Microchip Technology Intrinsic Stock Value – Microchip Technology’s Market Decline: What Investors Need to Know

March 30, 2024

🌥️Trending News

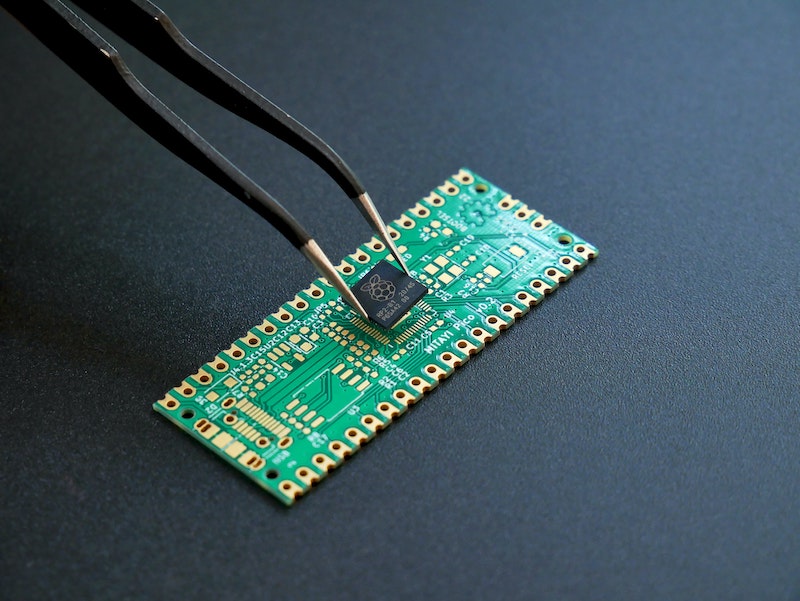

Microchip Technology ($NASDAQ:MCHP) is a leading provider of microcontroller, mixed-signal, analog and Flash-IP solutions which are used by businesses across various industries such as automotive, consumer electronics, industrial automation, and healthcare.

However, in recent times, Microchip Technology has experienced a significant decline in its market value, causing concern among investors. In fact, the company’s decline has been greater than that of the overall market. So what exactly is going on with Microchip Technology and what do investors need to know? First and foremost, it’s important to understand that the decline in Microchip Technology’s market value is not unique to the company. In fact, many technology companies have experienced a similar trend in recent months due to the ongoing trade tensions between the US and China. These tensions have led to increased tariffs on imported goods, which has directly impacted companies like Microchip Technology that rely heavily on global supply chains. In addition to external factors, there are also internal challenges that have contributed to Microchip Technology’s decline. For example, the company’s recent acquisition of Microsemi Corporation has resulted in higher debt levels and integration challenges, which have put pressure on its financial performance. Despite these challenges, there are still reasons for investors to remain optimistic about Microchip Technology. The company’s most recent quarterly report showed an increase in revenue and earnings per share, and it still maintains a strong market position in its core areas of business.

Additionally, the company has a track record of successfully navigating through challenging market conditions and has a strong management team that is focused on driving growth and shareholder value. In conclusion, while the decline in Microchip Technology’s market value may be concerning for investors, it is important to understand the various factors at play and not make rash investment decisions based on short-term trends. With its solid financial performance and strong market position, Microchip Technology has the potential to bounce back and continue delivering value to its shareholders in the long run.

Market Price

Microchip Technology, a leading provider of microcontroller and analog semiconductors, has recently experienced a decline in its market value. On Tuesday, the company’s stock opened at $88.4 and closed at $86.2, representing a 1.6% decrease from the previous day’s closing price of $87.6. One of the main factors contributing to this decline is the overall market volatility that has been seen in the technology sector in recent weeks. With the ongoing trade tensions between the US and China, as well as concerns about global economic growth, many investors have become more cautious and are pulling back from riskier investments such as technology stocks. Additionally, Microchip Technology has faced some challenges within its own business. The company reported lower than expected revenue and earnings in its most recent quarter, which may have caused some investors to lose confidence in the company’s future performance.

However, it is worth noting that Microchip Technology has a strong track record of consistent growth and profitability. The company has a diverse portfolio of products and serves a wide range of industries, which helps to mitigate risk during market downturns. Furthermore, the demand for microcontroller and analog semiconductors is expected to continue to grow as technology becomes increasingly integrated into various aspects of our daily lives. For investors who are considering buying or holding onto Microchip Technology’s stock, it is important to pay attention to the company’s upcoming earnings report. This will provide insight into the company’s performance and potential future growth.

