Olaplex Holdings Stock Intrinsic Value – Olaplex Holdings Sees Stock Drop Despite Room for Improvement in Value

April 20, 2023

Trending News 🌧️

Olaplex Holdings ($NASDAQ:OLPX) Inc. saw its stock price drop on Tuesday, as the company closed the day trading at $3.91, a decrease of 2.98% from its previous closing price of $4.03. Despite this drop, there is still potential room for improvement in the company’s value. Olaplex Holdings Inc. is a technology-based healthcare company that develops and manufactures products that enable healthcare professionals to diagnose and treat diseases. The company is known for its innovative approaches to tackling problems related to accuracy and efficiency of diagnostics, as well as identifying new treatments and therapies for illnesses.

However, it is still too early to determine if there are still ways for Olaplex Holdings Inc. to increase its value. Investors should wait for more clarity before making any decisions about investing in the company’s stock.

Stock Price

Tuesday saw a decline in the stock of OLAPLEX HOLDINGS Inc., with the stock opening at $3.9 and closing at the same price, down 0.3% from the previous closing price of 3.9. Despite this decline, there is potential for improvement in the value of the stock as the company continues to develop and grow. OLAPLEX HOLDINGS Inc. has recently made several improvements that could benefit investors, such as investing in more efficient production processes and expanding their product line. The company has also seen an increase in their customer base, which could potentially lead to higher profits in the future.

Furthermore, OLAPLEX HOLDINGS Inc. has been involved in several philanthropic initiatives and partnerships, which could improve the company’s public image and, in turn, positively affect its stock value. With the company’s dedication to improving production efficiency and its commitment to giving back to the community, it is likely that the stock will increase in value over time. Therefore, investors should keep an eye on this company and consider investing in it if they are looking for long-term gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Olaplex Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 704.27 | 244.07 | 36.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Olaplex Holdings. More…

| Operations | Investing | Financing |

| 255.32 | -2.68 | -116.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Olaplex Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.7k | 916.72 | 1.2 |

Key Ratios Snapshot

Some of the financial key ratios for Olaplex Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 68.1% | 82.6% | 49.2% |

