Kraft Heinz Stock Fair Value Calculator – KRAFT HEINZ Stock Struggles to Rebound Amidst Unfavorable Market Conditions

April 20, 2023

Trending News 🌧️

Kraft Heinz ($NASDAQ:KHC), the well-known American food business, has been struggling to rebound amidst unfavorable market conditions. The company is the fifth largest food and beverage business in the world, and its stock is one of the most widely traded on the global exchanges.

However, the stock seems to have reached a standstill, and it appears unlikely that the situation will improve any time soon. The market downturn is largely due to an overall decline in consumer spending due to the global pandemic, as well as other economic factors.

Additionally, Kraft Heinz has been hit hard by rising costs and increasing competition from retailers such as Amazon and Walmart. This has resulted in reduced profit margins for the company and a consequent dip in its stock price. In the past few months, Kraft Heinz has taken steps to try and mitigate its losses. This includes cutting costs and introducing new products. However, these efforts have yet to pay off and there doesn’t seem to be any optimism with regards to its stock rebounding anytime soon. It appears that until the global economic conditions improve, Kraft Heinz will continue to struggle to recover.

Stock Price

On Wednesday, KRAFT HEINZ stock had a lackluster performance as the opening price of $39.5 remained unchanged at the closing bell. This lack of growth comes at a time when the market conditions have been generally unfavorable for many food companies. KRAFT HEINZ has been heavily impacted by rising commodity costs, increased competition, and slower consumer spending.

As a result, their stock has not been able to rebound from the pressure in the market despite their efforts to improve the company’s overall financial health. The company’s shareholders are hoping that KRAFT HEINZ can turn things around in the near future, but it remains to be seen if they will be able to navigate these difficult economic conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kraft Heinz. More…

| Total Revenues | Net Income | Net Margin |

| 26.48k | 2.36k | 11.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kraft Heinz. More…

| Operations | Investing | Financing |

| 2.47k | -1.09k | -3.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kraft Heinz. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 90.51k | 41.64k | 39.74 |

Key Ratios Snapshot

Some of the financial key ratios for Kraft Heinz are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -2.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 5.9% | 5.0% | 2.7% |

