Mge Energy Intrinsic Stock Value – PNC Financial Services Group Decreases Stake in MGE Energy, Inc

June 12, 2023

☀️Trending News

MGE ($NASDAQ:MGEE) Energy, Inc. is a public utility based in Wisconsin that provides electricity and natural gas to customers in the Midwest. It was announced recently that PNC Financial Services Group Inc. has reduced their holdings in MGE Energy, Inc. The amount of the reduction was not specified, but it comes as no surprise as PNC Financial Services Group Inc. has been steadily reducing their stake in MGE Energy, Inc. in recent months. The sale of shares by PNC Financial Services Group Inc. may be a sign of their lack of confidence in MGE Energy, Inc., or it could simply be a means of diversifying their investments. It is difficult to speculate on the reason for the sale without access to more information.

However, it is clear that the company’s stock price has been on the decline since PNC Financial Services Group Inc. began reducing their stake. The impact of this news on MGE Energy, Inc.’s stock price is likely to be minimal, as the amount of shares sold by PNC Financial Services Group Inc. was not significant enough to cause any major fluctuations. The company’s stock price will likely continue to suffer due to the current economic climate and uncertainty about the future of the energy industry. Despite this, MGE Energy, Inc. is still a sound investment option for investors looking for long-term growth opportunities in the energy sector.

Market Price

On Friday, PNC Financial Services Group Inc. decreased their stake in MGE Energy, Inc. resulting in a small but measured drop in the stock price of the company. The stock opened at $77.4 and closed at the same price, marking a decrease of 0.1% from the closing price of the previous day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mge Energy. More…

| Total Revenues | Net Income | Net Margin |

| 722.83 | 107.61 | 14.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mge Energy. More…

| Operations | Investing | Financing |

| 147.64 | -197.54 | 41.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mge Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.52k | 1.42k | 30.37 |

Key Ratios Snapshot

Some of the financial key ratios for Mge Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.5% | 6.4% | 22.2% |