Additionally, keeping an eye on broader market trends and developments in the technology sector can help investors make informed decisions about their investments in Microchip Technology. In conclusion, while Microchip Technology’s recent market decline may be concerning to investors, it is important to take a long-term perspective and consider the company’s solid fundamentals and growth potential. As with any investment, it is crucial to conduct thorough research and stay informed about market conditions in order to make sound decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microchip Technology. More…

| Total Revenues | Net Income | Net Margin |

| 8.54k | 2.36k | 27.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microchip Technology. More…

| Operations | Investing | Financing |

| 3.17k | -471.7 | -2.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microchip Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.14k | 9.06k | 13.1 |

Key Ratios Snapshot

Some of the financial key ratios for Microchip Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.3% | 53.5% | 36.9% |

| FCF Margin | ROE | ROA |

| 33.0% | 28.0% | 12.2% |

Analysis – Microchip Technology Intrinsic Stock Value

As an analyst, I have examined the fundamentals of MICROCHIP TECHNOLOGY and have found them to be quite strong. The company is a leading provider of microcontroller, mixed-signal, analog and Flash-IP solutions, serving a wide range of industries including automotive, industrial control, telecommunications, and consumer electronics. One of the key strengths of MICROCHIP TECHNOLOGY is its diversified product portfolio, which allows the company to cater to a diverse set of customers and industries. This not only helps in mitigating risks but also provides opportunities for growth in various sectors. In terms of financials, MICROCHIP TECHNOLOGY has been consistently profitable with a strong balance sheet and cash flow. The company has a healthy debt-to-equity ratio and a strong cash position, which provides it with the flexibility to invest in research and development and pursue growth opportunities. Based on my analysis, I have calculated a fair value for MICROCHIP TECHNOLOGY’s share price to be around $89.4 using our proprietary Valuation Line. This takes into account the company’s financials, growth potential, and industry trends. Currently, MICROCHIP TECHNOLOGY’s stock is trading at $86.2, which means it is slightly undervalued by 3.6% according to our valuation. This presents an opportunity for investors to purchase the stock at a fair price and potentially benefit from future growth. Its stock is currently undervalued, making it an attractive investment opportunity for those looking for long-term growth potential. More…

Peers

Microchip Technology Inc is a publicly traded company that designs, develops, and manufactures semiconductor products for a variety of embedded control applications. The company offers microcontrollers, development tools, analog and interface products, wireless and wired connectivity products, memory products, and digital power products. It serves customers in the automotive, communications, computing, consumer, and industrial markets. The company was founded in 1987 and is headquartered in Chandler, Arizona.

Globetronics Technology Bhd is a Malaysia-based company that provides semiconductor assembly and test services. It offers a range of services, including wafer fabrication, wafer probing, final test, packaging, and others. The company serves customers in the automotive, communications, computing, consumer, and industrial markets.

Wafer Works Corp is a Taiwan-based company that provides wafer foundry services. It offers a range of services, including wafer fabrication, final test, and packaging. The company serves customers in the automotive, communications, computing, consumer, and industrial markets.

Skyworks Solutions Inc is a publicly traded company that designs, develops, and manufactures semiconductor products for a variety of radio frequency (RF) and microwave applications. The company offers a range of products, including amplifiers, attenuators, circulators, detectors, diodes, directional couplers, mixers, modulators, oscillators, phase shifters, power dividers/combiners, receivers, switches, and transmitters. It serves customers in the automotive, communications, computing, consumer, industrial, medical, military, and aerospace markets.

– Globetronics Technology Bhd ($KLSE:7022)

Globetronics Technology Bhd is a Malaysian-based company that designs, manufactures and supplies precision sensors, optical and electronic products. The company has a market cap of 696.22M as of 2022 and a Return on Equity of 11.73%. Globetronics Technology Bhd’s products are used in a variety of industries including automotive, healthcare, consumer electronics and industrial.

– Wafer Works Corp ($TPEX:6182)

Wafer Works Corp is a leading provider of semiconductor wafers with a market cap of 21.1B as of 2022. The company has a return on equity of 16.27%. Wafer Works Corp is a leading provider of semiconductor wafers used in the manufacture of integrated circuits. The company’s wafers are used in a variety of electronic devices, including computers, cell phones, and other electronic devices.

– Skyworks Solutions Inc ($NASDAQ:SWKS)

Skyworks Solutions Inc is a company that manufactures radio frequency and microwave semiconductor products. The company has a market cap of 13.11B as of 2022 and a ROE of 25.56%. The company’s products are used in a wide variety of wireless communication applications, including smartphones, tablets, laptops, and other mobile devices.

Summary

Microchip Technology recently experienced a decline in their stock price, which was greater than the overall market. This may be concerning for investors, but there is some information that could offer insight into the situation. The company has a strong track record of growth and profitability, and their recent acquisition of Microsemi is expected to bring in additional revenue.

Additionally, Microchip has a diverse customer base and a focus on innovation and research and development. While the recent decline in stock price may be unsettling, it is worth considering the company’s overall financial health and potential for future growth before making any investment decisions.

Recent Posts