Analysis – Kraft Heinz Stock Fair Value Calculator

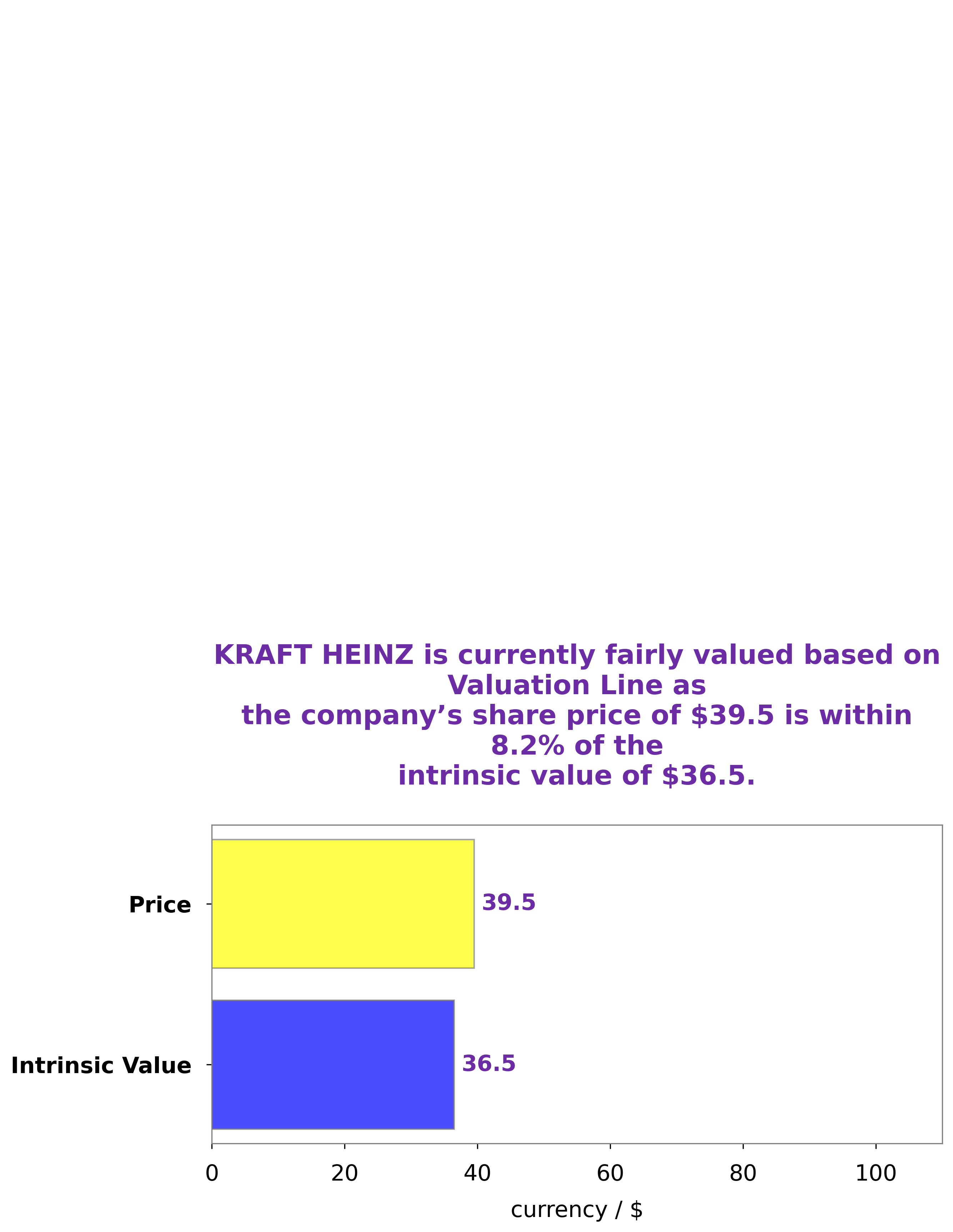

At GoodWhale, we recently conducted an analysis of KRAFT HEINZ’s wellbeing. After thorough examination, we determined that the intrinsic value of KRAFT HEINZ shares is around $36.5. This figure was arrived at by utilizing our proprietary Valuation Line. Currently, KRAFT HEINZ shares are being traded at $39.5 – a fair price, albeit one that is slightly overvalued by 8.3%. It’s important to note that this figure may change depending on the market situation, so investors should be aware of this possibility. More…

Peers

The Kraft Heinz Co. is a food and beverage company that offers a variety of products. Its competitors include Kellogg Co, General Mills Inc, and Treehouse Foods Inc.

– Kellogg Co ($NYSE:K)

Kellogg Co is a food manufacturing company that produces cereal, snacks, and other food products. The company has a market cap of $25.03 billion and a return on equity of 33.71%. Kellogg’s products are sold in more than 180 countries and include brands such as Kellogg’s, Keebler, Pop-Tarts, and Eggo. The company has more than 30,000 employees worldwide.

– General Mills Inc ($NYSE:GIS)

General Mills Inc is a food company that produces and markets branded consumer foods in the United States and internationally. The company’s products include cereals, yogurt, snacks, and baking mixes. General Mills Inc has a market cap of 46.37B as of 2022 and a return on equity of 20.18%. The company’s products are marketed under the brands including Cheerios, Lucky Charms, Nature Valley, and Betty Crocker.

– Treehouse Foods Inc ($NYSE:THS)

Treehouse Foods Inc is a food manufacturing company with a market cap of $2.7 billion as of 2022. The company has a return on equity of 0.58%. Treehouse Foods Inc manufactures and sells packaged foods and beverages in the United States. The company offers canned soups, salad dressings, peanut butter, syrups, and other food products. It also provides infant formula and baby food products; and pet food and pet snacks.

Summary

The company has experienced a decrease in sales, profit, and earnings over the past few quarters, and analysts remain uncertain that the future will bring better results. Despite numerous initiatives to improve operations, the company continues to struggle with rising costs, steep competition, and a weak consumer spending environment. As such, investors may want to take a cautious approach when considering whether or not to invest in Kraft Heinz.

Recent Posts