Marinemax Intrinsic Value Calculator – MarineMax Looks to Digital Improvements, Further M&A, and Undervaluation

June 3, 2023

☀️Trending News

MARINEMAX ($NYSE:HZO): MarineMax is a large recreational boating company in the United States, providing sales, services, and financing of boats and yachts. It is the nation’s leading recreational boat retailer and its stock is currently undervalued. In recent years, the company has made a number of digital advancements, such as launching a new e-commerce platform and introducing a digital brokerage platform to help buyers and sellers connect. This has enabled the company to further expand its reach and increase its customer base. In addition to these digital efforts, MarineMax is also looking to grow through potential mergers and acquisitions.

The company has identified multiple potential acquisition targets that could be integrated into its current operations, which would increase its market share and presence in the recreational boating industry. Overall, MarineMax’s efforts to improve its digital capabilities, continue to explore potential mergers and acquisitions, and capitalize on its undervalued stock make it an attractive investment opportunity. Investors should assess the company’s strategy closely to determine if it is the right choice for their portfolio.

Price History

On Friday, MARINEMAX stock opened at $29.4 and closed at $31.0, marking a 7.2% increase from its last closing price of $28.9. This strong performance can be attributed to the company’s ongoing focus on digital improvements, further mergers and acquisitions, and its current undervaluation. This year, MARINEMAX has been working to strengthen its online presence and offer more services to its customers through digital improvements. The company is also looking to pursue further M&A opportunities that can bolster their business operations and customer service.

Lastly, MARINEMAX is currently undervalued when compared to other companies of similar size, which has caused the stock to rise in recent weeks. MARINEMAX is confident that these strategic moves will ensure that they remain a leader in the industry and further improve their bottom line. Investors should take note of the company’s commitment to innovation and growth, as this could be a great opportunity for long-term gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marinemax. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | 158.26 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marinemax. More…

| Operations | Investing | Financing |

| -87.78 | -140.45 | 73.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marinemax. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.32k | 1.47k | 37.18 |

Key Ratios Snapshot

Some of the financial key ratios for Marinemax are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.9% | 52.9% | 10.3% |

