Luna Innovations Intrinsic Value Calculation – LUNA INNOVATIONS Secures Contract for Industrial Battery Storage Monitoring in Europe

April 13, 2023

Trending News ☀️

LUNA INNOVATIONS ($NASDAQ:LUNA), a global provider of differentiated sensor and instrumentation solutions, has recently secured a contract for the monitoring of industrial battery storage in Europe. This contract is a milestone for the company, as it indicates their ability to develop innovative solutions that can be used in multiple industries. Its portfolio includes optical fiber sensing, telecommunication sensing, medical sensing, and industrial sensing. The company also offers specialized services and systems engineering capabilities to its customers. Through its products and services, LUNA INNOVATIONS aims to help its customers improve their operations, enhance their products, and increase their efficiency.

Its stock is traded on the Nasdaq Global Market under the ticker symbol LUNA. As the demand for industrial battery storage continues to grow, LUNA INNOVATIONS is poised to benefit from the increased demand for its sensing solutions. With this contract, LUNA INNOVATIONS is able to demonstrate its commitment to providing quality products and services to its customers, as well as its ability to innovate and develop new solutions that meet the needs of its customers.

Market Price

LUNA INNOVATIONS announced on Wednesday that they have secured a contract for industrial battery storage monitoring in Europe, causing their stock to open at $7.0 and close at $6.8, down 1.0% from the previous closing price of 6.9. LUNA INNOVATIONS is committed to providing innovative and reliable solutions for industrial battery storage monitoring, with the goal of helping their customers maximize the efficiency and maximize the performance of their battery storage operations. The company is actively pursuing new opportunities and partnerships in order to continue to develop and provide cutting edge solutions for their customers. They are committed to providing high quality products and services to ensure their customers get the most out of their battery storage operations. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Luna Innovations. More…

| Total Revenues | Net Income | Net Margin |

| 109.5 | 9.28 | -2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Luna Innovations. More…

| Operations | Investing | Financing |

| -8.57 | -11.05 | 9.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Luna Innovations. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 151.01 | 57.6 | 2.82 |

Key Ratios Snapshot

Some of the financial key ratios for Luna Innovations are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | – | -1.5% |

