OMI Stock Fair Value Calculation – Owens & Minor Price Target Lowered to $19.00

November 21, 2023

🌧️Trending News

Owens & Minor ($NYSE:OMI) Inc. is a global healthcare solutions company that serves hospitals, integrated delivery networks, alternate care sites, physician offices and more. It has a long-standing presence in the healthcare supply chain and provides solutions from product sourcing to logistics. Although, analysts still maintain their Outperform rating for the company’s shares.

Market Price

This caused the stock to open at $18.6 and close at $19.0, a 1.3% increase from the prior closing price of $18.8. This was due to analysts changing their outlook on the company and its stock. While the stock closed at a higher price than the target, the lower price target suggests that investors should be cautious in investing in this stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OMI. More…

| Total Revenues | Net Income | Net Margin |

| 10.23k | -117.08 | -0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OMI. More…

| Operations | Investing | Financing |

| 715.91 | -131.11 | -429.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OMI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.12k | 4.24k | 11.59 |

Key Ratios Snapshot

Some of the financial key ratios for OMI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | -16.9% | -0.1% |

| FCF Margin | ROE | ROA |

| 5.0% | -0.6% | -0.1% |

Analysis – OMI Stock Fair Value Calculation

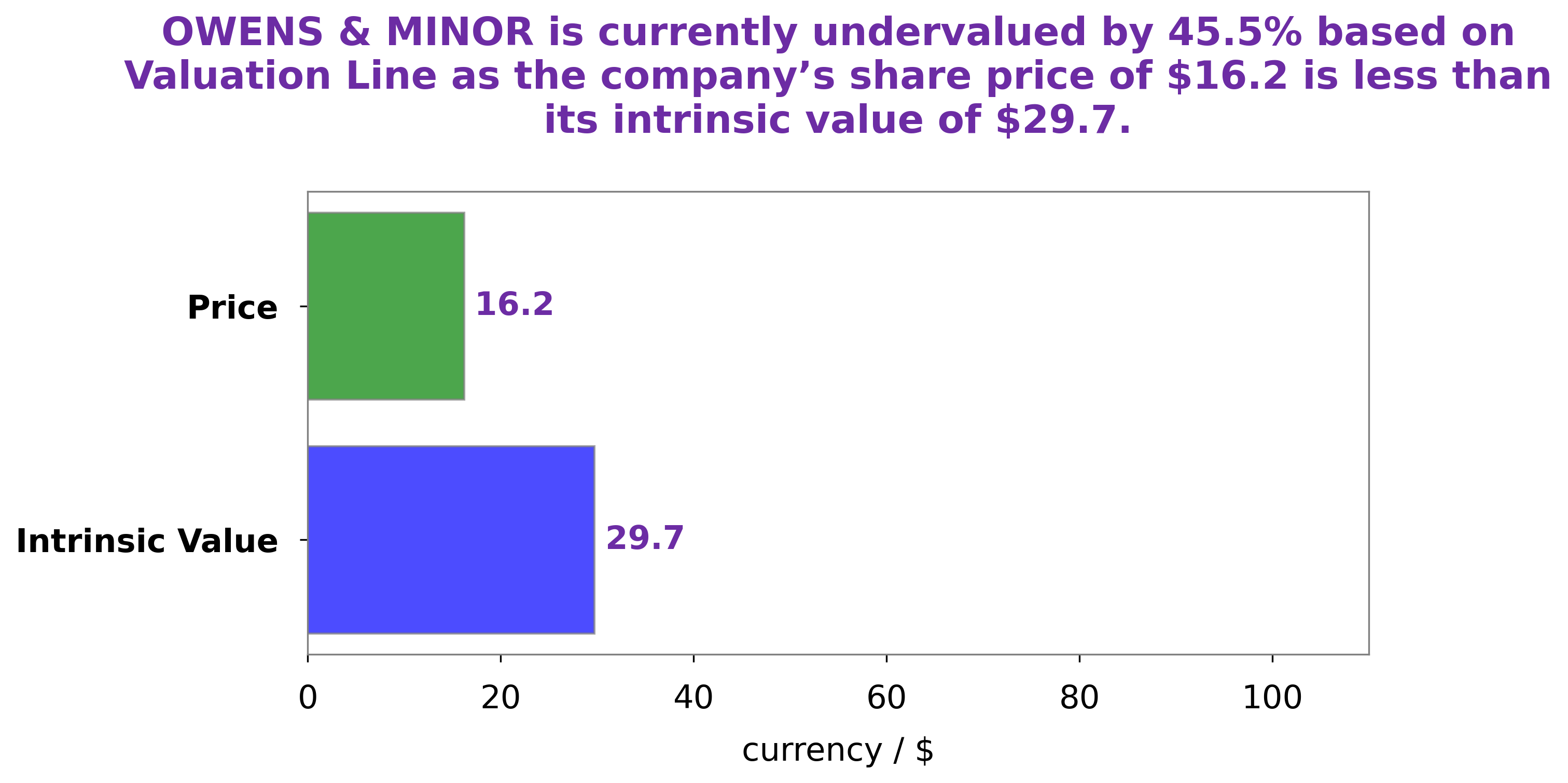

GoodWhale has conducted an analysis of OWENS & MINOR’s wellbeing. Our proprietary Valuation Line shows that the fair value of OWENS & MINOR share is around $30.6. However, the current market price of OWENS & MINOR is $19.0, which is significantly lower. This implies that the stock is currently undervalued by 37.8%. More…

Peers

Owens & Minor Inc is in the business of distributing medical supplies and providing related services to healthcare providers. The company operates in North America and Europe. Its competitors include Orthofix Medical Inc, Medirect Latino Inc, PT Millennium Pharmacon International Tbk.

– Orthofix Medical Inc ($NASDAQ:OFIX)

Orthofix Medical Inc is a medical device company that provides orthopedic solutions to patients worldwide. The company has a market cap of 297.51M as of 2022 and a Return on Equity of -4.8%. The company’s products are used in the treatment of various conditions, including osteoarthritis, degenerative disc disease, scoliosis, and deformities. The company’s products are sold through a network of distributors and retailers.

– Medirect Latino Inc ($OTCPK:MLTO)

PT Millennium Pharmacon International Tbk is a leading pharmaceutical company in Indonesia with a market cap of 156.7B as of 2022. The company has a strong focus on research and development, and has a strong portfolio of products. The company has a Return on Equity of 17.77%.

Summary

Owens & Minor is a healthcare-focused distribution services company. Owens & Minor has a strong presence in the US healthcare market, and this position may allow them to capitalize on the increasing demand for healthcare services and products. The company also has a diversified portfolio of services, which could help it weather any potential economic downturns. Furthermore, Owens & Minor’s supply chain capabilities provide them with an edge over their competitors.

With a robust balance sheet and financial position, Owens & Minor is well-positioned to capitalize on potential opportunities. Investors should watch for any positive news on the company and look to gain exposure at an attractive price.

Recent Posts