Peabody Energy Stock Intrinsic Value – Elliott Investment Management Exits Position in Peabody Energy Co. Stock with 489,643 Share Sale

November 21, 2023

☀️Trending News

Peabody Energy ($NYSE:BTU) Corporation is one of the world’s largest publicly-traded coal companies and a leader in clean coal solutions. The company provides energy solutions to customers worldwide, and is working to reduce emissions through advanced technologies, including carbon capture, utilization and storage. Its portfolio includes metallurgical, thermal and coking coal from mines located throughout the world. Peabody Energy also engages in trading, logistics and other activities related to the coal industry.

Stock Price

The stock opened at $23.8 and closed at $23.5, representing a 1.3% drop from the previous closing price of $23.8. Despite the recent sale of shares by Elliott Investment Management, Peabody Energy Co. remains one of the leading coal producers in the world and is continuing to innovate in the industry with new technologies and practices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Peabody Energy. More…

| Total Revenues | Net Income | Net Margin |

| 5.34k | 1.2k | 23.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Peabody Energy. More…

| Operations | Investing | Financing |

| 1.42k | -264.4 | -925.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Peabody Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.72k | 2.21k | 26.04 |

Key Ratios Snapshot

Some of the financial key ratios for Peabody Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 83.7% | 28.3% |

| FCF Margin | ROE | ROA |

| 20.9% | 27.4% | 16.5% |

Analysis – Peabody Energy Stock Intrinsic Value

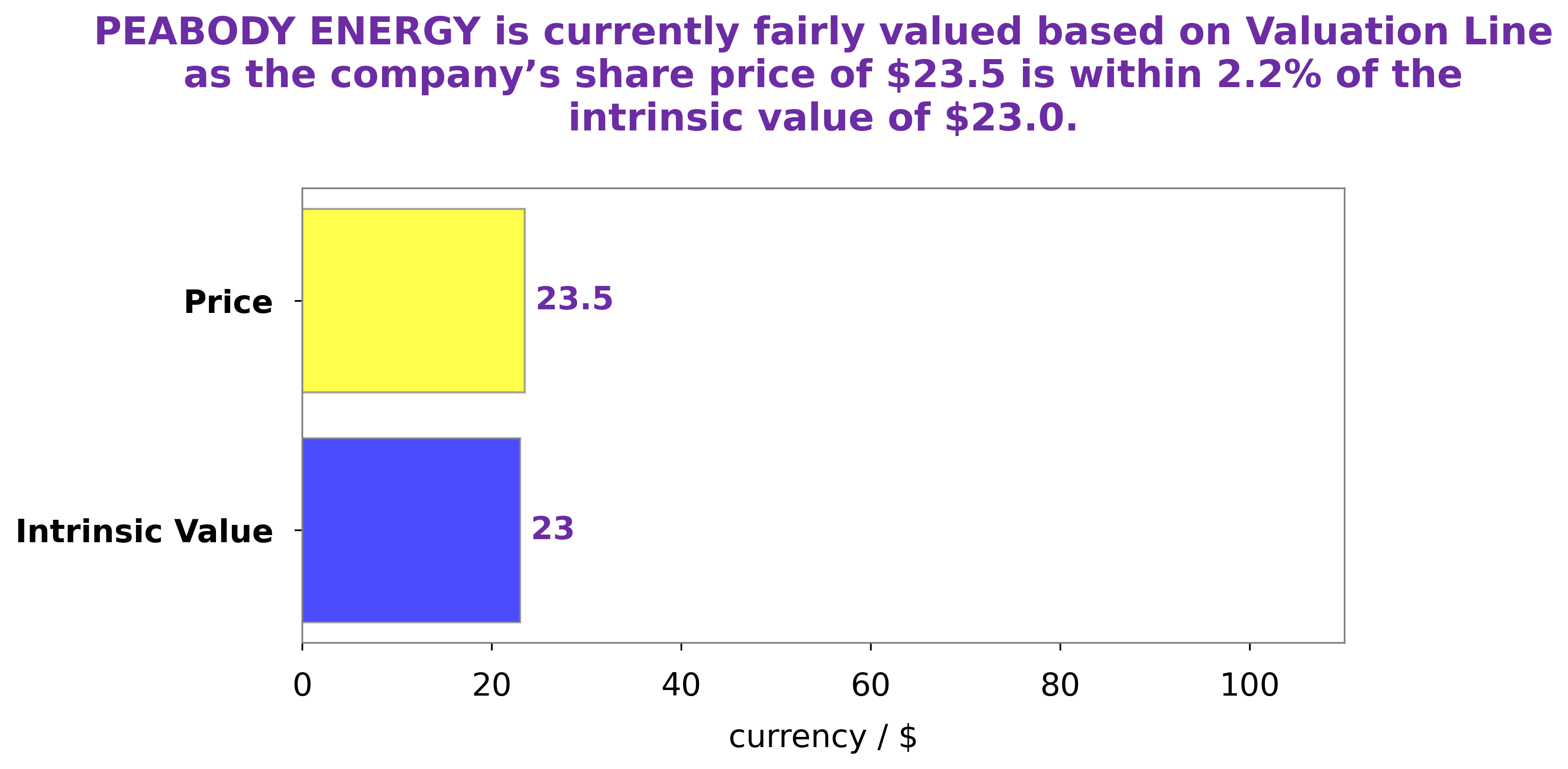

At GoodWhale, we have conducted an in-depth analysis of PEABODY ENERGY‘s fundamentals. Our proprietary Valuation Line has calculated the fair value of a PEABODY ENERGY share to be around $22.6. Currently, the stock is traded at a price of $23.5, slightly overvalued by 4.0%. This implies that investing in PEABODY ENERGY at the current price may not be a good option for long-term investors. More…

Peers

In the coal industry, there is stiff competition among the top companies. Peabody Energy Corp, Alliance Resource Partners LP, CONSOL Energy Inc, and Arch Resources Inc are all vying for a piece of the pie. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which company they want to support.

– Alliance Resource Partners LP ($NASDAQ:ARLP)

Alliance Resource Partners LP is a leading producer and marketer of coal in the United States. The company has a market cap of $3.06 billion and a return on equity of 19.31%. Alliance Resource Partners LP is engaged in the business of mining, processing and selling coal to electric utilities and metallurgical coal customers. The company operates mines in Illinois, Indiana, Kentucky, Maryland, Pennsylvania, Virginia and West Virginia.

– CONSOL Energy Inc ($NYSE:CEIX)

CONSOL Energy Inc. is a coal and natural gas company. It has a market cap of 2.2B as of 2022 and a ROE of 40.18%. The company has a diversified portfolio of high-quality assets including the Marcellus Shale, the Utica Shale, the Barnett Shale, and the Appalachian Basin. The company is committed to providing safe and reliable energy to its customers and is one of the largest producers of both coal and natural gas in the United States.

– Arch Resources Inc ($NYSE:ARCH)

Arch Resources, Inc. operates as a metallurgical coal and thermal coal producer for the steel and power generation industries. It owns and operates coal mines in Wyoming, Colorado, West Virginia, Kentucky, Virginia, and Illinois. As of December 31, 2020, the company had estimated recoverable reserves of 1.1 billion tons of coal. Arch Resources, Inc. was founded in 1969 and is headquartered in St. Louis, Missouri.

Summary

Analysts suggest that investors should be cautious when considering investing in Peabody Energy Co. due to the fluctuating coal industry. The coal industry is heavily reliant on technological advances, governmental regulation changes, and prices of natural gas and alternative energy sources.

Recent Posts