MLCO Stock Intrinsic Value – 2023 Brokerage Consensus Recommends ‘Hold’ for Melco Resorts & Entertainment Limited.

March 29, 2023

Trending News ☀️

Melco Resorts & Entertainment ($NASDAQ:MLCO) Limited has recently received a consensus recommendation of “Hold” from brokerages for 2023. The Hong Kong-based entertainment and gaming company serves customers from all over the world with their integrated resorts, casino gaming, and online gaming products. The “Hold” recommendation from brokerages comes despite the company’s powerful presence in Asia, where it is one of the most profitable gaming companies. Melco has a well-performing portfolio of businesses in Macau, Singapore, the Philippines, and Cyprus. These four markets represent the company’s primary areas of focus, with the majority of its revenue coming from Macau. In the last few years, Melco has implemented various strategies to improve its performance.

They have launched new products and services in key locations, such as the City of Dreams Manila and Morpheus in Macau. They also continue to invest heavily in their online gaming platforms. These investments have helped to improve their financials and increase their customer base. Meanwhile, Melco shares have been relatively stable throughout the year, reflecting the company’s overall financial performance. In spite of this, brokerages still believe that the stock is overvalued at current levels and recommend that investors “Hold” on buying Melco shares until further market conditions become clearer in 2023.

Price History

An analysis of current media coverage of Melco Resorts & Entertainment Limited (MELCO) reveals mostly positive sentiment. On Monday, the stock opened at $12.0 and closed at $12.1, indicating a 0.9% increase from the prior closing price of $12.0. In light of this, analysts from various brokerages have released a consensus recommendation to ‘hold’ for MELCO stocks through 2023.

The call for a ‘hold’ implies that investors neither buy nor sell the stock, but rather maintain the same number of shares in their portfolio. Thus, it appears that analysts are forecasting a continued resilience of MELCO stocks in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MLCO. More…

| Total Revenues | Net Income | Net Margin |

| 1.35k | -930.53 | -69.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MLCO. More…

| Operations | Investing | Financing |

| -860.96 | -53.31 | 1.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MLCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.3k | 9.62k | -1.91 |

Key Ratios Snapshot

Some of the financial key ratios for MLCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -38.3% | 27.2% | -53.0% |

