Pagseguro Digital Stock Fair Value Calculation – PagSeguro Digital Sees Positive Trends Despite Brazil’s Interest Rate Slowdown in Q3

November 21, 2023

☀️Trending News

PAGSEGURO ($NYSE:PAGS): It is the leader in online payments in Brazil and Latin America, helping to facilitate digital transactions for consumers and businesses. This decrease caused a slowdown in economic activity, and many companies suffered during this time.

However, PagSeguro was able to continue to show positive trends due to its focus on digital transactions. These numbers show that PagSeguro is continuing to attract more customers despite the slower economic environment. In addition to its impressive transaction growth, PagSeguro also reported strong growth in its payment volume. This shows that PagSeguro is continuing to gain traction with its customers, and that more people are using the platform for their digital transactions. The company’s focus on digital transactions and its strong growth in both customers and payment volume bode well for its future success.

Market Price

The stock opened at $9.1 and closed at $9.3, up by 2.8% from the previous closing price. The positive trend in the stock performance was a result of a strong performance in recently released earnings and other financial figures. Analysts also cited the company’s strong fundamentals, with revenue growth and profitability continuing to increase year over year.

This has resulted in the company’s stock rising steadily over the past few months. With a strong outlook for the future, PagSeguro is expecting even more positive trends in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pagseguro Digital. More…

| Total Revenues | Net Income | Net Margin |

| 8.91k | 1.54k | 17.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pagseguro Digital. More…

| Operations | Investing | Financing |

| 3.89k | -2.04k | -1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pagseguro Digital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.84k | 30.31k | 38.63 |

Key Ratios Snapshot

Some of the financial key ratios for Pagseguro Digital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.7% | – | 58.4% |

