Norfolk Southern Intrinsic Value Calculator – NORFOLK SOUTHERN Reaches Agreement to Provide 3,300 BLET Members With Paid Sick Leave

May 20, 2023

Trending News 🌥️

Norfolk Southern ($NYSE:NSC) has reached an agreement to offer 3,300 members of the Brotherhood of Locomotive Engineers and Trainmen (BLET) paid sick leave. This significant moment marks a major victory for the employees of the nation’s fourth-largest railroad. Norfolk Southern is one of America’s premier transportation companies.

The new paid sick leave policy will enable members to take time off work for medical or other reasons without facing financial hardship. This follows a trend of improving employee welfare across the wider rail industry, with many other railroads agreeing to similar policies.

Market Price

In response to the news, NORFOLK SOUTHERN’s stock opened at $214.1 and closed at $216.2, up 0.6% from its prior closing price of $215.0. This serves as a positive sign of the company’s commitment to its employees during these difficult times. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Norfolk Southern. More…

| Total Revenues | Net Income | Net Margin |

| 12.96k | 3.03k | 26.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Norfolk Southern. More…

| Operations | Investing | Financing |

| 4.4k | -1.66k | -3.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Norfolk Southern. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 39.17k | 26.44k | 55.91 |

Key Ratios Snapshot

Some of the financial key ratios for Norfolk Southern are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | 5.9% | 34.8% |

