Par Pacific Stock Fair Value Calculation – Par Pacific Holdings, (PARR): Why Investors are Taking Notice Now

April 2, 2023

Trending News 🌥️

Par Pacific ($NYSE:PARR) Holdings, Inc. (PARR) is a publicly-traded energy and logistics company that has been on investors’ radars for a while now. With its strong presence in the mid- and downstream segments of the energy market and its diverse portfolio of assets, PARR is an attractive option for investors looking to diversify their portfolios. The company operates throughout the United States and Hawaii, and is a major player in the wholesale distribution and retail sale of petroleum products. It also owns and operates oil refineries and storage facilities, as well as pipeline systems, tankers, and terminals. These assets make Par Pacific a major participant in the mid- and downstream energy markets. In addition to its energy business, Par Pacific is also involved in logistics operations and the marketing of agricultural products. This adds to the company’s diversified portfolio and gives investors a way to hedge against price volatility and potential losses associated with energy commodities. The company has been growing rapidly and is expected to continue its growth trajectory in the coming years. In recent years, Par Pacific has made strategic acquisitions that have further expanded its operations and bolstered its balance sheet.

Additionally, the company has made investments in renewable energy infrastructure technology and developed strategic partnerships with leading energy companies, further increasing its appeal to investors. Overall, Par Pacific Holdings is an attractive option for investors looking for a diversified portfolio.

Price History

Par Pacific Holdings, Inc. (PARR) is a publicly-traded company that has recently been garnering the attention of investors. On Wednesday, PARR stock opened at $29.6 and closed at $29.2, down slightly by 0.4% from its prior closing price of 29.3. This minor decline has demonstrated some investors’ hesitance to make any major moves in the stock.

PARR has also been able to weather market volatility better than some of its competitors, giving investors reason to believe the company will perform well over the long term. Despite the current uncertainty, investors are taking notice of PARR and remain optimistic about its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Par Pacific. More…

| Total Revenues | Net Income | Net Margin |

| 7.32k | 364.19 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Par Pacific. More…

| Operations | Investing | Financing |

| 452.61 | -87.31 | 13.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Par Pacific. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.28k | 2.64k | 10.66 |

Key Ratios Snapshot

Some of the financial key ratios for Par Pacific are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 42.5% | 5.9% |

