MCW Intrinsic Value – First Trust Advisors LP Increases Stake in Mister Car Wash by 123.8% in Q4

June 12, 2023

☀️Trending News

Mister Car Wash ($NYSE:MCW), Inc., is an American company which owns and operates a national chain of car wash and express lubrication service centers. The increase of ownership reflects the company’s success in providing a consistent and superior car wash experience to its customers. The firm’s decision to invest in Mister Car Wash is a testament to its confidence in the company’s long-term success and growth potential. The decision also indicates the firm’s belief that the car wash industry will continue to thrive and prosper in the years to come.

This investment will help Mister Car Wash continue to strengthen its position as a leader in the industry and help it expand into new markets and offer new services. With this new investment, Mister Car Wash is well-positioned to take advantage of the growth opportunities that come with the changing car wash industry.

Analysis – MCW Intrinsic Value

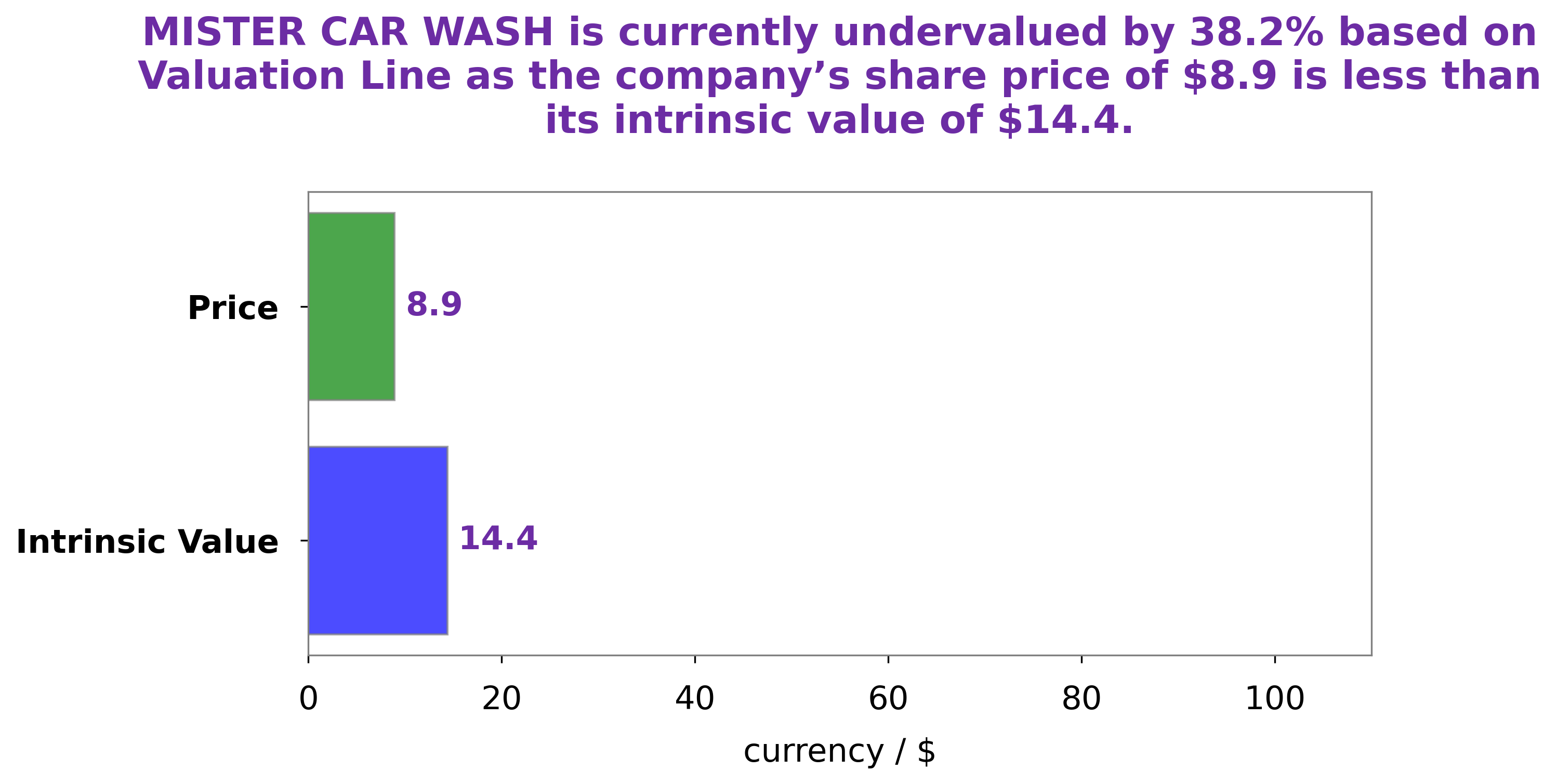

At GoodWhale, we have conducted an analysis of MISTER CAR WASH’s financials to determine its intrinsic value. Using our proprietary Valuation Line, we have determined that the intrinsic value of MISTER CAR WASH shares is around $14.4. This presents a great opportunity for investors to buy the stock at a discounted price. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MCW. More…

| Total Revenues | Net Income | Net Margin |

| 883.05 | 98.55 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MCW. More…

| Operations | Investing | Financing |

| 214.67 | -223.28 | 8.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MCW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.72k | 1.89k | 2.69 |

Key Ratios Snapshot

Some of the financial key ratios for MCW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 34.7% | 20.5% |

| FCF Margin | ROE | ROA |

| -2.1% | 13.9% | 4.2% |

Peers

The company offers a wide range of car wash services, including full-service car washes, express car washes, and self-service car washes. Mister Car Wash Inc competes with Bilia AB, Winnebago Industries Inc, and Eastern Pioneer Driving School Co Ltd in the car wash industry.

– Bilia AB ($LTS:0RQ2)

Bilia AB is a Swedish company that specializes in the retail of automobiles and related products. The company has a market capitalization of 11.66 billion as of 2022 and a return on equity of 30.75%. Bilia AB operates through a network of over 100 stores in Sweden, Norway, and Finland. The company offers a range of vehicles, including cars, vans, trucks, and motorcycles. In addition to its retail operations, Bilia AB also provides financing, leasing, and insurance services.

– Winnebago Industries Inc ($NYSE:WGO)

Winnebago Industries Inc is a leading manufacturer of motorhomes in the United States. It has a market cap of 1.7B as of 2022 and a ROE of 28.08%. The company designs, manufactures and markets motorized and towable recreational vehicles, parts and accessories through its dealer network.

– Eastern Pioneer Driving School Co Ltd ($SHSE:603377)

As of 2022, East Pioneer Driving School Co Ltd has a market cap of 3.97B and a Return on Equity of 5.8%. The company is a driving school that offers driving lessons and tests. It also provides car rental and leasing services.

Summary

Mister Car Wash, Inc. has seen an increase in investing interest in the fourth quarter, as First Trust Advisors LP boosted its position in the company by 123.8%. This trend is indicative of an increased focus on the company’s potential for growth. Analysts have suggested that Mister Car Wash may offer investors strong returns, with its reliable business model and global presence. With continued investments, Mister Car Wash is expected to further expand and capitalize on its market opportunities.

Recent Posts