, and sells fitness products. The company’s products include a line of fitness equipment, such as treadmills, stationary bicycles, and rowing machines, as well as a line of fitness apparel and accessories. Peloton Interactive Inc has a number of competitors, including City Sports and Recreation PCL, Lindblad Expeditions Holdings Inc, and Vista Outdoor Inc.

– City Sports And Recreation PCL ($SET:CSR)

City Sports And Recreation PCL is a publicly traded company with a market capitalization of 1.32 billion as of 2022. The company has a return on equity of 1.21%. City Sports And Recreation PCL is engaged in the business of providing sports and recreation facilities and services. The company operates in Thailand and has a network of sport and recreation facilities that includes swimming pools, fitness centers, and tennis courts.

– Lindblad Expeditions Holdings Inc ($NASDAQ:LIND)

Lindblad Expeditions Holdings Inc is a global provider of expedition cruises and adventure travel experiences. The company operates a fleet of purpose-built expedition ships and offers itineraries to destinations in Antarctica, the Arctic, Galápagos, Alaska, the South Pacific, Europe, and South America.

Lindblad Expeditions Holdings Inc has a market cap of 390.55M as of 2022. The company has a strong ROE of 95.66%, indicating that it is efficient in generating profits for shareholders. Lindblad Expeditions Holdings Inc is a great company for investors looking to profit from the growth of the expedition cruise industry.

– Vista Outdoor Inc ($NYSE:VSTO)

Vista Outdoor Inc is a publicly traded company with a market capitalization of 1.49 billion as of 2022. The company has a return on equity of 35.55%. Vista Outdoor is engaged in the design, manufacture and marketing of consumer products in the outdoor sports and recreation markets. The company’s product portfolio includes firearms, ammunition, archery, fishing, hunting, and camping products.

Summary

Peloton Interactive is a leading interactive fitness company that has seen considerable growth in recent years. The company produces a variety of at-home fitness technology, including its flagship product, the Peloton Bike. For investors, Peloton is an attractive option due to its innovative product range and its strong financial performance.

Analysts view the company’s long-term prospects favorably, citing the increasing popularity of at-home fitness technology and the company’s ability to target new markets. Key factors to consider when analyzing the company include its financial performance, competitive landscape, and potential catalysts for future growth.

Recent Posts