| FCF Margin | ROE | ROA |

| 5.5% | 45.4% | 8.3% |

Analysis – Par Pacific Stock Fair Value Calculation

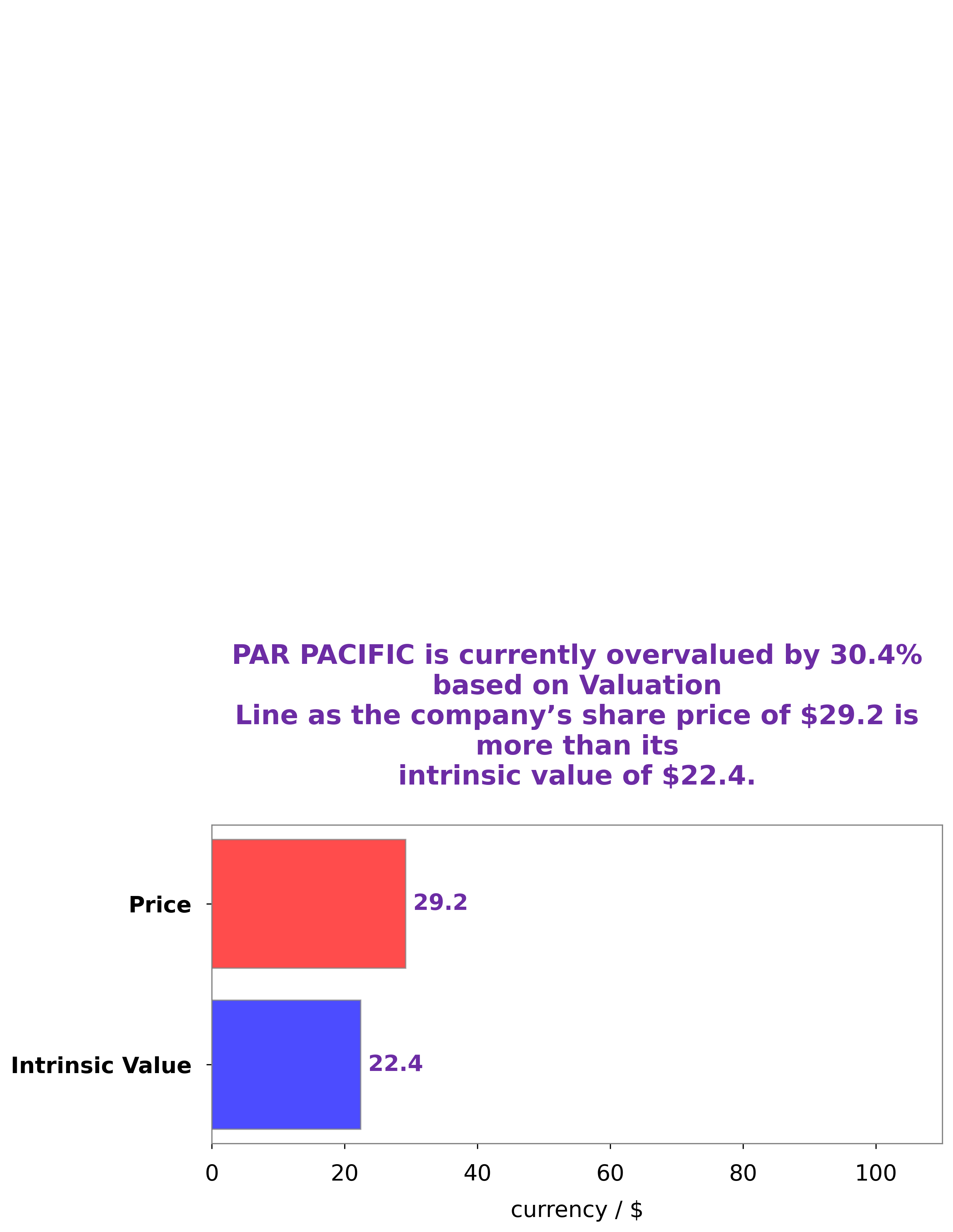

At GoodWhale, we have conducted an analysis of PAR PACIFIC‘s financials. Our proprietary Valuation Line indicates that the intrinsic value of PAR PACIFIC shares is around $22.4. However, PAR PACIFIC stock is currently trading at $29.2, representing an overvaluation of 30.4%. More…

Peers

The competition among Par Pacific Holdings Inc and its competitors is fierce. CVR Energy Inc, HF Sinclair Corp, and PBF Energy Inc are all major players in the petroleum refining industry, and each company is striving to gain market share. The company’s innovative approach to refining has allowed it to quickly gain market share and become a major competitor.

– CVR Energy Inc ($NYSE:CVI)

CVR Energy Inc. is a petroleum refining and marketing company. It owns and operates two petroleum refineries in the United States. CVR Energy’s operations are conducted through its subsidiaries, CVR refining LP and CVR Partners LP. The company was founded in 2008 and is headquartered in Sugar Land, Texas.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcast Group, Inc. is one of the largest and most diversified television broadcasting companies in the country. The company owns, operates and/or provides services to more than 190 television stations in 89 markets. Sinclair is the leading local news provider in the country, as well as a producer of sports content. Sinclair’s content is delivered via multiple-platforms, including over-the-air, multi-channel video program distributors, and digital platforms. The company also owns and operates the Tennis Channel and the Ring of Honor professional wrestling promotion.

– PBF Energy Inc ($NYSE:PBF)

PBF Energy Inc is an American oil refining and marketing company. The company owns and operates oil refineries in the United States. PBF Energy Inc has a market cap of 5.73B as of 2022 and a Return on Equity of 52.76%. The company’s primary business is the refining of crude oil into petroleum products. PBF Energy Inc also owns and operates a petrochemical plant in Delaware City, Delaware.

Summary

PAR Pacific Holdings, Inc. (PARR) is a Houston-based energy company with a focus on acquiring and developing strategic energy assets in the United States. Recently, the company has been gaining investor attention due to its strong financial performance and strategic investments in refining and retailing operations. The company has also seen positive analyst ratings, with several firms giving it an ‘Outperform’ rating. All of these factors make PAR Pacific an attractive investment opportunity for those interested in energy stocks.

Recent Posts