| FCF Margin | ROE | ROA |

| -5.8% | 17.9% | 6.4% |

Analysis – Marinemax Intrinsic Value Calculator

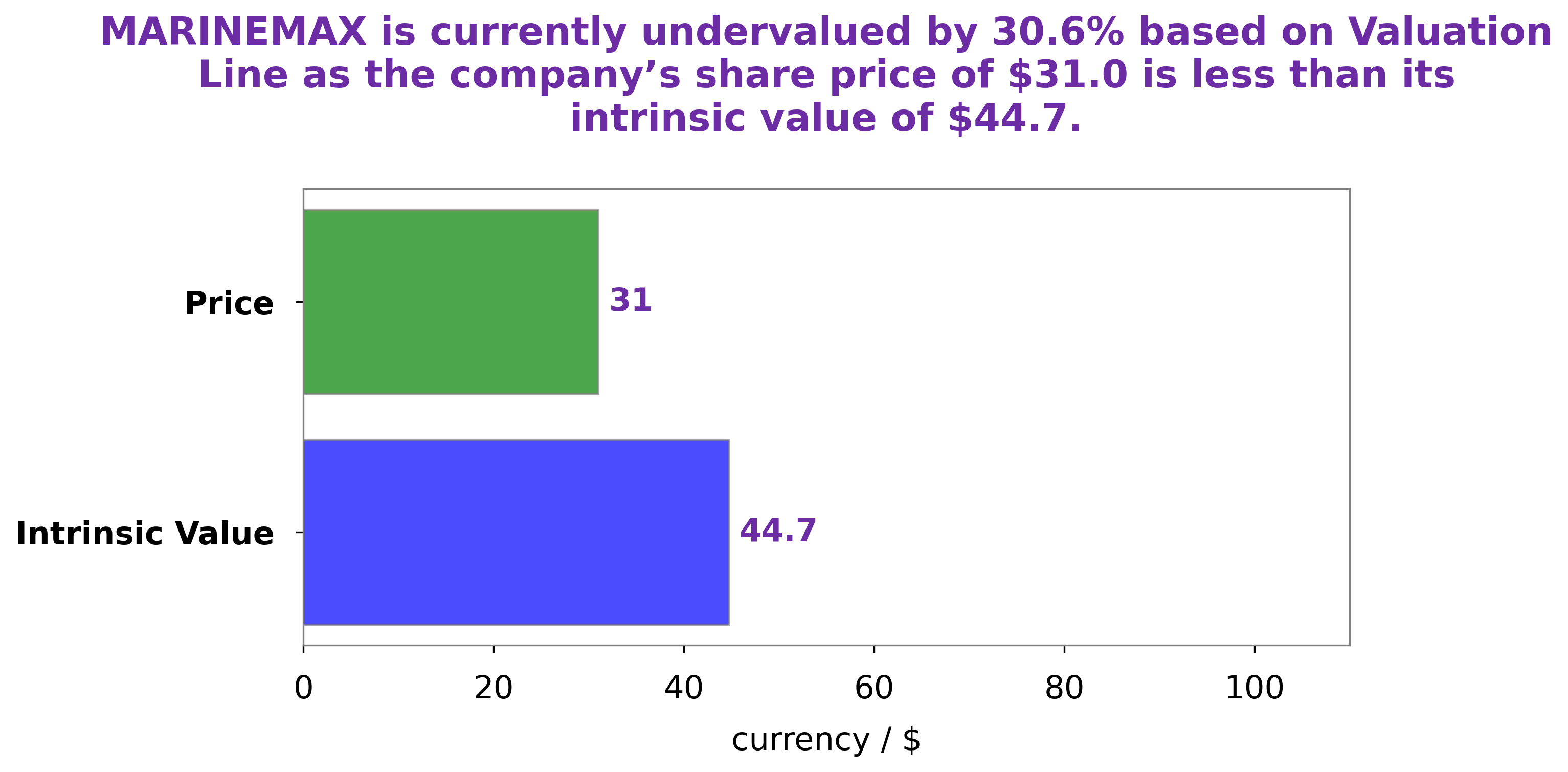

At GoodWhale, we have conducted an extensive analysis of MARINEMAX‘s financials. After careful consideration, we have determined a fair value of $44.7 per share for MARINEMAX. This estimate was calculated using our proprietary Valuation Line, which takes into account the company’s historical performance and future prospects. Currently, MARINEMAX stock is trading at $31.0 per share, meaning it is undervalued by 30.7%. This discrepancy offers investors a potential opportunity to enter the market at a discounted price. However, it is important to consider all potential risks before investing, as no one can predict with certainty how the stock may behave in the future. More…

Peers

MarineMax Inc is one of the largest recreational boat and yacht retailers in the United States with 63 locations. The company operates in 20 states and sells new and used recreational boats, including pleasure boats, sport boats, and fishing boats, from brands such as Sea Ray, Boston Whaler, Meridian, Hatteras, Azimut Yachts, Ocean Alexander, Galeon Yachts, Grady-White, Harris, Bennington, Crest, MasterCraft, Nautique, Scarab, Scout, Sailfish, Sea Pro, Sportsman, Tahoe, Hurricane, Key West, Regal, Riviera, and Sanpan. MarineMax also offers yacht charters and related services. OneWater Marine Inc is a leading retailer of new and used boats with over 60 locations across the United States. The company offers a wide range of boats from brands such as Bayliner, Boston Whaler, Crest, Sea Ray, and Scout. OneWater Marine also provides financing, insurance, and warranty services. Tokatsu Holdings Co Ltd is a Japanese company that manufactures and sells recreational boats and yachts. Tokatsu Holdings Co Ltd operates in Japan and North America. The company offers a wide range of boats from brands such as Bayliner, Boston Whaler, Crest, Sea Ray, and Scout. Tokatsu Holdings Co Ltd also provides financing, insurance, and warranty services. Lazydays Holdings Inc is one of the largest recreational vehicle dealerships in the United States with locations in Arizona, Colorado, Florida, Georgia, Kansas, Minnesota, Nebraska, Nevada, New Hampshire, New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, and Texas. Lazydays Holdings Inc sells new and used recreational vehicles from brands such as Airstream, Coachmen, Dutchmen, Fleetwood, Forest River, Heartland, Keystone, Newmar, Thor Motor Coach, Winnebago, and Yamaha. Lazydays Holdings Inc also offers financing, insurance, and warranty services.

– OneWater Marine Inc ($NASDAQ:ONEW)

As of 2022, OneWater Marine Inc has a market cap of 470.77M and a Return on Equity of 38.97%. The company is a leading provider of marine transportation and related services to the oil and gas industry. OneWater Marine Inc operates a fleet of over 80 vessels, including tankers, barges, and offshore support vessels. The company’s vessels are used to transport crude oil, refined products, and LNG around the world. OneWater Marine Inc is headquartered in Houston, Texas.

– Tokatsu Holdings Co Ltd ($TSE:2754)

Tokatsu Holdings Co Ltd is a Japanese company that specializes in the manufacture and sale of construction machinery and equipment. The company has a market capitalization of 1.65 billion as of 2022 and a return on equity of 5.23%. Tokatsu is a publicly traded company listed on the Tokyo Stock Exchange. The company was founded in 1948 and is headquartered in Tokyo, Japan. Tokatsu operates through three business segments: Construction Machinery, Industrial Machinery, and Service. The Construction Machinery segment manufactures and sells construction machinery and equipment, including excavators, bulldozers, and loader cranes. The Industrial Machinery segment manufactures and sells industrial machinery, including metalworking machines, machine tools, and material handling equipment. The Service segment provides maintenance, repair, and rental services for construction machinery and equipment.

– Lazydays Holdings Inc ($NASDAQ:LAZY)

Lazydays Holdings Inc is a publicly traded company that owns and operates the largest RV dealership in the United States. The company has a market capitalization of 149.85 million as of 2022 and a return on equity of 33.42%. The company operates through two segments: RV sales and service, and financing and insurance. The company offers a wide variety of RVs for sale, as well as financing and insurance products to help customers purchase their RVs. In addition, the company provides service and repair services for RVs.

Summary

MarineMax is an undervalued stock in the marine industry, offering investors an excellent opportunity for profit. The company has made several digital improvements to its operations that have enabled better customer experience while reducing costs. Its focus on further M&A activities has allowed for expansion into new markets and increased revenue.

Despite these positive developments, the company’s stock price remains low, making it a worthy investment for the savvy investor. Analysts recommend considering MarineMax as an investment option, as it has strong potential for profits and growth.

Recent Posts