Microsoft Corporation Stock Fair Value – Microsoft to Equip Government Agencies with OpenAI GPT Models

June 10, 2023

🌥️Trending News

Its products and services include Windows operating systems, Office suite of productivity software, Xbox gaming consoles, and more. The company has recently announced its plans to equip US government agencies with OpenAI GPT models. OpenAI GPT is a natural language processing model which can generate human-like written text. It can be used to automate report writing, data analysis, and document summarization. The US government agencies will be able to use the GPT models for more accurate and efficient decision making. Microsoft ($NASDAQ:MSFT) has also mentioned that it would work with the government to develop safeguards to ensure the data created by the GPT models is accurate and secure.

The partnership between Microsoft and United States government agencies is a testament to Microsoft’s commitment to delivering innovative technology to public sector organizations. The company is focused on helping governments modernize their operations with artificial intelligence, cloud computing, and other technologies. This move is also likely to benefit Microsoft in terms of gaining access to more government contracts. The GPT models will enable government organizations to streamline their operations and make decisions faster and more accurately. Microsoft’s move is likely to open up further opportunities for collaboration between the tech giant and the US government.

Share Price

On Thursday, MICROSOFT CORPORATION stock opened at $323.9 and closed at $325.3, representing a 0.6% increase from its previous closing price of $323.4. The GPT-3 model is an open-source language model that uses neural networks to generate human-like responses to natural language queries. The model is expected to be used by various government agencies to understand and interpret the natural language of users, thereby providing better customer service. This move by Microsoft is seen as a strategic effort to make its services more accessible and user-friendly for government agencies. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microsoft Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 207.59k | 69.02k | 33.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microsoft Corporation. More…

| Operations | Investing | Financing |

| 83.44k | -23.27k | -45.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microsoft Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 380.09k | 185.41k | 26.18 |

Key Ratios Snapshot

Some of the financial key ratios for Microsoft Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 17.7% | 41.9% |