| FCF Margin | ROE | ROA |

| -6.1% | 9.2% | 4.0% |

Analysis – Mge Energy Intrinsic Stock Value

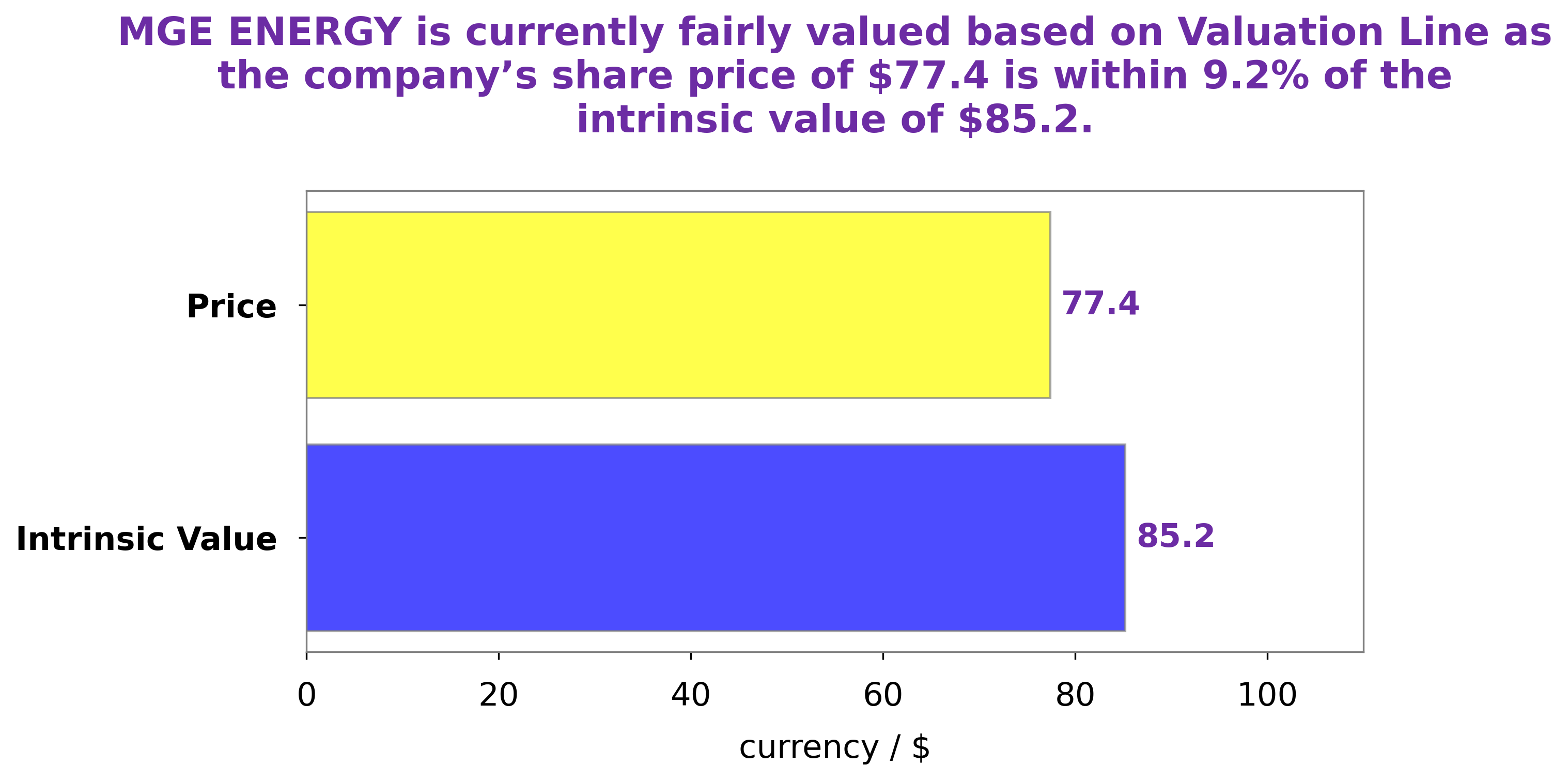

At GoodWhale, we conducted an analysis of MGE ENERGY‘s wellbeing. Our proprietary Valuation Line allowed us to calculate the intrinsic value of MGE ENERGY shares to be approximately $85.2. Currently, MGE ENERGY stock is being traded at a price of $77.4, which makes it a fair price that is slightly undervalued by 9.2%. More…

Peers

The company has a long history dating back to 1855, when the city of Madison, Wisconsin, was founded. Today, MGE Energy Inc is a publicly traded company on the New York Stock Exchange and has a market capitalization of over $2 billion. The company’s main competitors are NorthWestern Corp, South Jersey Industries Inc, and ALLETE Inc.

– NorthWestern Corp ($NASDAQ:NWE)

NorthWestern Corporation, doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and industrial customers in Montana, South Dakota, and Nebraska, the United States. It generates, transmits, and distributes electricity from coal, hydro, solar, wind, and biomass resources. The company also generates, stores, transmits, and distributes natural gas. In addition, it engages in the energy marketing activities. As of December 31, 2020, the company owned or leased approximately 3,300 megawatts of generating capacity; and operated and maintained approximately 16,200 miles of transmission and distribution lines. NorthWestern Corporation was founded in 1923 and is headquartered in Sioux Falls, South Dakota.

– South Jersey Industries Inc ($NYSE:SJI)

South Jersey Industries Inc is a company that provides energy services to its customers. The company has a market cap of 4.21B as of 2022 and a return on equity of 9.62%. South Jersey Industries Inc is a provider of energy services to its customers and has a strong focus on customer satisfaction. The company has a long history of providing energy services to its customers and has a strong reputation in the industry.

– ALLETE Inc ($NYSE:ALE)

The company is a leading provider of advanced security, video surveillance and facility access control solutions. The company’s products are used in a variety of applications, including government, commercial, industrial, transportation and residential. The company’s products are designed to provide a high level of security and safety for people and property.

Summary

MGE Energy, Inc. is an energy company that has drawn the attention of PNC Financial Services Group Inc., who recently trimmed its holdings in the company. Investors should take note of this change and perform an analysis of MGE Energy before investing. They should carefully assess the company’s financial performance, its business strategy, and the competitive environment to determine whether or not the stock is a good fit for their portfolio.

They should also analyze the company’s management team to ensure they have a good track record and are equipped to achieve MGE Energy’s objectives. Finally, investors should consider the overall industry trends and the company’s competitive position in the energy sector before investing in MGE Energy, Inc.

Recent Posts