| FCF Margin | ROE | ROA |

| -76.7% | 58.9% | -4.8% |

Analysis – MLCO Stock Intrinsic Value

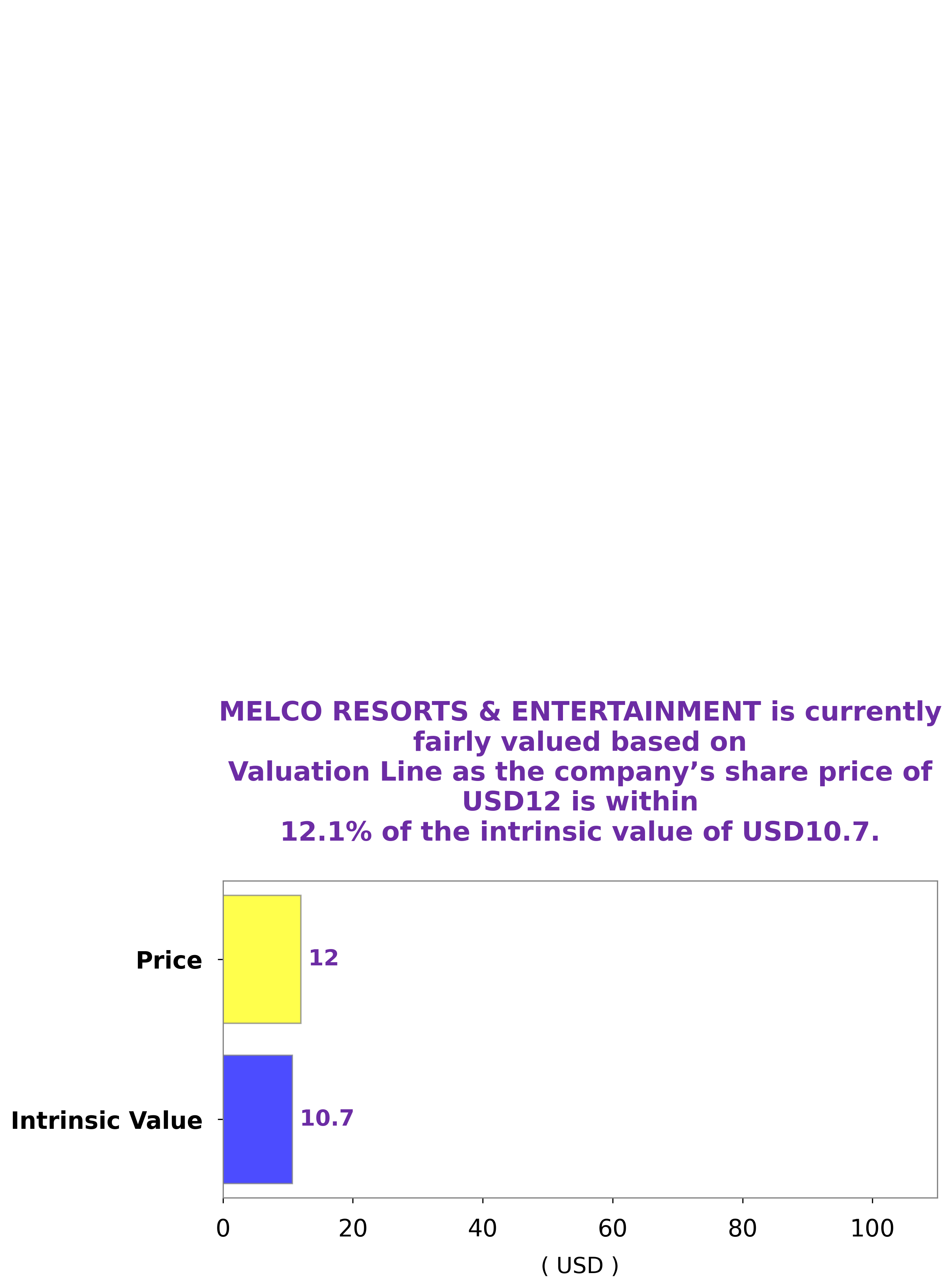

At GoodWhale, we have conducted a thorough analysis of MELCO RESORTS & ENTERTAINMENT’s fundamentals and have come to the conclusion that its intrinsic value is around $10.7, as indicated by our proprietary Valuation Line. More…

Peers

Each of these companies has its own unique strengths and strategies to stay ahead of the game, creating a dynamic and intense competition between them.

– Las Vegas Sands Corp ($NYSE:LVS)

Las Vegas Sands Corp is an American casino and resort company based in the US state of Nevada. It is the parent company of the Venetian Casino Resort and the Sands Expo and Convention Center, among other properties. The company has a market cap of 36.73B as of 2022, which is a reflection of its market presence and business performance. Additionally, its Return on Equity (ROE) stands at -11.56%, indicating that it is not performing well in terms of generating shareholder value. Las Vegas Sands Corp is a leader in the gaming and hospitality industry, and it continues to be a major player in Las Vegas, Macau, and other international markets.

– Wynn Resorts Ltd ($NASDAQ:WYNN)

Wynn Resorts Ltd is a global hospitality and entertainment company, operating integrated resorts in Las Vegas, Macau, and other parts of the world. As of 2022, the company has a market capitalization of 9.34 billion dollars and a return on equity of 27.93%. This suggests that the company is performing relatively well and is able to generate a healthy return on the capital it has invested. The company has positioned itself as an international leader in the hospitality and entertainment industry, with a focus on providing high-quality experiences for its guests. The strong financial performance of the company indicates that its strategies are working and that it is well-positioned for future growth.

– MGM Resorts International ($NYSE:MGM)

MGM Resorts International is a leading global hospitality and entertainment company, based in Las Vegas, Nevada. The company operates a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, Park MGM, and New York-New York. With a market cap of 12.88 billion USD as of 2022, the company’s stock has been performing well in the market with a Return on Equity (ROE) of 20.62%. This indicates a strong financial performance and suggests that the company is utilizing its equity to generate profits and add value to its shareholders.

Summary

Melco Resorts & Entertainment Limited (MELCO) is an international entertainment and gaming operator. According to the latest brokerage consensus, analysts are recommending a ‘hold’ rating on the company’s stock. The company has seen mostly positive media coverage, with many analysts praising its solid fundamentals and financial performance.

In addition, its strategic initiatives have been well-received by investors. Its core business operations have consistently yielded strong growth, and its financials remain healthy. Its global presence continues to expand, with plans to open new properties in multiple countries. The company is well-positioned to capitalize on the global gaming and entertainment industry with its robust portfolio of products and services. Overall, MELCO appears to be a favorable investment opportunity for those looking for long-term growth potential.

Recent Posts