| FCF Margin | ROE | ROA |

| 27.7% | 28.8% | 14.3% |

Analysis – Microsoft Corporation Stock Fair Value

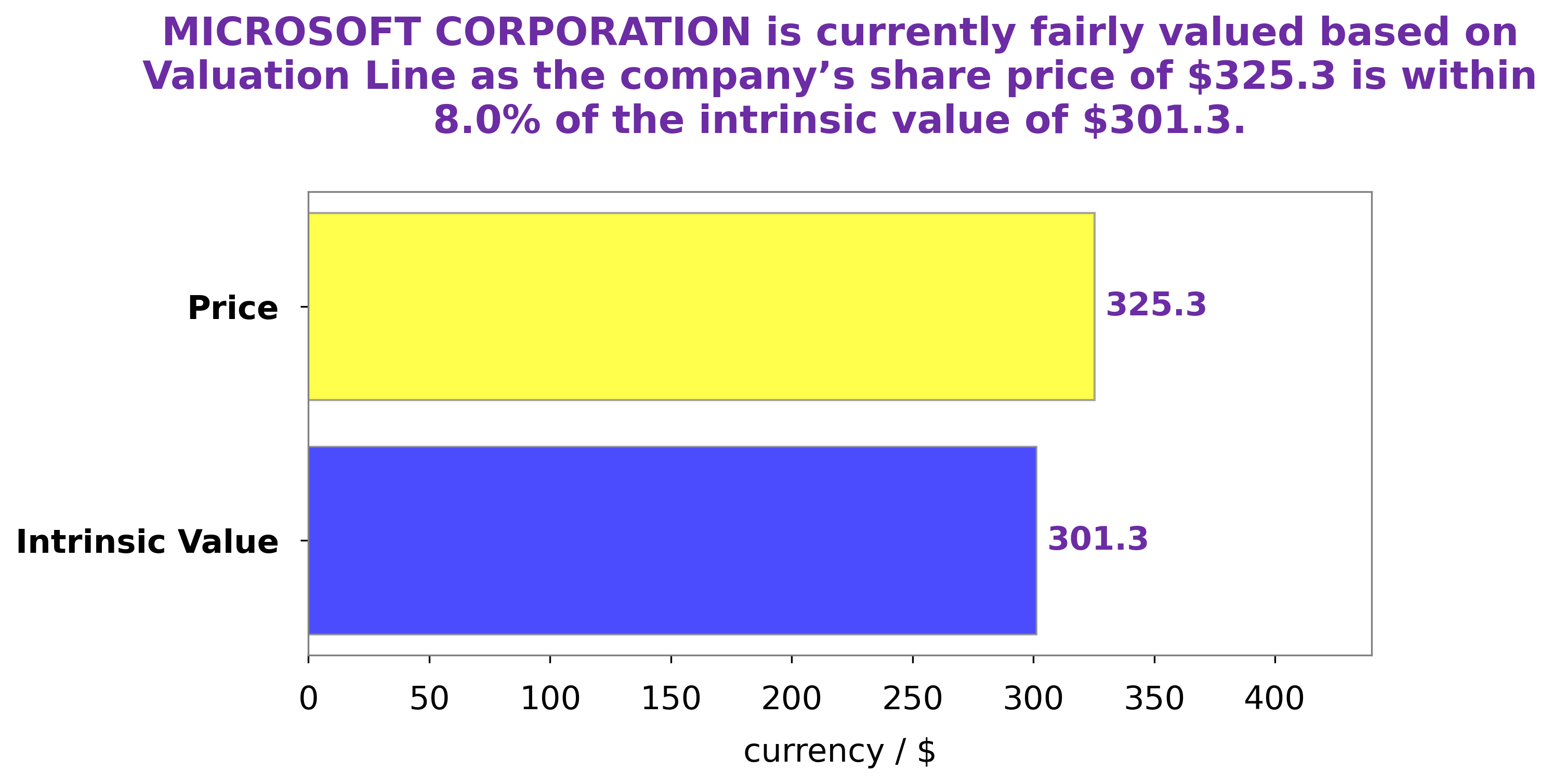

GoodWhale has analyzed the fundamentals of MICROSOFT CORPORATION and found that its intrinsic value is around $301.3. This value has been calculated using our proprietary Valuation Line. Currently, MICROSOFT CORPORATION stock is trading at a price of $325.3, which is 8.0% higher than its intrinsic value. Therefore, we would classify it as being fairly overvalued. More…

Peers

In the business world, there is always competition. For Microsoft Corp, its main competitors are Salesforce Inc, Apple Inc, and DocuSign Inc. While each company has its own strengths and weaknesses, Microsoft Corp must always be aware of what its competitors are doing in order to stay ahead.

– Salesforce Inc ($NYSE:CRM)

Salesforce Inc is an American cloud-based software company specializing in customer relationship management (CRM). As of March 2021, it had a market capitalization of US$153.53 billion, making it one of the most valuable companies in the world. Its Return on Equity (ROE) was 0.08%.

Salesforce was founded in 1999 by Marc Benioff and Parker Harris, and has since grown to become one of the largest CRM companies in the world. The company’s flagship product is its customer relationship management software, which helps businesses manage their customer data, sales, and marketing. Salesforce also offers a number of other software products and services, including a cloud-based development platform, a social networking service, and a customer service platform.

– Apple Inc ($NASDAQ:AAPL)

Apple is one of the world’s leading technology companies, with a market cap of 2.31T as of 2022. It designs, manufactures, and markets a range of mobile communication and media devices, as well as personal computers, portable digital music players, and sells a variety of related software, services, accessories, networking solutions, and third-party digital content and applications. The company has a strong focus on innovation and has been rewarded with a return on equity of 162.51% over the last year. This demonstrates the success of its business model and the confidence that investors have in its future prospects.

– DocuSign Inc ($NASDAQ:DOCU)

DocuSign Inc. is an American company that provides electronic signature technology and digital transaction management services for facilitating electronic exchanges of contracts and other documents. The company has a market capitalization of $9.74 billion as of 2022 and a return on equity of -15.28%. Founded in 2003, DocuSign has over 700,000 customers and more than 85 million users in 188 countries. The company’s headquarters are located in San Francisco, California. DocuSign’s primary product is its electronic signature platform, which enables users to sign, send, and manage documents electronically. The platform is used by businesses of all sizes, including over 90% of the Fortune 500. In addition to its signature platform, DocuSign offers a suite of products for digital transaction management, including contract management, workflow automation, and compliance tools.

Summary

Microsoft Corporation is one of the largest and most well-known technology companies in the world. Microsoft has a wide range of products, from the popular Windows operating system to software such as Office and Surface computers. The company’s growth has been strong in recent years, driven by its focus on cloud computing and artificial intelligence. For investors, Microsoft offers a variety of opportunities, from growth stocks to income stocks.

The company’s strong cash flow allows it to pay out dividends and repurchase shares, while its strong balance sheet gives it the financial flexibility to fund acquisitions and research and development initiatives. Microsoft also has an active share buyback program, which further supports its share price.

Recent Posts