| FCF Margin | ROE | ROA |

| 23.3% | 26.3% | 7.6% |

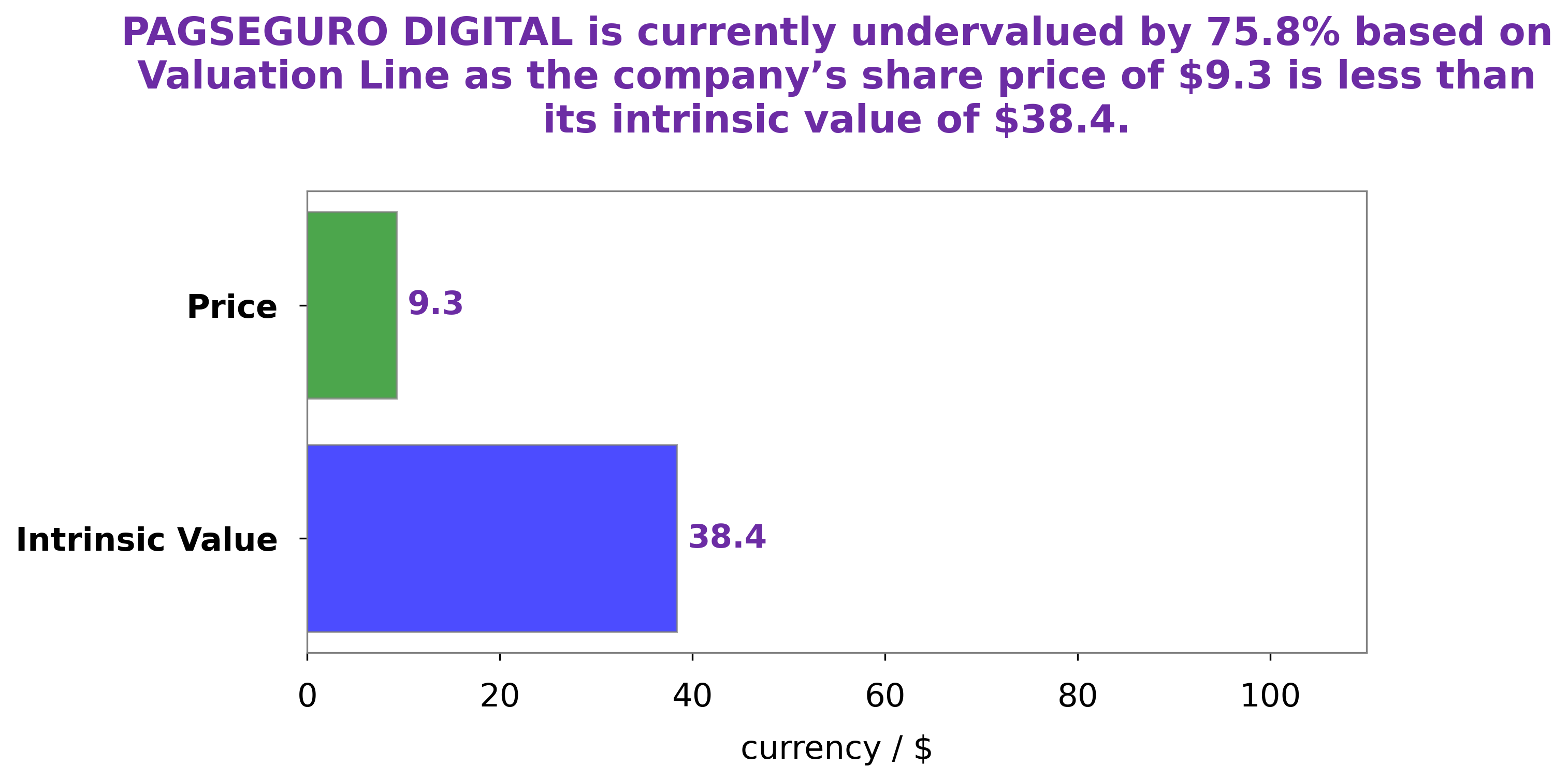

Analysis – Pagseguro Digital Stock Fair Value Calculation

GoodWhale has conducted an analysis of PAGSEGURO DIGITAL‘s financials, and have determined the intrinsic value of its share is around $38.4, calculated using our proprietary Valuation Line. This means that the current market value of PAGSEGURO DIGITAL stock at $9.3 greatly underestimates the actual worth of the company, undervaluing it by 75.8%. Therefore, GoodWhale believes that this presents a great opportunity for investors to take advantage of this mispricing and purchase the stock at a significant discount. More…

Peers

PagSeguro Digital Ltd, One97 Communications Ltd, Getnet Adquirencia E Servicos Para Meios De Pagamento SA, and AGS Transact Technologies Ltd are all competing in the online payment processing industry. All four companies offer similar services, but PagSeguro Digital Ltd has a distinct advantage because it is the only Brazilian company in the group. This gives PagSeguro Digital Ltd a first mover advantage in the Brazilian market and allows the company to better understand the needs of Brazilian customers.

– One97 Communications Ltd ($BSE:543396)

One97 Communications Ltd is a holding company that engages in the provision of digital entertainment services. It operates through the following segments: Digital Entertainment and Others. The Digital Entertainment segment offers online content and services such as music, videos, games, and news. The Others segment includes sale of mobile handsets and accessories, and other value-added services. The company was founded by Vijay Shekhar Sharma in 2000 and is headquartered in Noida, India.

– Getnet Adquirencia E Servicos Para Meios De Pagamento SA ($NASDAQ:GET)

Getnet Adquirencia e Servicos para Meios de Pagamento SA is a Brazil-based company engaged in the provision of payment solutions. The Company offers services in the areas of electronic commerce, m-commerce, point of sale (POS) and others. It also provides solutions for the management and control of expenses, such as virtual cards, corporate cards and prepaid cards. The Company operates through three segments: Merchant Acquiring, which includes the activities of contracting and providing technological solutions that enable acceptance of electronic payments in physical stores; e-Commerce, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments in online stores; and Financial Institution, which includes the contracting and providing of technological solutions that enable the acceptance of electronic payments by financial institutions.

– AGS Transact Technologies Ltd ($BSE:543451)

Transact Technologies Ltd is a global provider of integrated payment solutions. The company’s products and services include point-of-sale systems, payment processing services, and software solutions. Transact Technologies Ltd has a market cap of 9.88B as of 2022 and a Return on Equity of 20.68%. The company’s products and services are used by merchants of all sizes, from small businesses to large enterprises. Transact Technologies Ltd is headquartered in New York, New York.

Summary

PagSeguro Digital is a Brazilian financial services company that provides digital payment solutions. These trends show that PagSeguro is well-positioned to succeed in a difficult economic climate. The company’s strong financial performance is attributed to its focus on improving customer service and expanding its product offerings for both merchants and consumers. Furthermore, PagSeguro’s investment in digital technologies such as artificial intelligence and machine learning has allowed it to gain a competitive edge in the market.

Recent Posts