| FCF Margin | ROE | ROA |

| 18.6% | 22.1% | 7.2% |

Analysis – Norfolk Southern Intrinsic Value Calculator

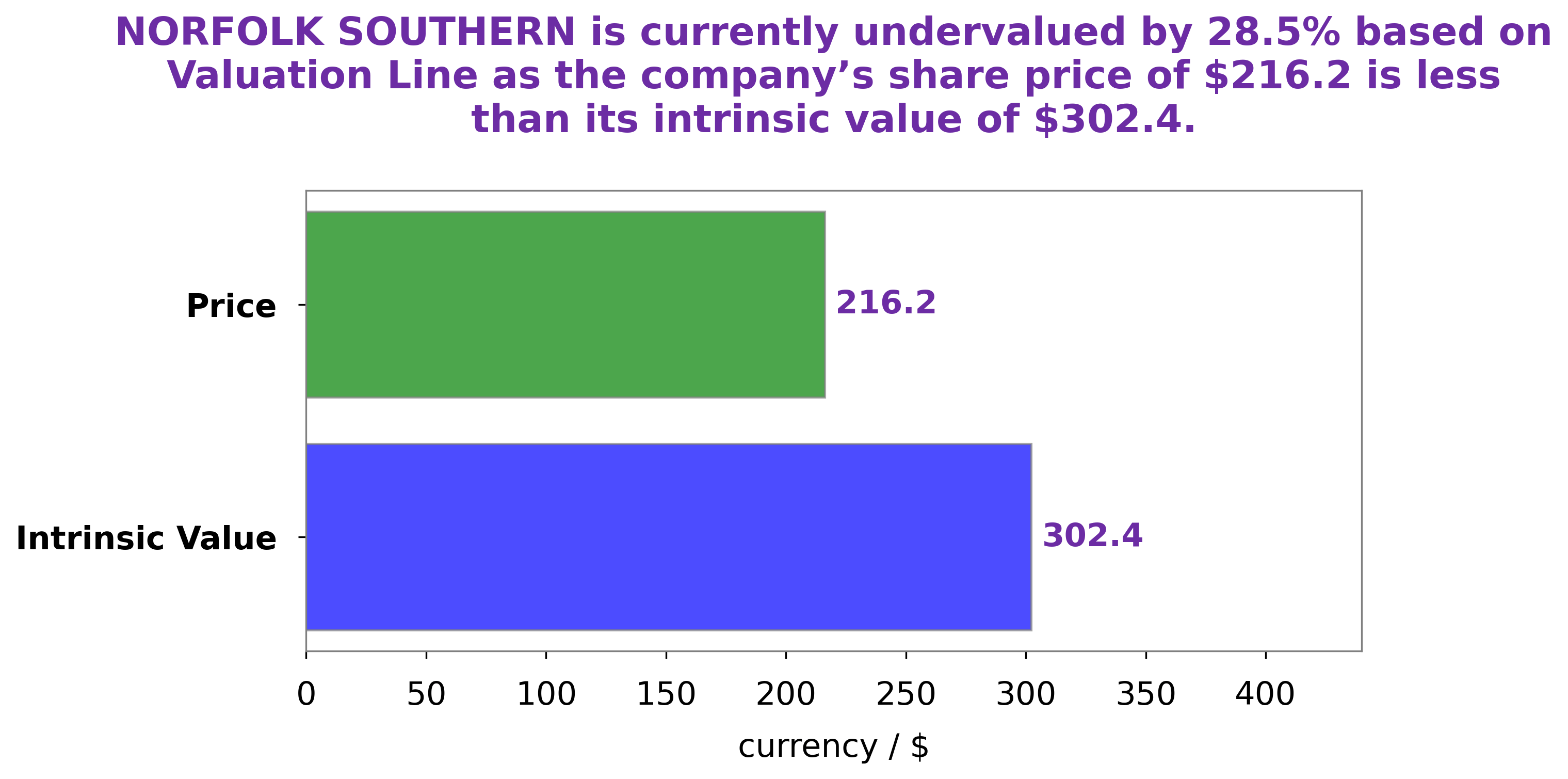

GoodWhale has conducted a thorough analysis of Norfolk Southern‘s financials. Our proprietary Valuation Line has determined that the intrinsic value of a NORFOLK SOUTHERN share is around $302.4. We find that the current trading price of the stock, $216.2, is undervalued by 28.5%. This presents an attractive opportunity for investors to capitalize on a potential upside. More…

Peers

Norfolk Southern Corp is a publicly traded company on the New York Stock Exchange under the ticker symbol NSC. The company’s headquarters are located in Norfolk, Virginia. Norfolk Southern is one of the largest railroads in the United States. The company operates 19,500 miles of track in 22 states and the District of Columbia. Norfolk Southern employs 28,000 people. The company was founded in 1838.

Norfolk Southern’s main competitors are CSX Corp, Westshore Terminals Investment Corp, Canadian Pacific Railway Ltd.

– CSX Corp ($NASDAQ:CSX)

CSX Corporation is an American publicly traded company that operates as a Class I railroad in the United States. The company’s operating revenues and net income have both grown in recent years, and its market capitalization reached nearly $60 billion by early 2021. The company’s strong financial performance is due in part to its focus on efficiency and cost-cutting measures.

– Westshore Terminals Investment Corp ($TSX:WTE)

Westshore Terminals Investment Corp is a Canadian company that owns and operates a coal terminal on the west coast of Canada. The company has a market cap of 1.56B as of 2022 and a Return on Equity of 13.29%. The company’s terminal is the largest coal export facility in North America and handles nearly 30% of all thermal coal exports from the United States.

– Canadian Pacific Railway Ltd ($TSX:CP)

As of 2022, Canadian Pacific Railway Ltd has a market cap of 90.72B and a Return on Equity of 6.42%. The company operates a transcontinental railway in Canada and the United States, connecting major cities such as Vancouver, Toronto, and Chicago. CP is known for its efficiency and service, and is a major player in the freight transportation industry.

Summary

Norfolk Southern has recently reached a deal with its Brotherhood of Locomotive Engineers and Trainmen (BLET) members to provide paid sick leave benefits. This deal follows the company’s commitment to invest in its employees, as they strive to maintain a successful and safe working environment. Approximately 3,300 BLET members will be eligible for the paid sick leave benefits, providing investors with assurance that Norfolk Southern is taking all necessary steps to protect employee welfare and maintain a productive workplace. The deal is expected to have a positive impact on the company’s financials, providing further incentive for potential investors to consider investing in the stock.

Recent Posts