| FCF Margin | ROE | ROA |

| 35.9% | 28.4% | 12.8% |

Analysis – Olaplex Holdings Stock Intrinsic Value

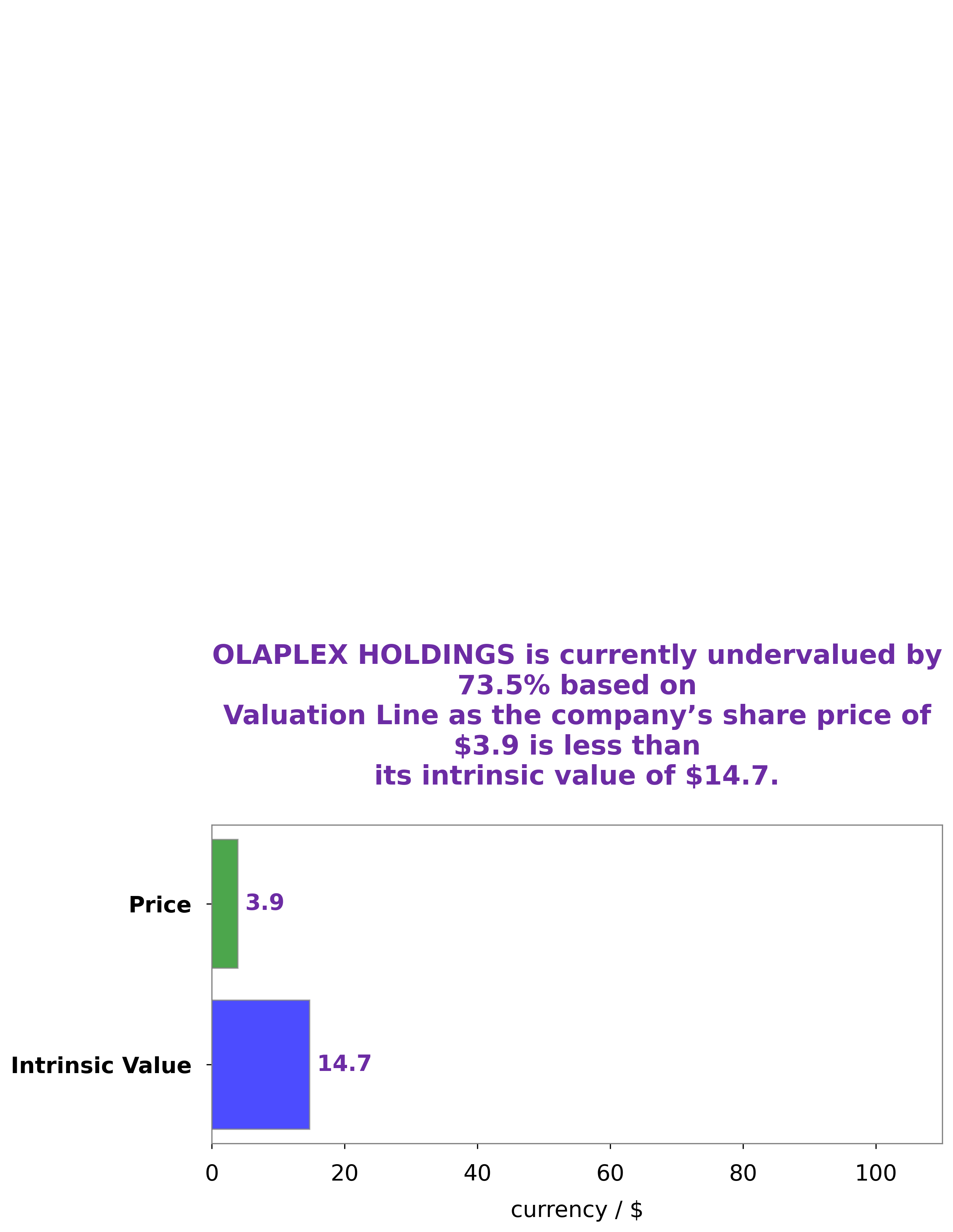

At GoodWhale, we have carried out an analysis of the fundamentals of OLAPLEX HOLDINGS. Our proprietary Valuation Line indicates that the intrinsic value of OLAPLEX HOLDINGS share is around $14.7. However, the stock is currently trading at $3.9 – this represents a huge 73.5% discount to its intrinsic value. Given this discrepancy, we believe that OLAPLEX HOLDINGS is a good opportunity for investors who want to purchase undervalued stocks. More…

Peers

The market for hair care products has seen intense competition in recent years, with Olaplex Holdings Inc emerging as a major player. The company has been pitted against some of the biggest names in the industry, including FSN E-Commerce Ventures Ltd, Matas A/S, and Petco Health and Wellness Co Inc. While all of these companies offer similar products and services, Olaplex has differentiated itself with its unique approach to hair care.

– FSN E-Commerce Ventures Ltd ($BSE:543384)

FSN E-Commerce Ventures Ltd. is an online retailer that operates in the e-commerce industry. The company was founded in 2004 and is headquartered in Shenzhen, China. FSN E-Commerce Ventures Ltd. operates in three segments: Retail, Marketplace, and Advertising. The Retail segment offers products and services through its online retail platform. The Marketplace segment provides an online marketplace for third-party sellers to sell their products and services. The Advertising segment offers online advertising services. FSN E-Commerce Ventures Ltd. has a market cap of 542.98B as of 2022 and a Return on Equity of 4.81%.

– Matas A/S ($LTS:0QFA)

Matas A/S is a Danish retailer of health and beauty products with a market cap of 2.87B as of 2022. The company has a Return on Equity of 8.02%. Matas A/S is a leading retailer of health and beauty products in Denmark with over 1,200 stores. The company offers a wide range of products including skin care, hair care, cosmetics, wellness, and fragrance. Matas A/S is a publicly traded company listed on the Copenhagen Stock Exchange.

– Petco Health and Wellness Co Inc ($NASDAQ:WOOF)

Petco Health and Wellness Co Inc is a leading pet retailer with a market cap of 2.83B as of 2022 and a Return on Equity of 6.12%. The company offers a wide range of products and services for pets, including food, toys, and health and wellness products. Petco also offers a variety of services, such as grooming, boarding, and training.

Summary

Olaplex Holdings Inc. is an investment opportunity with potential for increased value. Despite closing the day at $3.91, down -2.98%, there may still be room for growth. Investors should await more clarity from the company before making any decisions on investing in this stock.

Olaplex Holdings Inc. could be a key player in the industry, but it is important that investors analyze the risks and potential rewards before investing. By looking at company filings, financial statements, and other publicly available information, investors can make an educated decision regarding Olaplex Holdings Inc.

Recent Posts