| FCF Margin | ROE | ROA |

| -10.5% | -1.1% | -0.7% |

Analysis – Luna Innovations Intrinsic Value Calculation

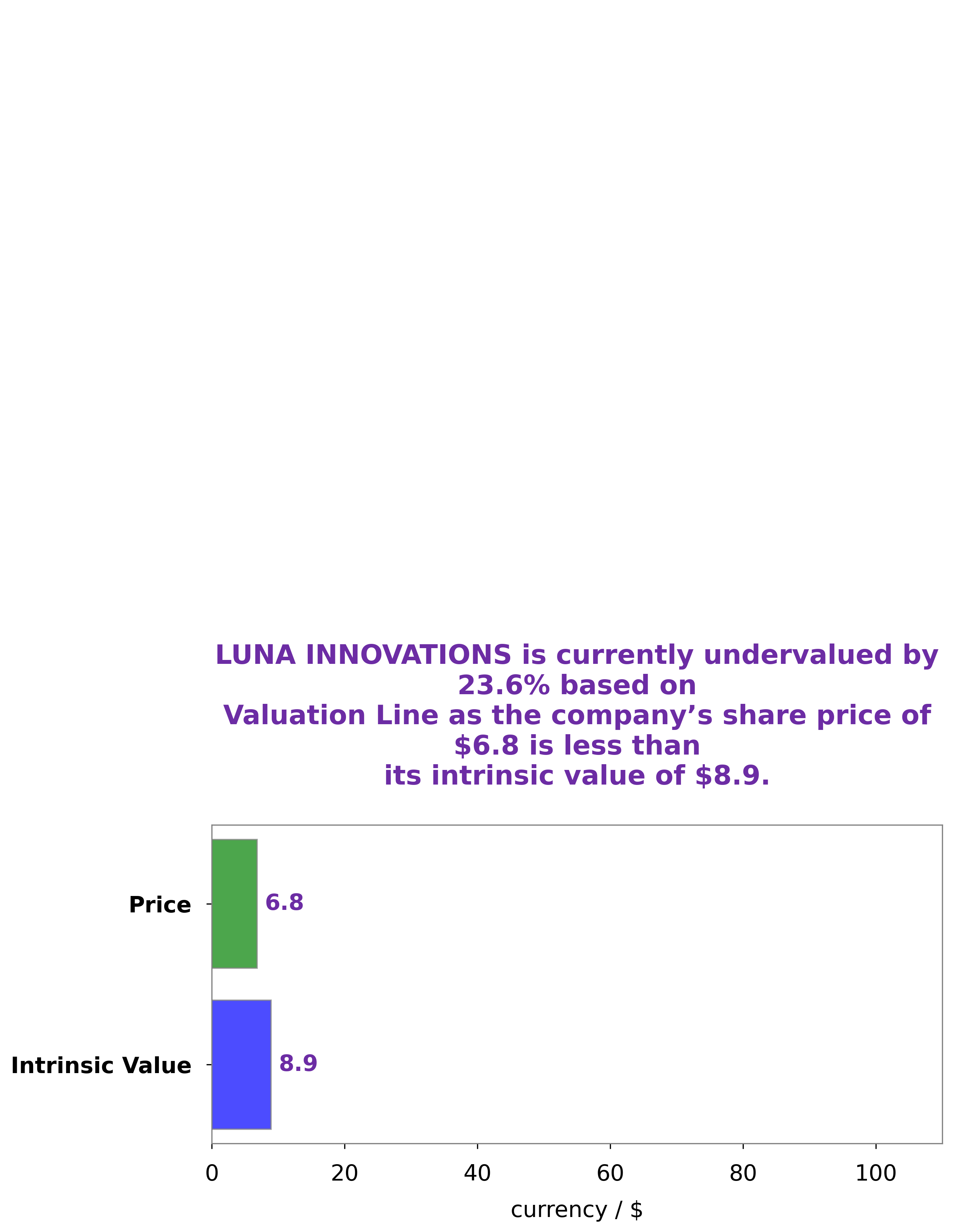

At GoodWhale, we have conducted a thorough analysis of LUNA INNOVATIONS‘ fundamentals to determine their intrinsic value. Through our proprietary Valuation Line, we have calculated that the intrinsic value of LUNA INNOVATIONS share is around $8.9. Currently, the company’s stock is trading at $6.8, which means it is undervalued by 23.9%. We believe that this presents an opportunity for investors to capitalize on the potential upside of LUNA INNOVATIONS stock. More…

Peers

Headquartered in Roanoke, Virginia, Luna has about 200 employees and operates in over 30 countries. Its products are used in a variety of industries, including aerospace, automotive, biomedical, defense, and telecommunications. Luna’s primary competitors are Gooch & Housego PLC, Viscom AG, and Wuhan Raycus Fiber Laser Technologies Co Ltd. These companies are all based in Europe and Asia, respectively.

– Gooch & Housego PLC ($LSE:GHH)

Gooch & Housego PLC is a leading international provider of advanced photonic solutions. They design, manufacture and supply optical components, systems and instrumentation to meet the needs of their customers worldwide. Gooch & Housego has a market cap of 119.45M as of 2022 and a Return on Equity of 3.16%. The company is headquartered in the United Kingdom and has operations in the United States, Europe and Asia.

– Viscom AG ($LTS:0GED)

Vcom AG is a German company that provides software for the visual inspection of products. Its products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals. The company has a market cap of 71.97 million as of 2022 and a return on equity of 4.98%.

– Wuhan Raycus Fiber Laser Technologies Co Ltd ($SZSE:300747)

Raycus is a Chinese company that manufactures fiber lasers. It is headquartered in Wuhan, China and was founded in 2007. The company went public on the Shenzhen Stock Exchange in 2014. As of 2022, Raycus has a market cap of 15.78B and a ROE of 2.49%. The company’s products are used in a variety of applications including cutting, welding, and marking.

Summary

Luna Innovations Incorporated (LUNA) has recently been awarded a contract for industrial battery storage monitoring in Europe. This is a major development for the company, as it presents a major opportunity for expansion and growth in the European market. Analysts view this as a positive development for LUNA, predicting it to result in increased revenue and stock price appreciation.

Furthermore, LUNA has a strong track record of generating revenue growth and, according to analysts, has a strong potential to become a market leader in industrial battery storage monitoring. Therefore, investors should consider LUNA as a good long-term option for their portfolio.

Recent Posts